By Daniel Aronowitz

A group of plaintiff law firms continues to second-guess the investment decisions of the fiduciaries of America’s large retirement plans by alleging fiduciary malpractice based on plan fees and investment performance. Most of these cases attempt to compare actively managed investments to lower-cost passively managed investments. But in two cases filed on July 29 against the plan fiduciary committees of Citigroup and Stanley Black & Decker, the Miller Shah law firm takes the claims of investment imprudence a step further. This firm purports to second-guess the judgment of Morningstar, the leading independent firm that rates mutual fund investments, by challenging the investment performance of Morningstar’s number one rated target-date fund series. In both lawsuits, Miller Shaw flips the script of the typical excessive fee lawsuit by alleging that the respective plan fiduciaries “chased the low fees” charged by the BlackRock index target-date funds and saddled the plans with purportedly inferior returns compared to other target-date funds. The complaints are filled with charts from Morningstar’s 2022 Annual Target Date Strategy Landscape, implying that Morningstar validates their fiduciary malpractice claims. But they leave out the most important chart in the entire Morningstar survey – the one that identifies the very same BlackRock target-date funds as the number one rated target-date funds in the 2022 Morningstar survey.

It is one thing for plaintiff law firms to challenge the prudence of retail share classes for target-date funds, but it is quite another to challenge the performance of leading target-date suites. If Miller Shah is allowed to profit by alleging that plan fiduciaries committed malpractice by selecting the highly rated, low-cost BlackRock target-date funds, then every fiduciary in America is at risk of being accused of malpractice if they serve on a retirement plan. In other words, if BlackRock target-date funds (TDFs) can be challenged, then every investment selection can be challenged. That may be what plaintiff firms want, but that is not what Congress intended in ERISA, and not what the Department of Labor, which has been largely absent from the debate on the merits of excessive fee and investment underperformance lawsuits, should allow. Whatever merit some of the initial excessive fee and imprudence cases might have had, that has been perverted by the Citigroup and Stanley Black & Decker lawsuits challenging the performance of the #1-rated target-date funds in America.

The analysis below shows that Miller Shah is essentially claiming that it is imprudent for any retirement plan to choose a “to” target-date retirement glide path that BlackRock provides, as opposed to the more aggressive “through” retirement glide path. The firm is alleging that all of the $289 billion of assets invested by institutional plans in BlackRock TDFs with an 8.8% market share is imprudently invested – an outrageous claim that would deny America’s plan fiduciaries the ability to choose conservative investment strategies that hedge against market downturns. The firm is also taking the position that the benchmark for target-date funds is not funds with similar glidepaths and investments, but rather the other leading target-date funds on the market, even if the glidepaths and investments are dramatically different with inapposite investments goals and strategies. These are legal conclusions that are not entitled to deference by any reviewing court. But more importantly, they are faulty legal conclusions. Just like plaintiffs’ firms have attempted to claim that Fidelity Freedom funds have experienced deficient investment performance, Miller Shah is now claiming – equally without merit – that BlackRock funds have performed poorly. But their purported comparisons are misleading in four different ways, beyond that fact that Morningstar rates the BlackRock funds as the #1 target-date fund series in the market: (1) the BlackRock TDFs are being compared to more aggressive “through” retirement TDF suites with higher equity allocations closer to retirement; (2) they are being compared to active target-date funds with different strategies; (3) they are being unfairly compared to two of the highest performing TDFs series in the last ten years [American Funds and T. Rowe Price]; and (4) BlackRock TDFs will almost always lag the highest performing funds in long bull markets against purported comparator funds, including American Funds and T. Rowe Price, that have higher equity allocations, but BlackRock TDFs will outperform in down markets like the current 2022 bear market, and as they did in the short downturn in the first quarter of 2020.

The Investment Imprudence Claims Against Citibank

The Citibank defined contribution plan had 109,634 participants and $17.91 billion in assets as of December 31, 2020. The qualified default investment option was the BlackRock LifePath Index Funds, offering a suite of ten TDFs, which two participants in the plan claim were “not a suitable and prudent option for the Plan” based on alleged inferior performance. Plaintiffs claim that “as is currently in vogue, Defendants appear to have chased the low fees charged by the BlackRock TDFs without any consideration of their ability to generate return.” This assertion is humorous and ironic given that this same plaintiff law firm has filed many cases alleging just the opposite – that plan fiduciaries have acted imprudently by investing in high-cost actively managed target-date funds instead of lower cost index funds.

