By Daniel Aronowitz, President, Euclid Fiduciary

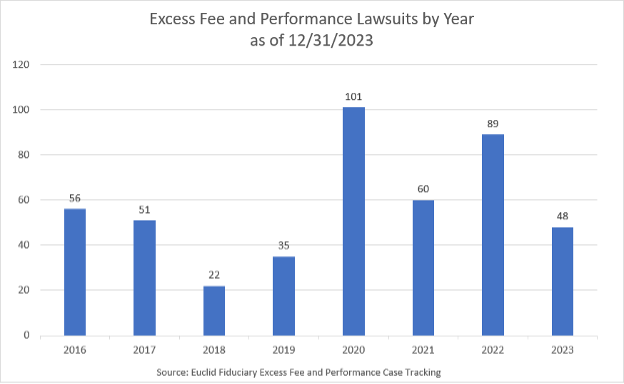

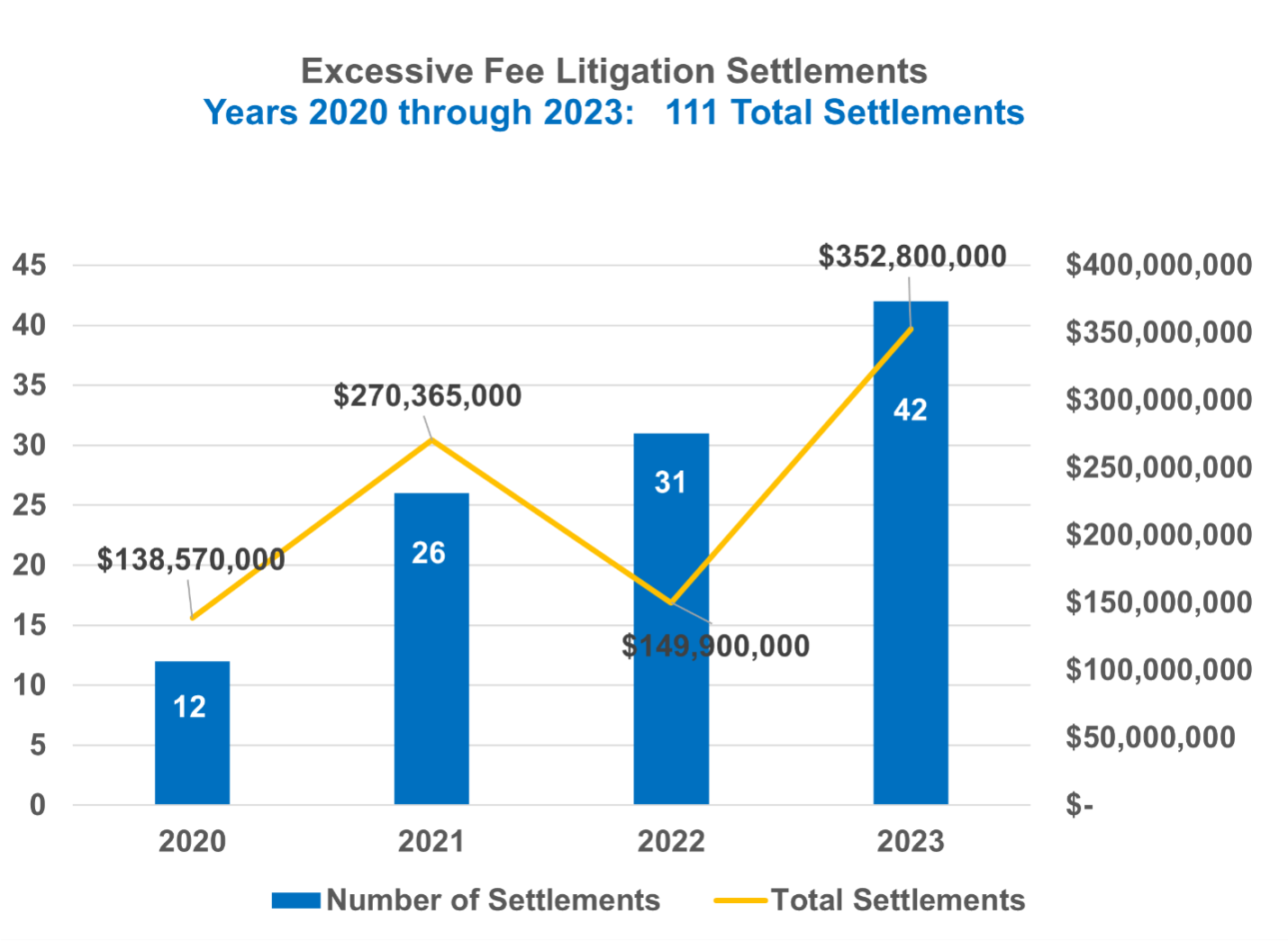

ERISA class action litigation remains, as the Chamber of Commerce labeled it in its Home Depot appeal amicus brief, at a “fever pitch.” We counted forty-eight new excess fee and performance lawsuits filed in 2023. This is down from a near-record eighty-nine complaints in 2022, but still reflects the higher filing frequency of the last eight years in which 463 excess fee cases have been filed. The most obvious explanation for the lower number of filings in 2023 is that frenzied court activity in the over 200 pending cases is keeping legacy law firms like Capozzi Adler and Walcheske & Luzi too busy to file many new cases. The Schlichter law firm, widely reported to be trolling for participants on LinkedIn and social media to initiate excess fee claims against large company sponsored health plans, was fully engaged with three excess fees trials in the last eight months. In all, 2023 was a year of significant activity in pending cases, with a record forty-two settlements, a record number of motions to dismiss, summary judgment, and appellate rulings, and at least five cases being tried, including one before a jury. With new plaintiff firms entering the fray, all signs point to a continued high volume of excess fee cases and heightened risk exposure for sponsors of America’s large retirement plans, especially jumbo-sized plans.

The following is a summary of the 2023 case filings, trends, and reported settlements in ERISA excess fee and performance litigation.

- FREQUENCY: 48 Cases Filed in 2023 – A Decrease from 2022 as Legacy Firms Digested Their Pending Inventory of Cases, With the Majority of Lawsuits Filed by Newer Plaintiff Firms to the Space.

As noted above, plaintiff law firms filed forty-eight new excess fee and performance cases in 2023. This is down from the higher number of complaints filed in the three previous years, but the total number is more consistent with the approximate 55-per year average of the modern era of excess fees cases that started with the