By Daniel Aronowitz

The risk environment for fiduciaries of America’s employee benefit plans continues to heighten, as creative and enterprising plaintiff lawyers discover new ways to engineer fiduciary risk for plan fiduciaries in America’s judicial system. This past year, politicians and regulators have added further uncertainty and risk for plan fiduciaries. The following is a summary of the key fiduciary liability stories from the past year, and the implications for what might lie ahead in 2023 and beyond. We conclude with a summary of the state of the fiduciary liability insurance market heading into the new calendar year.

Euclid held a 2022 Fiduciary Claims Trend Webinar in December 2022 that provides a comprehensive summary of current fiduciary claim trends. You can access the slide deck and replay of the claim trends webinar here.

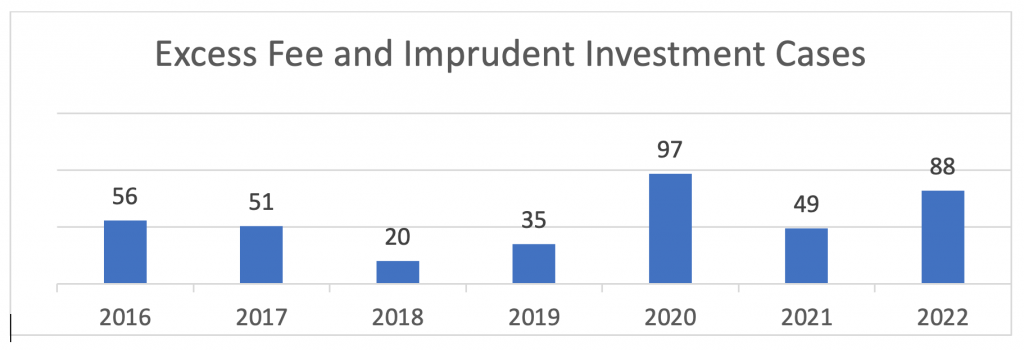

1. The Frequency of Lawyer-Driven ERISA Class Action Litigation Continued to Accelerate with 88 Excess Fee Lawsuits in 2022, but There is Finally Progress in the Plausibility Standard for Early Dismissal of Meritless Cases.

The era of lawyer-driven litigation in the ERISA space remained in hyperdrive in 2022 with over 175 class action lawsuits filed last year. Several new law firms joined an established coterie of plaintiff law firms that have business models designed to sue large employee benefit plans for purported breaches of fiduciary duty. The types of class action cases remain the same: (1) excessive fee and imprudent investment cases against large defined contribution plans alleging that plan fiduciaries overpaid for plan recordkeeping services and investments, or otherwise allowed imprudent investments in the plan; (2) actuarial equivalence cases against defined benefit retirement plans, alleging that the plans use outdated mortality tables when calculating annuity benefits; (3) class actions against health plans alleging violations of COBRA notice requirements; and (4) conflict of interest cases, mostly against employee stock option plans claiming that insiders sold the company at inflated valuations. Most of these lawsuits are manufactured claims by plaintiff lawyers designed to force settlements and earn high attorney fees based on litigation uncertainty.

We count 88 excess fee and imprudent cases filed in 2022, which is the second highest historical amount, second only to the previous record of 97 cases filed in 2020. This is nearly double the number of filings in 2021, but that number was down mostly because the most prolific Capozzi Adler law firm filed less cases in 2021. The Capozzi firm came back with a vengeance by filing 60% of the cases filed in the first half of 2022.