In a somewhat sophisticated complaint, Plaintiffs attempt to preempt two key defenses that Citibank fiduciaries will use to defend the prudence of choosing the BlackRock index TDFs. The first is the question of what is the “meaningful benchmark” to prove that BlackRock TDFs somehow under-performed alternative options. Plaintiffs allege that “[t]he managers of the Blackrock TDFs, like those of many TDF suites, have designed a custom benchmark against which their performance can be assessed.” For example, for each TDF vintage, the BlackRock LifePath Index Custom Benchmark “is a weighted mix of several market indices that are representative of the asset classes in which the BlackRock TDFs invest.” But plaintiffs allege that this composite benchmark “simply mirrors the overall strategy of the series and fails to demonstrate how the investment is performing relative to peers” and thus “is an imperfect evaluative tool.” In other words, plaintiffs are claiming that BlackRock will defend its TDF performance by using a custom benchmark that “merely reflects the managers’ ability to execute their own particular strategy.”

Instead of a benchmark that compares BlackRock TDFs to a custom benchmark with similar investments and strategy, plaintiffs allege that BlackRock should be compared to the largest six target-date series offered in the market, which make up seventy-five percent of all TDF assets [drawn from the 2022 Morningstar report]: Vanguard Target Retirement [$1,190B/36.4% market share]; T. Rowe Price Retirement [$350m/10.7%]; BlackRock LifePath Index [$287B/8.8%]; American Funds Target Date Retirement [$248B/7.6%]; Fidelity Freedom $221B/6.8%]; Fidelity Freedom Index [$152B/4.6%]. Plaintiffs claim that the five non-BlackRock TDF suites “represent an ideal group for comparison” – not because they match the investment goals and strategy of plan fiduciaries – but because “they represent the most likely alternatives from which to replace the BlackRock index TDFs.” In sum, plaintiffs are taking the position that investment mix and strategy is irrelevant. Instead, they claim that BlackRock TDFs need to be compared against other popular target-date funds from Vanguard, American Funds and T. Rowe Price, never mind that only one of these TDFs are passively managed.[i]

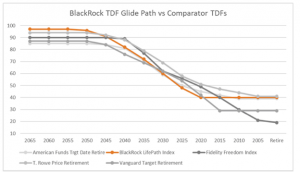

Plaintiffs next attempt to preempt the likely defense of the BlackRock TDFs that any difference in performance was based on the fact that BlackRock TDFs have a more conservative glidepath. The key difference in the BlackRock LifePath glide path is that it is a “to” retirement glidepath that is designed for an investor who expects to invest in the fund up until retirement, whereas a “through” glide path is for the investor who plans to withdraw funds gradually after retirement. Of the top six TDFs in the market, BlackRock is the only option with the more conservative “to” retirement glidepath designed for investments to be transferred out of the plan at retirement. This is a critical difference. Citigroup fiduciaries are going to argue – quite legitimately – that you cannot compare “to” retirement glidepaths against “through” glidepaths.” The reason is that a considerably heavier weight to equities in a through-retirement TDF strategy will likely produce greater returns in up markets.

But plaintiffs know this defense is coming and allege preemptively that any assertion by plan fiduciaries that they chose “a more conservative approach is misleading.” They admit that BlackRock TDFs “de-risk at a quicker pace than most of the Comparator TDFs,” but argue that “the resulting equity allocation discrepancy is only reflected in its two most conservative vintages, the 2025 and [2020] Retirement TDFs.” Instead, plaintiffs claim that “the BlackRock TDF series has the industry’s most aggressive glide path for investors furthest from retirement and maintains a comparable equity allocation to its peers until an investor is approaching retirement”:

[i] Plaintiffs conclude this argument by taking a defamatory swipe at the Fidelity Freedom funds in a footnote, claiming that the “anemic and imprudent” Fidelity Freedom funds “do not represent an appropriate comparator” because of the “issues plaguing the Freedom Funds.” This is pure defamation, but it has been repeated in many lawsuits, and except in an amicus brief in the CommonSpirit case, Fidelity has taken no steps to defend the performance of its Fidelity Freedom Funds.