university cases in 2016. We would note that the frequency of filings was slightly higher in the second half of the year. Case filings averaged three to four cases per month in the first half of the year, but that increased to five cases per month in the second half of the year as the leading legacy firms returned with more filings.

The trend appears to be repeating the 2020-21 pattern in which the record 2020 year with 101 filings was followed by a forty percent drop-off the following year as legacy firms filed less cases. In that timeframe, the most prolific law firm Capozzi Adler filed less cases in the subsequent year (compared to forty in 2020) as they digested their pending volume of cases. As the charts below demonstrate, the most prolific law firms in 2022 were Capozzi Adler (21 cases), Miller Shah (15 cases), and Walcheske & Luzi (13). The overall lower volume of cases in 2023 is attributable to the reduced filings of these three law firms.

The following tables compare 2022 to 2023 by law firm filings of Excess Fee Lawsuits:

2022 v 2023 Plaintiff Law Firms Filings of Excess Fee Lawsuits

| 2022 Filings | 2023 Filings | ||

| Plaintiff Law Firm | 2022 # of Cases Filed: | Plaintiff Law Firm | 2023 YTD # of Cases Filed By Law Firm [including when filed jointly with another law firm] |

| Capozzi Adler | 21 | Wenzel Fenton Cabassa | 10 |

| Miller Shah | 15 | Christina Humphrey Law | 4 |

| Walcheske & Luzi LLC | 13 | Walcheske & Luzi | 8 |

| Wenzel Fenton Cabassa | 11 | Morgan & Morgan [in conjunction with Wenzel Fenton Cabassa] | 7 |

| Nichols Kaster | 8 | Nichols Kaster | 2 |

| Tower Legal | 4 | Tower Legal Group | 2 |

| Schlichter Bogard & Denton, LLP | 3 | Capozzi Adler | 6 |

| Fair Work | 2 | Hayes Pawlenko | 5 |

| Baillon Thome Jozwiak & Wanta LLP | 2 | Bailey & Glasser | 2 |

| Roberts Law | 1 | Cohen Milstein | 1 |

| Sanford Heisler Sharp, LLP | 1 | Sanford Heisler | 1 |

| Other firms | 7 | Izard Kindall & Raabe | 1 |

| Foulston Siefkin | 2 | ||

| Edelson Lechtzin | 1 | ||

| McKay Law | 1 | ||

| Ducello Levitt [but note the complaint follows the Walcheske template] | 1 | ||

