By Daniel Aronowitz

Many excessive fee lawsuits allege fees that overstate what the plan participants actually pay, and then compare the fabricated fee amounts to false and misleading “benchmarks” supposedly paid by other plans. This deceptive playbook by the plaintiffs’ bar was on full display in the Matney v. Barrick Gold case. Participants represented by the prolific Capozzi Adler law firm alleged that the plan imprudently used a higher-fee retail share class for the plan’s JP Morgan target-date funds when lower-fee institutional shares were supposedly available. Participants further alleged that the recordkeeping fees were too high because the 401k Averages book found that $200m plans pay only $5 per participant for recordkeeping fees, and thus large plans like the Barrick Gold $500m+ plan with more leverage should pay substantially less than $5 per participant.

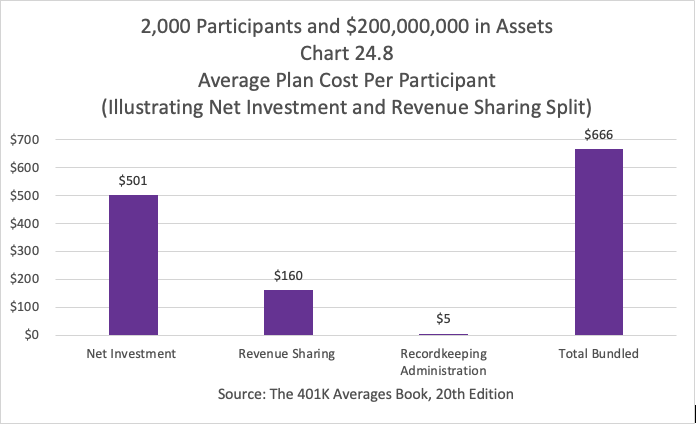

These are both false claims, and the plaintiffs’ lawyers know that. But that is how the con game of excess fee litigation is played. The truth is that the plan had negotiated a fifteen-basis point revenue sharing credit, which was higher than the ten basis point differential from the institutional share class that plaintiffs claim was more prudent. And there is no $200m plan in America that only pays $5 in recordkeeping per participant. In fact, based on Euclid research, there is not a single plan in America with a $5 per participant recordkeeping fee. The citation to the 401k Averages Book is intentionally misrepresented, because even if $5 is the correct direct recordkeeping fee, the chart in the book shows that the same plan paid over $160 in indirect revenue sharing for a total of at least $165 per participant.

This is all litigation gamesmanship. It will continue until it stops working or plaintiff lawyers are cited for ethics violations. But since the American Bar Association does not appear to police the truthfulness of representations in federal lawsuits, we are left to the federal courts to weed out meritless fiduciary malpractice claims. So it is noteworthy that the Tenth Circuit has drawn a line in the sand on lawsuits based on false excess fee share class claims that misrepresent plan contracts.

In a key appellate decision, the Tenth Circuit in Matney v. Barrick Gold of North America on September 6, 2023 upheld the Utah District Court’s dismissal of the Barrick Gold excessive fee case with prejudice. The decision has two key rulings.

- First, the Court allowed documentary evidence from plan documents that contradicted the false share class investment fee claims, which precluded the crass attempt to create an issue of fact by intentionally withholding the truthful investment fees paid by the plans. Some courts do not allow plan sponsors to defend with the actual plan fees, and this is the key difference in the disparate rulings on the ERISA excessive fee pleading standard across the county. The deceptive complaint in the Barrick Gold case shows why the pleading standard must allow plan sponsors to proffer the actual fees before the plausibility of an excess fee complaint can be decided.

- Second, the Court required a meaningful benchmark to allege that plan investment and recordkeeping fees were too high. There are many features to a meaningful benchmark, but we believe that rejection of the 401k Averages Book is critical for precedential value in other excessive fee cases. The appellate court did not call out the false $5 benchmark, but nevertheless did not allow participants to support an excess recordkeeping claim based on small-plan data without an apples-to-apples comparison of specific large-plan services. Many courts allow the assertion that recordkeeping fees are commoditized for large plans, but several federal appellate courts have now required a comparison of plan administration services to assert excessive recordkeeping fees. Until we have a reliable national benchmark of what large plans actually pay in recordkeeping fees, courts must require meaningful comparisons to justify claims of fiduciary imprudence.