As the high case count confirms, the predominant type of ERISA class action lawsuit remains claims of excess recordkeeping and investment fees. The key change in these lawsuits is that plaintiff law firms have included more investment imprudence claims in these lawsuits, with some lawsuits not claiming any excess fees at all. The most prominent example of this trend is the ambush by the Miller Shah law firm in early August of eleven plan sponsors who offered BlackRock LifePath target-date funds as the QDIA. Notwithstanding that these same target-date funds are rated #1 by Morningstar out of all target date funds in the market for several years in a row, the eleven nearly identical lawsuits claim that the LifePath TDF investments were imprudent because they failed to achieve the same investment returns compared to four of the five other most popular target-date funds in the market for short three- and five-year time frames. The claim in these lawsuits is not that the TDF investments have similar objectives, but have a similar level of popularity in the market. The first two lawsuits were dismissed in the Eastern District of Virginia, but Miller Shah filed amended complaints to address the court’s requirement of a meaningful benchmark. The only substantive change in the amended complaints is the inclusion of a generic S&P target-date benchmark. If allowed to survive, this type of lawsuit would allow plaintiff law firms to second-guess the investment decisions of any investment option that does not track the results of a market average.

The key storyline in 2022 for excess fee cases was the Supreme Court’s January 2022 decision in Hughes v. Northwestern regarding the plausibility standard for motions to dismiss of ERISA excess fee cases, and how courts have applied the decision. Given that most cases that are not dismissed at the pleadings stage settle because of the high damages model and exorbitant legal fees to defend these class actions, the standard for a motion to dismiss has taken on an outsize importance. The question in the Hughes excess fee case before the Supreme Court was whether the heightened Iqbal/Twombly pleading standard from antitrust jurisprudence applies in ERISA class actions. Despite ruling for participants and remanding the case back to the Seventh Circuit in rejecting a participant-choice defense, the Court held that the heightened plausibility standard – as opposed to the lesser notice-pleading standard – applies in ERISA cases, and cited to the stock-drop Dudenhoeffer case to require a “context specific” inquiry. In the key language of the opinion, the Court stated that “[a]t times, the circumstances facing an ERISA fiduciary will implicate difficult tradeoffs, and courts must give due regard to the range of reasonable judgments a fiduciary may make based on her experience and expertise.”

The immediate aftermath of the Hughes decision was not helpful to plan sponsors, with most motions to dismiss denied after the Supreme Court issued its decision. The hallmark of the initial post-Northwestern decisions was the Ninth Circuit in April 2022 reversing both the Trader Joe’s and Salesforce cases, holding that plan sponsors could not defend revenue sharing at the pleading stage. But the plausibility standard took a positive turn on June 21, 2022, when the Sixth Circuit issued its decision in the CommonSpirit Health case. The CommonSpirit court vindicated that ERISA is a law of process and does not allow hindsight second-guessing of fiduciary decisions. The court ruled that it is not imprudent to offer active funds in a defined contribution plan, and, in fact, it may be imprudent not to offer some active funds. The court further ruled that claims of investment imprudence are not plausible based on simply pointing to a fund with better performance. Plausible claims instead require a deficient process and signs of serious distress. Finally, claims of excessive recordkeeping must be proven in proper context, and not by comparisons to a few other plans taken out of context.

The Sixth Circuit followed this decision with a ruling on July 13 in Forman v. TriHealth that reiterated the CommonSpirit ruling that claims of investment underperformance must be judged by the distinct objectives of each investment. Nevertheless, the court upheld the share-class claim that plan fiduciaries had purchased numerous investment options in retail-share classes as opposed to lower-fee institutional share classes. The share-class claim was plausible because it “has a comparator embedded in it.”

The Sixth Circuit’s twin opinions created two rules that have been followed by many courts in the second half of 2022: (1) that you cannot compare passive funds to active funds to allege breaches of fiduciary duty, as a passive fund is not a meaningful benchmark for an active fund with a different investment strategy and objective; and (2) a share-class claim that fiduciaries should have purchased a lower-fee institutional share class of the same exact investment is a plausible claim.