| Hacker Stephens | 1 | ||

| Sharp Law LLP | 1 | ||

| Pomerantz LLP | 1 | ||

| Scott & Scott | 1 | ||

In 2023, the Capozzi law firm filed only six cases; the Walcheske law firm filed eight cases; and Miller Shah filed none, likely because they are consumed in their quixotic claims against twelve plan sponsors that offer low-cost BlackRock LifePath target-date funds. These numbers are well below the historical averages of these law firms. Notably, the Schlichter Bogard firm filed no cases in 2023, but they were involved in three separate trials, before a jury in the Yale case, and two separate trials in the Central District of California involving NFP FlexPATH funds against the Wood Group and Molina Healthcare respectively. They are also advertising on LinkedIn to investigate novel ERISA excess fee claims involving health plans sponsored by State Farm and Target, and other large companies. We would note that the increase in frequency in the second half was influenced by the return of legacy law firms, with Capozzi Adler filing four cases and Walcheske filing five additional lawsuits in the second half of the year. The law firm filing the most cases in 2023 was the Wenzel Fenton Cabassa law firm, which has evolved from filing COBRA notice cases to focus on excess recordkeeping claims against retirement plans.

Size of Plans Being Sued:

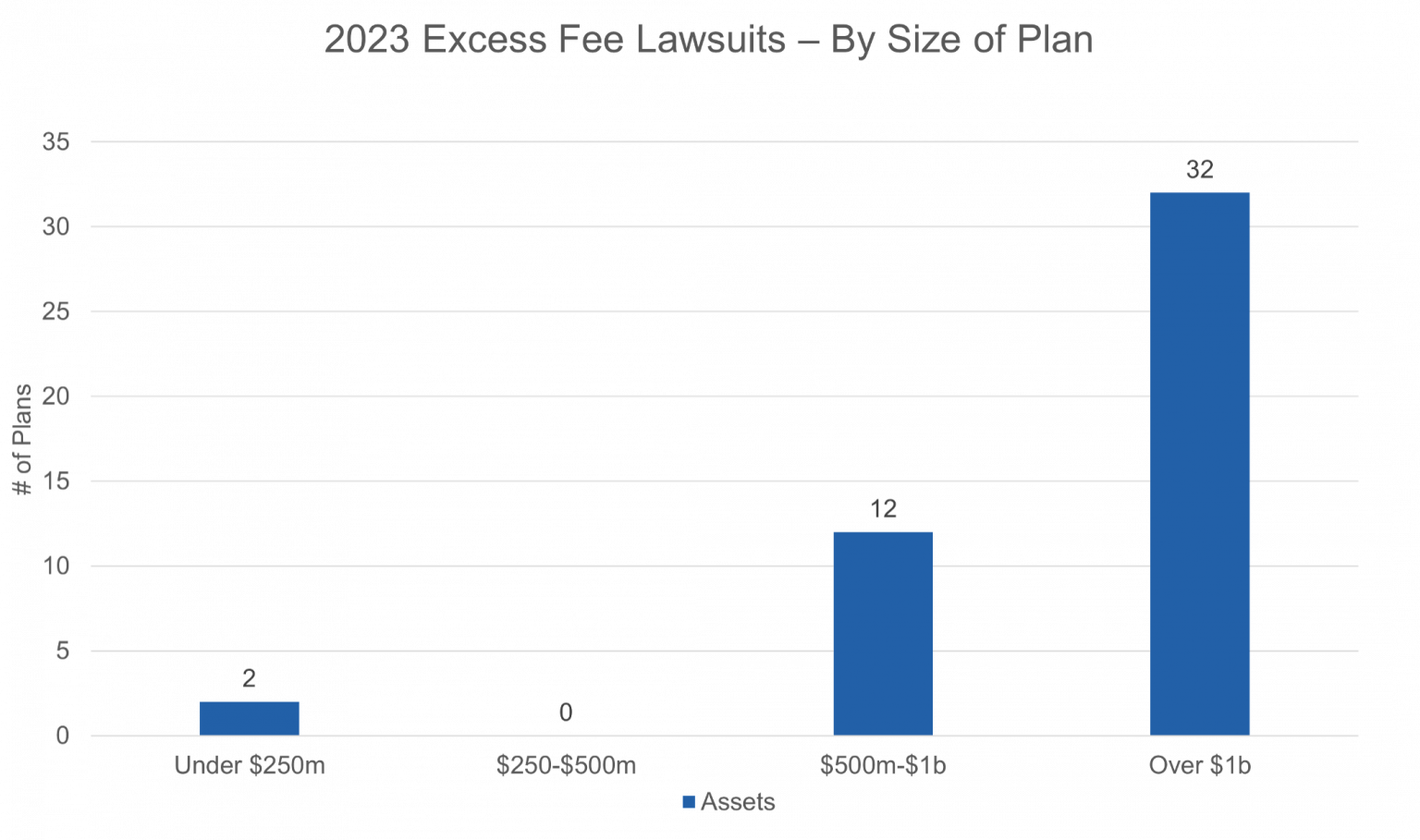

2023 was the year of plaintiff law firms targeting jumbo plans with assets over one billion dollars. If you read internet blogs, you will see commentary that plaintiff law firms are moving downstream to sue smaller plans, but that was not true in 2023. The vast majority of cases were filed against large plans over $500m in assets, and two-thirds of the cases were against jumbo plans with $1b or more in assets. The outliers were the proprietary case against the small $102m GWA Weiss plan, and the excess fee case against the $140m Amy’s Kitchen plan. The overwhelming trend was to sue jumbo plans with a higher potential for damages or to leverage a settlement.

Perspective: While the headline is a significant reduction in the number of filings from 89 in 2022 to 48 in 2023, it is useful to put the number of filings into the perspective of the total number of large plans. The animating theory of excess fee cases is that the plan fiduciaries failed to leverage the size of the plan to reduce fees because they were “asleep at the wheel,” and that logically means that the plan needs to be large enough to leverage its size to achieve lower recordkeeping and investment fees. The latest statistics from ICI Brightscope indicate that, as of