| Percentage of Portfolio in Equities

Target Year 2065 2060 2055 2050 2045 2040 2035 2030 2025 2020 2015 2010 2005 Retire |

||||||||||||||

| American Funds Trgt Date Retire | 85 | 85 | 85 | 85 | 84 | 81 | 71 | 59 | 50 | 45 | 42 | 39 | ‐ | ‐ |

| Fidelity Freedom Index | 90 | 90 | 90 | 90 | 90 | 89 | 77 | 62 | 56 | 49 | 40 | 30 | 21 | 19 |

| T. Rowe Price Retirement | 94 | 94 | 94 | 94 | 92 | 88 | 79 | 69 | 58 | 51 | 47 | 44 | 41 | ‐ |

| Vanguard Target Retirement | 87 | 87 | 87 | 87 | 84 | 76 | 69 | 62 | 54 | 42 | 29 | ‐ | ‐ | 29 |

| BlackRock LifePath Index | 97 | 97 | 97 | 96 | 91 | 82 | 72 | 60 | 48 | 40 | ‐ | ‐ | ‐ | ‐ |

| Comparator TDF Average | 89 | 89 | 89 | 89 | 88 | 84 | 74 | 63 | 55 | 47 | ||||

| BlackRock +/‐ Average | 8 | 8 | 8 | 7 | 4 | ‐2 | ‐2 | ‐3 | ‐7 | ‐7 | ||||

The chart actually shows that BlackRock has less equity allocated in five of the ten glidepaths up to retirement, but they are correct that the initial allocation is aggressive.

Plaintiffs add another chart to claim that the BlackRock TDFs are considerably more aggressive than the Comparator TDFs from the vintage intended for the youngest investors through those with a target date of 2050:

Again, this chart shows that BlackRock starts with a higher equity allocation farther from retirement, but they move to a more conservative glidepath closer to retirement. The BlackRock glidepath is demonstrably different than “through” retirement alternative TDFs. Plaintiffs then conclude with charts comparing three- and five-year returns for the BlackRock TDFs against the other five largest TDFs in the market, and claim that the “BlackRock TDFs dramatically, repeatedly underperformed the average return of the Comparator TDFs for virtually the entire relevant period.” Plaintiffs then insert charts comparing performance against T. Rowe Price, American Funds, and Fidelity Freedom funds. Most of the charts show .5 to 2.0% alleged inferior returns to the performance of these popular TDFs.

The Claims against Stanley Black & Decker

The Stanley Black & Decker defined contribution plan had 20,603 participants and plan assets of $2.18 billion as of December 31, 2020. Unlike the Citigroup lawsuit, plaintiffs allege that the Stanley plan imprudently allowed excessive recordkeeping and administrative costs by paying an average of $49 per participant for recordkeeping to Wells Fargo. Plaintiffs purport to compare the Stanley $49 recordkeeping fee against seven other plans. This is the typical Miller Shah/Capozzi Adler/Walcheske & Luzi excessive recordkeeping claim that uses inaccurate and inflated Form 5500 data, rather than the more accurate participant and plan fee disclosures. In other words, the complaint is likely incorrect as to the actual recordkeeping fees incurred by the Stanley plan because the complaint includes transaction costs that are not included in the purported comparator plans. Plaintiffs also make no effort to compare the plan recordkeeping services to the services provided by the purportedly comparator plans. The claim is weak and unsupported but is typical of purported excessive fee lawsuits.

Nevertheless, our focus today is the claim that mirrors the Citigroup lawsuit that the Stanley plan imprudently invested in the BlackRock LifePath Index Funds. The claims of investment imprudence relating to the Blackrock TDFs are identical, word-for-word the same as the Citigroup lawsuit.