The Sixth Circuit’s pair of decisions were followed by a favorable decision in the Seventh Circuit in Albert v. Oshkosh that followed CommonSpirit in rejecting claims of excessive recordkeeping and investment fees. The Eighth Circuit subsequently rejected similar claims in the MidAmerican case. Oshkosh, however, did not address the issues of retail share classes and investment underperformance. Consequently, it is unclear how the Seventh Circuit will rule on the remanded Divane v. Northwestern case that was argued in late November. Based on the oral argument, it appears that the court was sympathetic to Northwestern’s arguments, but we have learned never to judge too much from oral arguments. Nevertheless, the court appeared to be evaluating whether it was necessary to remand the case back to the district court for a decision as to whether plaintiffs deserved the opportunity to file an amended complaint to comply with the Supreme Court’s new plausibility pleading standard.

In sum, the trend in the second half of the year was that approximately 50-60 percent of motions to dismiss were granted following the favorable precedent in the Sixth, Seventh and Eight Circuits. But despite the higher dismissal rate, many cases are still proceeding to discovery, and plaintiffs are often afforded the opportunity to refile and amend their complaints after the initial decision. This means that the actual dismissal percentage is much lower than fifty percent. Based on our analysis, more investment fee claims are being dismissed than before Hughes, but courts remain more sympathetic to allowing recordkeeping claims to proceed. Consequently, the menace of excess fee claims remains despite a higher chance of dismissal than the previous lower rate both before and immediately after the Supreme Court’s Hughes decision.

Euclid Fiduciary is offering a webinar on the current state of excessive fee and imprudent investment cases on January 19 that will provide a more in-depth analysis of excessive fee lawsuit trends. You can sign up for the webinar here: 2023 Excessive Fee Litigation Webinar Invitation

2. Uncertainty Over How to Handle Participant Account Theft and Cyber-Related Claims.

One of the most interesting ERISA cases of the year is the Colgate participant account theft lawsuit. See Disberry v. Employee Relations Committee of the Colgate-Palmolive Company, Case No. 22-CV-5778 S.D.N.Y. On July 7, 2022, Paula Disberry, as a participant in the Colgate-Palmolive Employee Savings and Investment (401k) Plan, filed an ERISA complaint against the Colgate plan fiduciary committee, Alight Solutions as the plan’s recordkeeper, and BNY Mellon as the plan custodian, seeking restoration of her 401k account balance that had been distributed to a fraudster. The complaint states that “[o]n September 14, 2020, Ms. Disberry was informed that the entire balance of her Plan account, totaling $751,430.53, had been distributed from the Plan in a single taxable lump sum, even though at no point had she authorized or received any such distribution.” The complaint describes how a fraudster schemed to impersonate the participant and con the plan recordkeeper into distributing her entire account balance (minus required tax distributions) to the fraudster.

The fact that the recordkeeper allowed the case to be filed was surprising, as most participant account theft cases are settled out of the public eye. But even more surprising is that all three defendants filed motions to dismiss and disclaimed any liability for the loss of the participant’s account balance: (1) the Colgate plan committee disclaimed any fiduciary responsibility for the “unfortunate” loss of the participant’s entire account balance because it was caused, not by anything the plan fiduciaries did, but by a “complex, international fraud that occurred through no fault of the Committee”; (2) Alight as the plan recordkeeper disclaimed responsibility for “this unfortunate loss” because it did not serve as a plan fiduciary in that it was a “ministerial administrative service provider” and had no discretionary control over the Plan or disposition of any Plan assets; and finally (3) the Bank of New York Mellon as the custodian of the plan assets claimed that it was “not to blame” as the directed trustee because its ministerial role in cutting the check to the fraudster was non-discretionary and thus also not a fiduciary function or cause of the loss.

On December 19, the New York federal district court ruled that the participant adequately alleged breach of fiduciary duty claims against the plan recordkeeper and the plan fiduciary committee (but not the bank custodian). The court was openly skeptical about the “very thin” theories of liability against the recordkeeper and plan committee, but ultimately allowed the complaint to proceed to discovery. With very little case law on this important topic, the Colgate court has signaled that sympathetic courts will allow fiduciary breach claims for cyber theft even when there is no evidence that the plan fiduciaries or recordkeeper failed to take reasonable steps to protect participant assets against sophisticated cyber fraud and theft.