three years ago, the number of defined contribution plans with assets over $500m is approximately 1,350. Given that the vast majority of the lawsuits are filed against plans with more than $500m in assets, that means that 4-8% of all large plans are sued in any given year. That is close to or higher than the percentage of the approximately 3,700 public companies in America that are sued annually for alleged federal securities violations. The D&O Diary indicates that 212 securities lawsuits were filed last year [about a 5-6% frequency]. But if you consider that at least 385 of these large plans have already been sued for excess fees in the last eight years [by omitting the 403b plan filings], the percentage of large plans being sued each year rises from five to ten percent. That is a really significant frequency of case filings.

Another perspective is that approximately 440 out of 1,350, or 33%, of large plans in America have been sued for alleged excessive fees in the last eight years. If you just focus on plans with assets over $1b or more, more than fifty percent of these plans have now been sued for purported excess fees. Any cynic of the plaintiffs’ bar would discern that many plans are being unfairly sued, because 33% of America’s large retirement plans, or over 50% of jumbo plans, cannot possibly have excessive fees. The law of averages would dictate otherwise, assuming that plan fees are properly compared. These lawsuits are not about excess retirement fees, but a business model in which ERISA fiduciary liability is being exploited for financial gain.

Any Slowdown is Likely Temporary: In addition to the normal cycle of high- and low-volume years, we have seen evidence that any short-term slowdown in the frequency of filings will be temporary. We continue to see ERISA rule 104(b) information demands from plaintiff law firms, and many of these turn into lawsuits. Notably, we have seen a plaintiffs law firm that specializes in securities fraud class actions and with no experience in excessive fee cases sending demand letters to multiple companies threatening litigation based on purported excess recordkeeping fees. It shows that we are nowhere near an end to strike lawsuits alleging excess recordkeeping fees and investment fees.

- 2023 LAWSUIT TRENDS: More Claims of Investment Imprudence, With the Newer Firms Asserting Novel Theories and Dubious Comparators for Excess Recordkeeping Claims

An analysis of the 2023 lawsuits reveals that plaintiff law firms continue to pursue bread and butter excess recordkeeping fee claims, but the number of investment underperformance lawsuits continues to rise.