Why the BlackRock LifePath Funds are Prudent Investment Options

The purported investment imprudence cases against the BlackRock LifePath funds are flawed in so many ways. But we will take time to explain at least the most obvious reasons why the claims are frivolous:

- The BlackRock LifePath funds are the number one rated TDFs by Morningstar for multiple years in a row;

- the BlackRock TDFs are being compared to more aggressive “through” retirement TDF suites with higher equity allocations closer to retirement;

- The BlackRock TDFs are being improperly compared to active target-date funds with different strategies;

- they are being unfairly compared to two of the highest performing TDFs series in the last ten years [American Funds and T. Rowe Price]; and

- BlackRock funds will almost always lag the highest performing funds in long bull markets because these funds, including American Funds and T. Rowe Price TDFs, have higher equity allocations, but BlackRock TDFs will likely outperform in down markets like the 2022 bear market, and as they did in the first quarter of 2020.

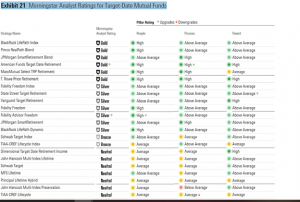

Flaw #1: Morningstar Ranks the BlackRock TDFs as the #1, Highest-Rated TDFs

Miller Shaw cites the Morningstar 2022 Target-Date Strategy Landscape report that was issued on March 23, 2022, for the data it uses to allege that the BlackRock TDFs should be compared to the five other most popular target-date funds. But plaintiffs leave out the most important chart in the Morningstar study, which details the Morningstar analyst ratings for the leading target-date funds. For the entire time period in which plaintiffs claim that BlackRock TDFs were unsuitable for retirement plans, BlackRock TDFs were rated in the highest Gold category and in the number one position. The 2022 report continues to rate BlackRock Life Path Index funds as the number one ranked TDFs in the market:

As recently as March 14, 2022, Morningstar reviewed the BlackRock LifePath Index Target-Date series and concluded that it “remains a first-class target-date series.” We quote the short report verbatim:

The BlackRock LifePath Index target-date series of funds features an innovative team with topnotch resources. It continues to earn a Morningstar Analyst Rating of Gold for its cheapest share classes and Silver for its more expensive ones.

This index-based series benefits from BlackRock’s robust approach to asset allocation and a research-intensive culture. They keep costs low by investing exclusively in passive index funds, though this gives management fewer tools to outperform over shorter periods compared with more active strategies that can tactically tilt the portfolio or select talented active managers. Yet, the team continues to innovate, with current research looking at ways to get targeted fixed-income exposures across the glide path. In 2022, the team will remove the iShares US Aggregate Bond Index in favor of five more pinpointed fixed-income index funds whose allocation will vary across the glide path in order to provide diversification benefits. These changes demonstrate the team’s dedication to continual improvements.

The team does not implement tactical moves, choosing instead to make incremental changes to allocations across the glide path. For example, in 2019, the team lowered the series’ overweight to global REITs early in the glide path to 5% from 16% to put more emphasis on assets with higher growth potential through broader equity index funds. The team’s willingness to revisit, and reverse, prior assumptions is another sign of its forward-thinking nature.

The team has been stable since it was restructured in December 2020. Chris Chung, head of asset allocation and custom strategies for LifePath, has been the lead manager for the past year following the departure of longtime manager Matt O’Hara. Chung’s track record here, although short, demonstrates his ability to continue employing the team’s forward-looking process, and we expect them to continue enhancing this series. The team leverages the expertise of Partha Mamidipudi, head of human capital research, whose team, in tandem with the asset-allocation research, informs the glide path. Management also has access to the firm’s breadth of data and tools. We remain confident that their resources and drive to enhance this low-cost solution will continue to win out over the long term.

In sum, Morningstar evaluates more than just investment performance to conclude that the BlackRock LifePath funds have a solid strategy and process. This analysis validates that is prudent for fiduciaries of large retirement plans to choose the BlackRock TDFs as the plans QDIA.

Flaw #2: The “To” Retirement BlackRock TDFs are being compared to more aggressive “through” retirement TDF suites with higher equity allocations closer to retirement.