As we wrote in our blog post analyzing the decision, there will be many other instances in which individual accounts are hacked despite the best intentions of plan administrators and fiduciaries. The question is whether there is liability when no responsible entity did anything wrong. This case is a reminder that it behooves the plan sponsor community to solve the issue of participant account theft in its contracts with third-party providers, including demanding that these providers maintain adequate cyber and crime insurance, and by purchasing cyber and crime insurance that is dedicated solely to protect plan assets. This will be necessary to avoid litigation in which courts will be understandably sympathetic to plan participants who have lost their retirement savings.

3. DOL is Regulatory-Neutral Towards ESG in a Surprise, But Governmental Fiduciaries Face an ESG Backlash by Anti-Woke State Legislators.

The Department of Labor Final ESG Rule: The rules for investing in environmental, social and governance investments (ESG) has ping-ponged back and forth since the first interpretive bulletin in 1994 from the Clinton Administration in what was then called “economically targeted investments.” The Trump Administration in late 2020 issued a regulation that added new standards for the use of ESG factors, which expressed skepticism that ESG factors could be used consistently with the duties of loyalty and prudence. The Trump regulation was considered to put a chill on the ability of fiduciaries to make ESG investments in retirement plans. Shortly after taking office, the Biden Administration indicated that it would not enforce the 2020 Trump rules, and that it would promote a pro-ESG regulation. Indeed, the proposed version of the Final Rule suggested that there may be circumstances in which consideration of certain ESG factors, including climate change impacts, must be considered in selecting plan investments.

In a surprise, the rule ultimately promulgated by the Biden Administration is more neutral towards ESG than it had previously indicated and does not create “an effective or de facto regulatory mandate.” On November 22, 2022, the Employee Benefits Security Administration released final regulations that provide a more neutral, middle-of-the-road approach to ESG factors. This Final ESG Rule confirms that ESG considerations may (but not must) be considered among the many factors that fiduciaries consider in making investment decisions. Notably, and contrary to some public statements on the topic, the Final Rule does not require ERISA fiduciaries to consider ESG factors.

Rather than focusing on ESG factors specifically, the Final Rule articulates the fiduciary investment standard that applies to the investment decision-making process overall. DOL emphasizes that the rule is not new, underscoring its attempt to build a durable “middle-ground rule” and help alleviate the chilling effect caused by the uncertainty of the prior Trump regulation. DOL expressed its intention of creating a durable rule that is not changed in the next Republican administration.

The prior Trump regulation contained a “tie-breaker” rule that has been eliminated. The tie-breaker rule required fiduciaries to evaluate whether ESG or economically targeted investments were “indistinguishable” from comparable investments to allow for consideration of collateral benefits. The Final Rule recognizes that it is likely a myth to find “indistinguishable” investments, finding that standard as impractical and unworkable. Instead, the tie-breaker test is now the collateral benefits exception. It allows for consideration of collateral benefits when “competing investments . . . equally serve the financial interests of the plan.” Also, the Final Rule removes the additional documentation required for the tie-breaker analysis under the 2020 rule.

Finally, the Final Rule adds a new provision that allows consideration of participant preferences. It specifies that fiduciaries of participant-directed individual account plans do not violate the duty of loyalty solely by considering participant preferences as part of their investment decision-making process, as long as the other investment prudence process is met.

The value of the Final Rule is beyond just guidance for whether plan fiduciaries can consider ESG factors. From our perspective, the Final Rule rearticulates the fiduciary investment standard for all investments, including providing permission to include preferences of plan participants. It is useful for all plan fiduciaries to study the Final Rule for a better understanding as to proper fiduciary standard for selecting plan investments.