2023 Types of Excess Fee and Investment Imprudence Claims

| 2023 Claim Type | # Of Complaints |

| Excessive Recordkeeping Fees | 28 |

| Excessive Investment Fees | 17 |

| Deficient Investment Performance – Investment Imprudence | 23 |

| Wrong Share Class | 11 |

| High Fee / Underperformance of Active TDFs | 10 |

| Excess Float Income | 9 |

| Proprietary Funds | 7 |

| Forfeiture Claims | 5 |

| Stable Value Fund Claims | 4 |

| Excessive Managed Account Fees | 1 |

| Other (self-dealing) | 1 |

Excess Recordkeeping Claims: Claims of fiduciary imprudence for failing to leverage the size of the plan to negotiate a lower recordkeeping fee remains the staple of excess fee lawsuits. The legacy law firms continue the same playbook of suing large plans for purported excessive recordkeeping fees based on the Form 5500 filing, and then comparing the plan fees to unreliable Form 5500 data from a handful of large plans that is inflated with transaction and other non-recordkeeping fees. While some of the complaints acknowledge that participants receive account statements and fee disclosures with the exact recordkeeping fee, most lawsuits continue to allege fees calculated by plaintiff law firms from Form 5500 data that includes transaction fees, which inflates the fees alleged to be excessive. The Walcheske firm’s complaint against Tyson Foods filed on November 30 in the Western District of Arkansas is an example of their typical recordkeeping claim, comparing a $41 amount from the company’s Form 5500 filing that overstates what participants actually pay for recordkeeping fees, and then comparing it to unreliable data from a few jumbo plans. Similarly, the Capozzi Adler firm’s November 16 lawsuit against the $1.9b Whole Foods Market plan alleges that the $31-34 recordkeeping fee paid by plan participants was unreasonable compared to a handful of much larger plans. The most notable excess recordkeeping claim from the Walcheske firm is found in the September 22, 2023 filing in Leon v. Maersk Inc. (W.D.N.C.), in which plaintiffs assert a new theory that it was imprudent to charge non-active participants a higher recordkeeping fees.

But while the legacy law firms continue the same basic excess fee playbook, newer entrants are advancing novel theories of fiduciary liability for recordkeeping fees. The most notable change in recordkeeping fee claims are the ten lawsuits filed by the Wenzel law firm in which they assert new claims of improper indirect compensation to recordkeepers beyond traditional revenue sharing claims. Most notably, they have alleged multiple claims that plan fiduciaries failed to monitor float interest in the clearing accounts of the plan’s recordkeeper. Float claims were brought in 2016 against Fidelity, but this is the first time, to our knowledge, that float claims have been brought against plan sponsors. For example, in Barner v. McLane Company, Inc., No. 6:23-00301 (W.D. Tex filed 04/24/2023), the complaint alleges that Merrill Lynch was permitted under its recordkeeping contract to allow participant deposits or money withdrawn from the plan from individual accounts to first pass through a Merrill Lynch clearing account. McLane allegedly agreed that any investment returns and/or interest earn on plan participant money in the clearing account – typically 2-3 days – belongs to Merrill Lynch. The complaint asserts that this additional compensation of even a 1% return on $263,000,000 would account for $2,630,000 in indirect float compensation. Plaintiffs allege that McLane imprudently permitted Merrill Lynch “to siphon millions of dollars from the Plan.”

Many of the 2023 excess recordkeeping fees suffer from the traditional flaw of a failure to compare the purported excess fees to a reliable benchmark. But while many of these cases assert incorrect recordkeeping fees based on unreliable Form 5500 data when accurate fee information is disclosed in participant account statements and regulator-required participant fee disclosures, the most notable flaw in recent complaints is the comparison to unreliable and often dubious comparator plan data. A good example is the Wenzel Fenton Cabassa filing in Stewart v. Nextera Energy, Inc., No. 9:23-cv-81314 (S.D. Fla. 09/25/2023). In the $6.9b Nextera Energy plan, plaintiffs purport to claim that the $56 per participant recordkeeping fee paid to Fidelity was imprudent compared to a $4.72 per-participant fee paid in the Nucor Corporation Profit Sharing Plan and $9.20 per participant paid in the Bloomberg L.P. 401(k) Plan. Similarly, in Sealy v. Old Dominion Freight Lines, Inc., (No. 1:23-cv-819 09/27/2023), plaintiffs compare the purported $66.67 per participant fee paid by participants in the $1.79b Old Dominion sponsored 401(k) plan to the purported $10.57 paid by McLaren Employees’ 403(b) participants; $8.26 paid by DX Technology Matched Asset Plan participants; and $6.91 by Novant Health, Inc. participants. Finally, in Ulch v. Southeastern Grocers LLC, No. 3:23-cv-01135 (M.D. Fla. 09/27/23), plaintiffs represented by the Wenzel and Morgan & Morgan law firms purported to compare the $1.05B Southeastern Grocers plan with a purported $73.72 per participant fee to $4.17 paid by participants in the Netflix 401k Plan and $9.23 paid by participants in the RPM International 401(k) Plan.

Anyone with knowledge of the 401k plan industry knows that all of these comparator numbers are false – particularly the many purported comparators of per-participant recordkeeping fees under $10 per participant. It is pure fiction. Netflix plan participants do not pay only $4.17 in annual recordkeeping fees. The obvious point we are making is that the 2023 genre of lawsuits have reached a new low in misrepresentation of fees and comparators to federal courts. It remains to be seen if there will be consequences for making false claims in federal court, and whether courts will allow these cases to proceed. They are nevertheless based on false and fictional fee comparators.