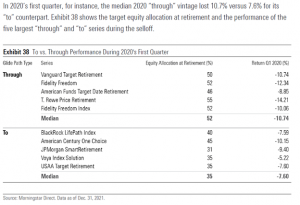

The Citigroup and Stanley imprudent investment lawsuits are essentially a wholesale attack on any TDF that utilizes the more conservative “to” retirement glidepath. As noted above, the key difference in the BlackRock LifePath glide path is that it is a “to” retirement glidepath that is designed for an investor who expects to invest in the fund up until retirement, whereas a “through” glide path is for the investor who plans to withdraw funds gradually after retirement. Of the top six most popular TDFs in the market, BlackRock is the only option with the more conservative “to” retirement glidepath designed for investments to be transferred out of the plan at retirement. You cannot compare “to” retirement glidepaths against “through” glidepaths.” The reason is that a considerably heavier weight to equities in a through-retirement TDF strategy will likely produce greater returns in up markets. But the opposite is true in down markets.

Miller Shah labels the BlackRock “to” retirement TDF strategy a “vastly inferior retirement solution.” But Morningstar’s analysis shows that the BlackRock “to” retirement strategy is a superior solution in down markets:

If a court somehow allows these cases to proceed, it will allow plaintiff law firms to claim any plan fiduciaries selecting a “to” retirement TDF strategy has acted imprudently. This is like claiming all actively managed investments are imprudent compared to passively managed investments. There is nothing in ERISA that allows such a wholesale challenge. As we have argued many times, this is not a judgment that courts should be allowed to make – in a constitutional democracy, only Congress should be allowed to legislate such fiduciary judgments. At a bare minimum, the Department of Labor as the legitimate regulator of ERISA fiduciary duties should be the decision maker, and certainly not plaintiff law firms that are trying to make a profit by challenging discretionary fiduciary decisions as malpractice.

Flaw #3: The BlackRock TDFs are being improperly compared to active target-date funds with different strategies.

A very obvious point, but the BlackRock TDFs are being compared to actively managed target-date funds – the highly regarded American Funds and T. Rowe Price funds – that are actively managed with different investment goals and strategies. While most cases attempt to compare actively managed funds to passively managed funds, this is the opposite – comparing BlackRock index TDFs to actively managed American Funds and T. Rowe Price funds – but just as flawed. It is the basic apples-versus-oranges faulty logic.

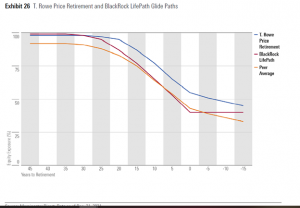

Flaw #4: The BlackRock TDFs are being unfairly compared to two of the highest performing TDFs series in the last ten years [American Funds and T. Rowe Price].

The Morningstar report made an important point that “[t]he 2021 calendar year also served as a reminder that being overly conservative when saving for retirement has significant drawbacks.” This meant that plans with flat glide paths and a lower equity allocation compared to peers had poor relative returns, but in no way reflects poor investment management. By contrast, funds with high equity allocations have performed the best in the last ten years, which were marked by a long bull market. In particular, the report notes that the American Funds Target Date Retirement series has delivered “strong returns” – “[o]n average, its funds topped 98% of peers in their respective categories.” Similarly, the “T. Rowe Price Retirement series also delivered top-decile 10-year returns” by featuring a “an aggressive equity tilt across its glide path. That means that plaintiffs are attempting to unfairly compare BlackRock index funds with completely different strategies to two of the highest performing funds in the entire industry. BlackRock slightly underperformed the two best performing TDFs available. That is not evidence of fiduciary imprudence, but just evidence that the two highest performing funds took high risk with a high equity allocation. The risk paid off, but only because the market had ten years of high performance. The two best performing funds are not meaningful benchmarks given that BlackRock had a more disciplined and conservative strategy. We believe the 2022 bear market will reverse the tide and demonstrate that plans with high-risk strategies cannot be compared to plans with lower-risk strategies. But that is exactly what the Citigroup and Stanley lawsuits purport to do.

The Morningstar report validated the BlackRock equity glidepath alleged in the complaint, but not plaintiffs’ conclusions. Morningstar stated that:

BlackRock, meanwhile, has long been one of the more aggressive sponsors furthest from retirement. Its target-date offerings, which include the Gold-rated BlackRock LifePath Index series, have started with 99% of assets in equities for years and maintain a higher equity posture relative to the average peer until roughly 10 years to retirement. But the BlackRock TDFs still have a more conservative glidepath compared to the T. Rowe Price Retirement plan TDFs. (Emphasis added by Euclid)

This Morningstar charts shows that, except for the two to three initial glidepaths, T. Rowe Price has a more aggressive equity allocation. Any higher returns of T. Rowe Price during the long bull market are directly related to their more aggressive equity positions. T. Rowe Price and American Funds, with the same higher-risk strategy, are not valid or meaningful benchmarks compared to the BlackRock index funds.