Anti-ESG Movement: While the Final Rule applies to ERISA plans, governmental plans are caught in a wave of uncertainty, as ESG has become a political football for state legislators who view ESG investing as another element of “woke” politics. Dozens of states have proposed or enacted state-specific guidance that may impact whether and how advisors and fiduciaries can implement ESG investment strategies. These regulations vary across the states, with some supportive and other restrictive. Similar anti-ESG positions have been espoused by Congressional members. The debate over ESG investing at the state and federal level is rooted in the question whether fiduciaries are considering ESG factors because they prudently believe that those factors are appropriate financial considerations; or alternatively, are fiduciaries considering ESG factors because of certain ethical or moral beliefs about certain industries and political attitudes? The political nature of ESG investments has created uncertainty for fiduciaries of governmental plans that has no signs of ending anytime soon.

4. Crypto-Currency in Defined Contribution Plans Invites Unwelcome Regulatory Scrutiny.

The Employee Benefits Security Administration of the Department of Labor caused a stir on March 10, 2022, when, without any regulatory rulemaking process or notice to allow public comments, it published a Compliance Assistance Release No. 2022-01 (CAR) regarding 401(k) Plan Investments in “Cryptocurrencies.” The Release cautioned plan fiduciaries “to exercise extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan participants.” The Release continued that “[a]t this early stage in the history of cryptocurrencies, the Department has serious concerns about the prudence of a fiduciary’s decision to expose a 401(k) plan’s participants to direct investments in cryptocurrencies, or other products whose value is tied to cryptocurrencies.”

The Department cited four reasons why crypto investments present “significant risks and challenges to participants’ retirement accounts, including significant risks of fraud, theft, and loss”: (1) crypto investments are “highly speculative” and volatile; (2) it is challenging for plan participants with insufficient knowledge to make informed decisions about speculative crypto investments, and can be easily misled or rely on the assumption that experts have approved the crypto option as a prudent investment; (3) custodial and recordkeeping concerns, including losing or forgetting a password can result in the loss of the asset forever, or methods of holding cryptocurrencies can be vulnerable to hackers and theft; and (4) valuation concerns, including lack of consistent accounting, reporting and data requirements of traditional investment products; and (5) an evolving regulatory environment in which some cryptocurrency market participants may be operating outside of existing regulatory frameworks or not complying with them.

The Department ended with a warning that any plan offering cryptocurrency as a plan investment option was essentially volunteering for a plan audit: “Based on these and other concerns, EBSA expects to conduct an investigative program aimed at plans that offer participant investments in cryptocurrencies and related products, and to take appropriate action to protect the interests of plan participants and beneficiaries with respect to these investments. The plan fiduciaries responsible for overseeing such investment options or allowing such investments through brokerage windows should expect to be questioned about how they can square their actions with their duties of prudence and loyalty in light of the risks described above.”

On April 12, 2022, eleven prominent trade associations, including The SPARK Institute, American Benefits Council and the United States Chamber of Commerce, jointly filed a statement to EBSA asking that the Departments’ compliance release be withdrawn, and that the Department instead develop guidance in the area of cryptocurrency through notice-and-comment rulemaking. The joint statement argued that EBSA’s release was inconsistent with prior law, primarily because plan sponsors have not been previously charged with fiduciary responsibility for investments made through brokerage windows. As these types of investments proliferate, the joint statement espoused that it will be increasingly difficult for plan sponsors to identify, evaluate and exclude such investments from brokerage windows. To this point, DOL regulation 2550.404a-5(h)(4) expressly excludes brokerage windows from the definition of a designated investment alternative. And the Department’s existing supplemental guidance under 404a-5, Field Assistance Bulletin 2012-02R, makes clear that, while there may be a fiduciary duty to evaluate the brokerage window provider, there does not exist a fiduciary duty to monitor or evaluate the underlying investments that plan participants make in the window. The statement further argued that the admonition that fiduciaries should use “extreme care” when considering adding cryptocurrency as an investment option in a plan’s fund lineup is not the legal standard applicable to fiduciaries under ERISA. Instead, it unnecessarily causes confusion with respect to ERISA’s standard that fiduciaries must act “with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.”