Finally, the Haley Pawlenko law firm filed five recent cases with novel theories of imprudent use of plan forfeitures. Their lawsuits have received significant attention for these novel theories. In these lawsuits, plan participants allege that plan fiduciaries violated ERISA by using plan forfeitures to offset employer contributions instead of paying plan expenses. The interesting fact of the five plans being sued is that the plan documents for these plans allowed discretion to plan fiduciaries to use plan forfeitures to offset plan expenses and employer contributions.

Investment Imprudence Claims: While many cases assert excess recordkeeping fee, we continue to see an evolution towards more cases alleging investment imprudence. For example, two cases filed by the Capozzi law firm are mostly focused on alleged investment underperformance [Macias v. Sisters of Leavenworth Health System, filed 06-13-2023 (D. Colo.) – alleging “mediocre” and “chronic underperformance” of the JP Morgan Smart Retirement target-date funds; and Fitzpatrick v. Nebraska Methodist Health System, Inc., filed 01-24-2023 (D. Nebr.) – alleging “chronically underperforming Wells Fargo target date funds]. Nichols Kastor filed a case alleging underperformance of TIAA funds, asserting that the plan sponsored $1.5B plan sponsored by Southwest Research Institute is the only ERISA plan in the country with over $250 million in assets (out of 9,000) to have an exclusive TIAA investment lineup. See Drust v. Southwest Research Institute, No. 5:23-cv-00767-XR (filed 06/16/2023 W.D. Tex.). The Edelson Lechtzin law firm teamed up with McKay Law to sue University of Vermont Medical Center for imprudently retaining ten TIAA-CREF legacy investment options. See Baker v. The University of Vermont Medical Center, Inc., No. 2:23-cv-87 (D. Vt. Filed 05/10/2023).

The Walcheske firm filed two separate cases alleging underperformance of Fidelity Freedom target date funds in both Daggett v. Waters Corporation, No 1:23-cv-11527-JGD (D. Mass. 07/07/2023) and Cure v. Factory Mutual Insurance Company, No. 1:23-cv-12399 (D. Mass. 10/17/2023). In prior years, many lawsuits have been filed alleging excessive fees and underperformance of the Fidelity Freedom funds. We have always believed these claims to be unfair and defamatory to the Fidelity’s investment franchise. The noteworthy aspect of these two cases is that it highlights two themes of investment imprudence cases. First, these complaints compare the Fidelity Freedom funds to the performance of the number-one rated – in hindsight – American Funds target-date funds. This is exactly what the Schlichter law firm has done in its expert evidence proffered in the two 2023 trials in California federal court in the Wood Group and Molina Health Care case. Plaintiffs in those cases argue that once they have proven a negligent investment process, they can compare the funds to the highest rated returning funds they can find. It is very prejudicial to plan sponsors to judge investment performance and fiduciary liability with a hindsight comparison to the top-performing funds. Many lawsuits assert deficient or even mediocre performance compared to the highest returning funds offered by American Funds. Others compare to the T. Rowe Price target-date performance, which has averaged in the top 90 percentile over the last decade. The Capozzi Adler firm does the same unfair comparison in alleging that PIMCO target-date blended funds “chronically underperformed” top-rated alternatives from T. Rowe Price and American Funds in Baird v. Steel Dynamics, No. 1:23-cv-00356 (N.D. Ind. 08/22/2023). The comparison is unfair.

Second, these lawsuits demonstrate another troubling trend in investment imprudence cases in which plaintiff firms allege fiduciary imprudence even when the purported underperformance is less than one or two percent compared to the highest returning fund they can find. In two December cases against Cape Cod Healthcare and CHA General Services, Inc., the Fair Work, P.C. firm takes issue with both companies’ offering of several active investments, even though, for example, Cape Cod offered a qualified default investment option of low-cost, high-performing Vanguard index target-date funds. In one of their comparisons, the Allspring Special Mid Cap Value Fund had a 9.08% five-year return and is compared to two index funds with inferior 6.80% and 6.17% returns. The only complaint is that the plan offered active funds with higher fees.