Flaw #5: BlackRock funds will almost always lag the highest performing funds in long bull markets, but BlackRock TDFs will likely outperform in down markets, as they did in the first quarter of 2020 and now in the bear market of 2022.

As shown in the section above comparing the “to” retirement TDF strategy in the first quarter 2020 short bear market, the BlackRock “to” retirement TDFs are designed to provide downside protection in bear markets. Plaintiff law firms have prospered by challenging investment performance in the long bull market. But no one could have predicted ten years of consecutive good returns. Some investors want a more conservative strategy and cannot be held responsible if more aggressive strategies win out. Yet that is exactly what most investment imprudence cases attempt to do.

The most interesting charts in the Citigroup and Stanley complaints are the charts comparing the performance of BlackRock TDFs to the market-leading Vanguard funds. Plaintiffs make no comment, because it does not help their case, but it clearly shows that BlackRock index TDFs lagged Vanguard performance in the long bull market, but have clearly outperformed Vanguard in the recent bear market:

BlackRock Rolling Returns vs Vanguard

The Euclid Perspective

The Citigroup and Stanley cases are important, because if allowed to proceed to discovery as plausible cases, then every retirement fiduciary is at risk of being second-guessed with hindsight judgment by plaintiff law firms. If you focus just on the Citigroup plan, it is a super low-fee plan with excellent investment selections for plan participants. Any of the 100,000+ participants have access to one of the lowest fee plans in the country. They are fortunate to have a plan that is better than nearly every other plan in the country. Citigroup has leveraged its size and clout to deliver a top-notch plan with investments, not from Citigroup, but from a leading index provider, BlackRock. The Citigroup plan fiduciaries did everything right. But if plaintiff law firms are allowed to accuse the fiduciaries of one of the lowest-fee, best plans in the country of fiduciary malpractice, then every plan fiduciary is at risk for every single investment choice. There has to be a point at which courts and the Department of Labor cry foul on this attempt to pervert ERISA law. We are at that point with these claims against top-rated BlackRock funds.

But there is one final point we want to make to BlackRock itself. The Citigroup and Stanley cases represent pure defamation of BlackRock. We urge BlackRock to intervene in these cases, and defend the performance and strategy of the BlackRock funds. They have a legitimate and necessary case to make to defend their institutional investment process. By contrast, Fidelity has taken a hands-off approach and has allowed dozens of its institutional clients to be sued for alleged under-performance of the Fidelity Freedom funds. Fidelity had the complicating factor that many of these lawsuits revealed that Fidelity is willing to charge retail fees to institutional clients. Nevertheless, the claims of investment underperformance of the Fidelity Freedom funds was always illegitimate. The Fidelity Freedom funds are excellent funds with sound long-term performance. But except for one amicus brief in the CommonSpirit case, Fidelity has allowed its clients to bear the burden of defending the reputation of the Freedom Funds performance, and it has gone poorly. Even the Citigroup and Stanley lawsuits take illegitimate swipes at the alleged “anemic” performance of Fidelity Freedom funds. Hopefully BlackRock has been paying attention and intervenes in these cases to defend both of its customers that have been unfairly accused of fiduciary malpractice. Otherwise, Miller Shah is inviting other law firms to file the same illegitimate and defamatory claims against America’s best suite of index target-date funds.

[1] Plaintiffs conclude this argument by taking a defamatory swipe at the Fidelity Freedom funds in a footnote, claiming that the “anemic and imprudent” Fidelity Freedom funds “do not represent an appropriate comparator” because of the “issues plaguing the Freedom Funds.” This is pure defamation, but it has been repeated in many lawsuits, and except in an amicus brief in the CommonSpirit case, Fidelity has taken no steps to defend the performance of its Fidelity Freedom Funds.