Fidelity and ForUsAll Inc. voiced opposition to the CAR as well. On June 2, 2022, plan provider ForUsAll Inc. took the extreme measure of filing a lawsuit against DOL, claiming that regulators breached their statutory purview by threatening an investigative program aimed at plan sponsors that offer digital accounts through their core plan lineup or self-directed brokerage accounts. The complaint claims that DOL violated the Administrative Procedure Act by arbitrarily and capriciously instituting what amounts to a ban on cryptocurrency investments without conducting a formal notice-and-comment rulemaking process.

ForUsAll was one of the first plan administrators to offer workers direct access to crypto holdings through qualified retirement accounts with its product launch in 2021. The company partners with digital exchange platform Coinbase Global Inc. to offer an in-plan brokerage window allowing workers to transfer up to 5% of their savings into more than 50 different cryptocurrencies. ForUsAll is arguing that DOL’s guidance implicates self-directed brokerage accounts or windows, which breaks with decades of precedent that has not required plan sponsors to monitor investments that participants choose for themselves in brokerage windows. This, ForUsAll argues, essentially amounts to a ban on crypto investments in retirement plans without formal regulatory rulemaking.

Separately, Fidelity Investments Inc. announced the release of its own crypto product for 401(k) investors just weeks after the department’s sub-regulatory guidance was released.

Some perspective: Against the backdrop of this regulatory food fight, Bitcoin, the most prominent cryptocurrency, lost 64% of its value in 2022. Ether and other crypto investments lost similar value in 2022. The FTX crypto exchange went insolvent in late 2022, with all participant accounts wiped out. Notwithstanding the hype and potential promise of the underlying blockchain technology in the long-term, crypto remains a toxic and speculative investment with insufficient regulatory oversight. The primary use of Bitcoin currently is by criminals who engage in cyber hacking and extortion. Whether or not DOL properly followed regulatory requirements, its pronouncement is largely correct that crypto is speculative and volatile. We fully support the position that a participant’s individual choices in a brokage account are not subject to fiduciary duties, but crypto is an investment class that does not belong in retirement accounts.

The second perspective we would provide is that the vast majority of retirement plans in America do not offer crypto investments, even in the brokerage windows. Based on our regular underwriting of thousands of retirement plans, only a few dozen plans in the entire plan universe offer crypto, and we believe this is only through brokerage windows and in a limited capacity. ForUSAll’s client base is limited, and they have disclosed that only 30% of their clientele allow crypto in brokerage windows. Given the limited extent of the use of crypto in retirement plans, the hoopla and DOL lawsuit over crypto guidance remains largely a sideshow. But this storyline provides a cautionary tale that offering crypto in a retirement plan – even in the brokerage window – is not worth the potential regulatory scrutiny.

5. ARPA Funding Relief for Distressed Multiemployer Plans

The American Rescue Plan Act (ARPA) that was enacted on March 11, 2021 allows certain financially troubled multiemployer plans to apply for special financial assistance. The program is estimated to provide $82 to $91 billion in assistance to enable the approximately 200 eligible multiemployer plans covering over three million participants to pay retirement benefits without reduction until at least 2051. While this was 2021 legislation, the storyline continued into 2022 because that is when the Public Benefit Guaranty Corporation started granting funding to the most distressed plans with priority status, including the twenty plans that had previously reduced benefits under the Multiemployer Pension Reform Act (MPRA) of 2014.

In December 2022, PBGC announced that $36 billion of special financial assistance under ARPA had been granted to the Central States Teamster Fund that covers approximately 385,000 Teamster workers and retirees. Nearly half of the funding is going to just one plan. The funding crisis of the Central States plan became more severe after UPS withdrew from the plan in 2007. The Central States Fund had tried to take advantage of the 2014 MPRA statute that allowed benefit cuts, but the Treasury Department under President Obama cynically refused the fund’s self-help remedy under the legislation. This allowed the funding deficit to get worse. But the delay allowed Congress, under the guise of Covid relief, to bail out the Central States Fund, along with as many as 49 other Teamster funds that saw funding declines because of deregulation of the trucking industry in the early 1980s and subsequent bankruptcy of many trucking companies.