Finally, the most noteworthy performance case of the year is the alleged investment imprudence claim against American Airlines. The case made headlines when the initial complaint alleged that the American plan was larded with dozens of woke-ESG themed investments. The lawsuit filed by Hacker Stephens and Sharp Law LLP alleged that American Airlines plan fiduciaries selected and included twenty-five or more ESG-themed investment options in its sponsored defined contribution plan that are more expensive and underperformed, or otherwise included funds from investment managers who voted for egregious examples of ESG proxy mandates. Plaintiffs immediately filed a new complaint after the motion to dismiss established that the plan had zero ESG investments, and the sole plaintiff had not accessed the brokerage link feature of the plan. The amended complaint takes a new tact, alleging that the plan should have eliminated the option for participants to select ESG-themed investments in the brokerage link, and should have divested from BlackRock investments in the plan because BlackRock has voted proxies to promote ESG corporate mandates. As the case has progressed through discovery, given that the motion to dismiss the amended complaint remains pending, plaintiffs have changed their theory of the case. Instead of divesting investments offered by investment managers who voted their proxies in favor of corporate ESG measures, the expert testimony proffered by plaintiff in the case now asserts that American Airlines should have leveraged its BlackRock investments to convince the firm to change its proxy voting related to certain stock investments in companies like Exxon and Chevron. This radical liability theory has many problems, but the main issue for the plan sponsor industry is that this type of lawsuit could be filed against any plan sponsor in the country, as there is nothing unique in the case that relates to the American Airlines plan. The case also shows how companies can be forced to spend significant defense dollars to defend frivolous claims when the district court does not rule on the motion to dismiss, including standing claims, before discovery and expert testimony is allowed.

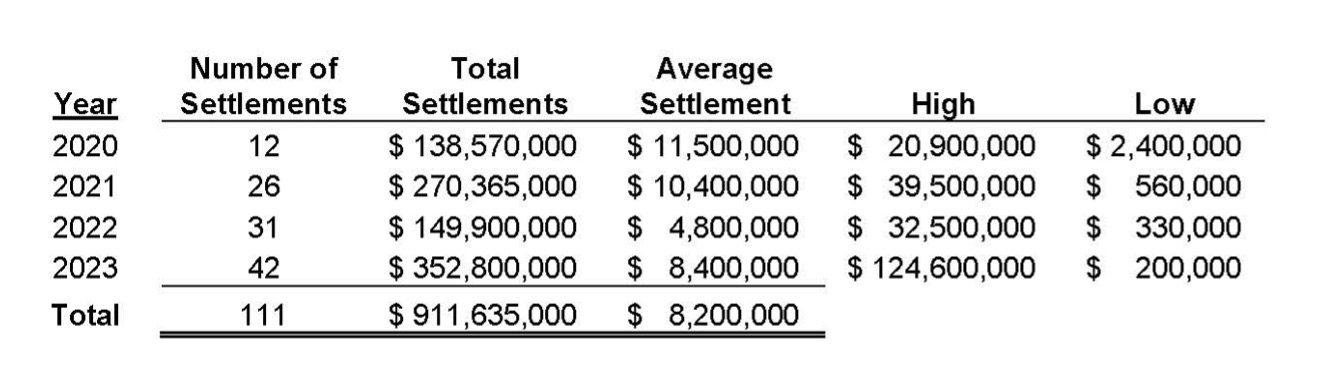

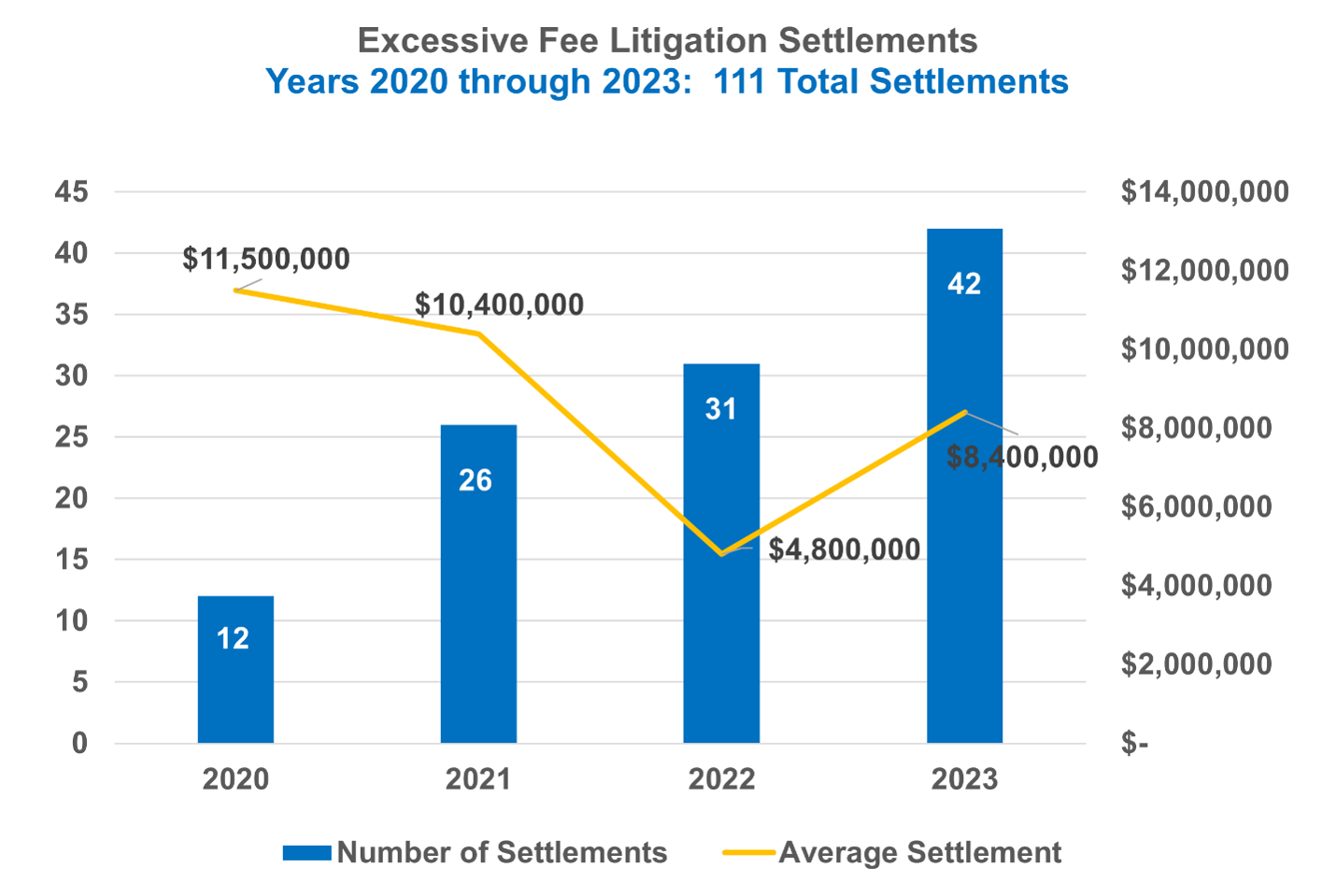

- A RECORD NUMBER OF SETTLEMENTS: 2023 was a year of record settlements in excess fee cases with an all-time high of 42 settlements. Since 2020, 111 settlements have been reported, with the number of settlements increasing progressively each year. During this four-year period, the 111 settlements amounted to $911m in total amount, with a record $353m in total settlement values in 2023. The 2023 average settlement was $8.4m, with a settlement range from $200,000 to $124.6m. The overall value was heavily influenced by the three record settlements [Verizon – $30m; GE – $61m; and Ruane Cuniff & Goldfarb – $124.6m]. If you take out the outlier $124.6m settlement, the average settlement value in 2023 was still a robust $5.6m.

While attempting to synthesize forty-two settlements into cohesive conclusions is difficult due to the various fact patterns and complexity of each case, we believe that two themes are emerging that demonstrate a settlement barbell effect. On one hand, the average settlement for routine excess recordkeeping and investment cases has gone down. This is due to the lower quality of the recent cases and the federal appellate decisions that have demonstrated that certain appellate courts will enforce a meaningful benchmark requirement comparing services for excess recordkeeping claims. There is also a perception that the prolific plaintiff firms are willing to take a cost-of-defense settlement in a business model of churning cases. By contrast, while the average settlement value has diminished for routine cases, certain plaintiff law firms are seeking record settlements in cases involving alleged investment underperformance. The Verizon case is emblematic of this pattern, as the case settled immediately after summary judgment was denied. This contrasting pattern leads to a settlement barbell, with lower-value cases on one end, and higher value investment underperformance cases on the other extreme. This is relevant as one pending high-profile investment imprudence case is proceeding to trial.

Disclaimer: The Fid Guru Blog is intended to provide fiduciary thought leadership and advocacy for the plan sponsor community in areas of complex fiduciary litigation. The views expressed on The Fid Guru Blog are exclusively those of the author, and all of the content has been created solely in the author’s individual capacity. It is not affiliated with any other company, and is not intended to represent the views or positions of any policyholder of Euclid Fiduciary, or any insurance company to which Euclid Fiduciary is affiliated. Quotations from this site should credit The Fid Guru Blog. However, this site may not be quoted in any legal brief or any other document to be filed with any Court unless the author has given his written consent in advance. This blog does not intend to provide legal advice. You should consult your own attorney in connection with matters affecting your legal interests.