One can only wonder if underfunded governmental plans will be next to receive federal government bailouts. This would have seemed crazy to even suggest, but Special Finance Assistance under ARPA for multiemployer plans seemed far-fetched until it happened, and we have seen very little pushback from taxpayers.

On a more practical level, based on our experience, it appears that every plan that receives Special Financial Assistance funding is subject to an automatic audit by DOL. DOL is looking to confirm that the plan has invested the ARPA funds properly under the investment restrictions of the PBGC regulations, but any audit leaves open the possibility of other issues that DOL uncovers.

6. Withdrawal Liability Litigation at Record Levels, and PBGC Proposes Rules that Favor Plan Actuarial Rate Discretion.

Without much fanfare, the number of withdrawal liability cases filed each week has exploded as multiemployer plans have initiated aggressive steps to collect contributions from employers. The number of withdrawal liability lawsuits filed against employers reached record levels in 2022 with hundreds of filed cases. An average of two to five withdrawal liability cases are now being filed most business days. But while withdrawal liability disputes have increased amidst decades of inaction by federal regulators to set the actuarial standard, the PBGC has proposed a new regulation that tips the scales in the favor of multiemployer plans.

For years, union employers have contested the fairness of the interest rates being charged to calculate withdrawal liability. Withdrawal liability is an exit fee imposed under ERISA when an employer withdraws (completely or partially) from a multiemployer pension plan that is underfunded. A key factor in calculating the amount of withdrawal liability allocable to a withdrawn employer is the interest-rate assumption used to project the pension plan’s liabilities or promised benefits. The lower the interest rate, the higher the underfunding—and the withdrawal liability allocable to the withdrawn employer. ERISA generally provides broad discretion to the pension plan’s actuary to select the interest rate for withdrawal liability calculations based on its “best estimate of anticipated experience under the plan.” The possible options for selecting an interest rate range from, at one end, the pension plan’s assumed interest rate for minimum funding purposes (often in the 7.0+ percent range) to the interest rate published by the PBGC applied upon a termination of the pension plan by mass withdrawal (approximately 2 percent or lower for most of the past decade before the recent increase in interest rates). Many plans use blended methods, including what is commonly referred to as the Segal Blend, to calculate withdrawal liability. The Segal Blend determines the withdrawal liability interest rate by making a weighted blend of the (higher) funding rate and the (lower) PBGC termination (annuity) rates.

Employers have challenged the use of the Segal Blend interest rate as unfair to the extent that the blended interest rate for withdrawal liability is much lower than the funding rate. Litigation over use of the Segal Blend has resulted in a split at the district court level. District courts in the Second (CT, NY, VT) circuit have ruled in favor of employers, while district courts in the Third (DE, NJ, PA, VI) and DC circuits have upheld use of the Segal Blend. All but one of the district court cases were settled by the parties before reaching any formal decision on appeal. The Sixth Circuit In Sofco v. Erectors v. Trustees of the Ohio Operating Engineers Pension Fund (Jan. 29, 2021 6th Circuit) was the first federal circuit court to rule in favor of employers, finding that the interest rate used in the Segal Blend actuarial assumption was inappropriate to use in a withdrawal liability calculation because it is not based on “anticipated experience under the plan.” The Sixth Circuit in Sofco concluded that the Segal Blend could not possibly be the plan actuary’s best estimate of anticipated experience because this methodology “dilutes” the best estimate with interest rates—mass withdrawal termination rates—that might never apply. In so concluding, the court noted that any deference owed to the plan actuary cannot excuse the explicit requirement in ERISA that requires the actuary to use actuarial assumptions and methods based on “anticipated experience.”

The Sixth Circuit decision created concern that it could unleash a wave of withdrawal liability exit lawsuits, which appears to have happened this year. In a footnote to the opinion, the Sixth Circuit implied that the PBGC could explicitly authorize use of the Segal Blend and thereby “displace” the ERISA requirement by regulation. That is exactly what the PBGC has done. On October 14, 2022, the PBGC issued proposed rules that validates discretion for plans to select withdrawal liability interest rates that differ from rates used for plan funding assumptions. The proposed rule clarifies that it is reasonable to base the interest assumption used to calculate an employer’s withdrawal liability on the market price of purchasing annuities from private insurers, such as by use of settlement interest rates prescribed by PBGC under Section 4044 of ERISA. More importantly, the proposed rule would specifically permit the use of 4044 rates either as a standalone assumption or combined with funding interest rate assumptions, to determine withdrawal liability. If the PBGC regulation is finalized in its proposed form, it would validate the use of the Segal Blend or other interest rate assumptions that are lower than the interest rate used by plans to calculate funding requirements. This greatly helps multiemployer plans in their quest to maximize contributions to plans. But one cannot help to contemplate whether this short-term help for plans will contribute in the long-term to the continued decline in defined benefit retirement plans.

7. SECURE Act 2.0

On December 29, 2022, Congress passed significant retirement legislation as part of the omnibus spending bill. We are still studying the SECURE 2.0 Act of 2022, but given our focus on fiduciary liability and risk, we are drawn to the provisions that relate to correction of plan mistakes, including the new rules for correcting overpayments and expansion of the Self-Correction Program under IRS’s Employee Plans Compliance Resolution System (EPCRS) to cover most inadvertent errors. The rules for recovering benefit overpayments are immediately applicable and represent major changes. SECURE 2.0 provides that plan fiduciaries are not required to recover inadvertent overpayments made to participants and beneficiaries, assuming that the plan complies with applicable tax limitations on benefits and the minimum funding rules. As a result, failure to seek reimbursement of an inadvertent overpayment will not be treated as a breach of ERISA fiduciary duty or as a violation of the tax-qualification requirements under the Internal Revenue Code. If a plan chooses to recover overpayments, recovery is limited by new rules in significant ways.

The Fiduciary Insurance Market Has Stabilized

These key fiduciary trends from 2022 demonstrate that plan fiduciaries continue to face an increased litigation risk. For several years starting in 2019-2020, the fiduciary liability insurance market contracted as the loss ratios for leading fiduciary insurers skyrocketed with the increased frequency and severity of ERISA class action litigation. Premiums increased for several years in a row, but the most significant change in the fiduciary insurance market was not higher premiums, but rather higher policy deductibles and retentions for class action and excessive fee claims. Leading carriers also reduced the limits available for fiduciary programs, requiring large plan sponsors to build necessary insurance limits with multiple carriers at $5m and $10m increments. The third significant change was that fiduciary carriers increased the underwriting scrutiny of large plans and required supplemental disclosures of the recordkeeping and investment fees of participant-directed defined contribution plans.

The broader market for management liability insurance turned in mid-2022, with insurance rates for directors and officers insurance experiencing rate decreases for the first time in five years due to significant market competition from new D&O entrants. This soft-market turn in the overall management liability insurance market has had an impact on the smaller market for fiduciary insurance. Leading fiduciary carriers with experience and expertise in fiduciary claims continue to underwrite fiduciary accounts cautiously, and continue to manage limits and require retentions for accounts with excessive fee litigation risks. But rate increases for fiduciary insurance have moderated as several D&O carriers without fiduciary claims experience have attempted to fill their premium losses from their D&O book with fiduciary opportunities. This has caused more competition in the fiduciary market for the first time in several years and allowed many policies to be renewed with minimal rate increases. Many current fiduciary policy renewals are renewing closer to expiring due to the change in the market.

Given that fiduciary liability claims frequency and severity remains very high, it remains to be seen in the coming year whether competition will return to the fiduciary insurance market. From our perspective, plan sponsors have the ability to secure quality fiduciary insurance at good rates and terms given the healthy current state of the fiduciary market. We continue to believe that all fiduciary policies and carriers are not the same, and that plan sponsors should focus on fiduciary insurance markets with substantial fiduciary experience and expertise to navigate the evolving world of fiduciary risk.