KEY ISSUE #1: An Excess Share-Class Investment Fee Claim Can Be Rebutted with Documentary Evidence From Plan Contracts.

We have written extensively on the Barrick Gold case as it worked its way to the appellate court, as it raised a common fact pattern involving plans with revenue sharing arrangements in which courts have applied different pleading standards. The key issue in the case was that the district court did not rely on the misrepresented investment fees in the complaint, but rather allowed the defense to use the plan contract to show that the R5 share class of the JP Morgan Smart Retirement Funds at .55% was actually cheaper than the .45% R6 institutional share class, because JP Morgan was required to rebate 15 bps to plan participants investing in the TDFs. The fees were .40% – not the misrepresented .55% alleged in the complaint. The same exact investments were at issue in the CentraCare and Old Dominion cases, and a similar share-class claim was asserted in the Trader Joe’s and Salesforce cases. Capozzi Adler and other plaintiff firms bring cases with the identical assertion that it is imprudent to use a retail share class when institutional share classes are available, and then claim it is an issue of fact as to whether the revenue sharing was rebated. It is all about creating an issue of fact, even if the plaintiff lawyers know from the plan contracts and the Form 5500 public filing that the revenue sharing is rebated. It is not about the truth – it is about creating an issue of fact to leverage a settlement for high plaintiff-lawyer fees.

The Tenth Circuit went outside the misleading complaint and based its decision on the actual plan documents showing a revenue sharing discount. The Master Trust Agreement showed a revenue credit applicable to the JP Morgan target-date funds. The Form 5500 also showed that the revenue credit rate for the R5 funds was 0.15%. As the district court had held, the R5 funds were “essentially discounted.” The appellate court agreed: “Here, the Master Trust Agreement and the 2018 Form 5500 show the complaint misstates the actual expense ratios for the Plan’s R5 funds. The district court did not err in refusing to accept as true factual allegations contradicted by these properly considered documents.”

This is a different result than the Ninth Circuit reached in Davis v. Salesforce.com, Inc. and Kong v. Trader Joe’s Co. cases. The defense in Salesforce argued that the share class offered by their plan included revenue sharing that was rebated, and thus was actually cheaper than alleged. But the court rejected this argument stating that “the judicially noticed documents . . . contain ambiguities” and therefore could not determine “at the pleading stage” how revenue sharing affected the plan’s costs. Likewise, in the Trader Joe’s case, the court rejected the defendants’ reliance on “a revenue sharing agreement” because “the agreement shows only what could occur in theory – not what occurred in fact.” As we analyzed here, https://www.euclidspecialty.com/the-ninth-circuit-reversals-of-the-salesforce-and-trader-joes-excessive-fee-cases-plan-fiduciaries-not-permitted-to-defend-revenue-sharing-at-the-pleadings-stage/, we believe that the Ninth Circuit did not understand the recordkeeping contract in the Trader Joe’s case. Whereas the defense in the Salesforce case, based on our reading of the case, did not give specificity as to whether and how the revenue sharing was rebated, the defense in Trader Joe’s submitted an attorney affidavit verifying that the revenue sharing was fully rebated. Thus, there was no factual issue, and the case is no different than the Barrick Gold revenue sharing contract. Nevertheless, this shows why the key issue in the Barrick Gold case is the court’s willingness to go outside the misleading complaint. This is important, because nearly every excessive fee lawsuit misrepresents the actual recordkeeping and investment fees. In the Barrick Gold case, the complaint “misstated the expense ratios,” as they were “contradicted” by the revenue sharing discount. This prevented plaintiffs from conjuring a false dispute of fact.

KEY ISSUE #2: A Meaningful Benchmark Is Required to Prove Excess Investment and Recordkeeping Fees.

Participants in the Barrick Gold case tried three different arguments to claim that the JP Morgan Smart Retirement Plan target date investments were imprudent: (1) the funds were more expensive than Fidelity collective investment trusts; (2) the actively managed funds were more expensive than passively managed funds; and (3) the TDFs were more expensive than the ICI median average [as opposed to the average of similar actively managed TDFs]. Following the Eighth Circuit in Meiners v. Well Fargo and the Sixth Circuit in CommonSpirit, the Court held that a meaningful benchmark to prove excessive fees must include a side-by-side comparison of investments that are “meaningfully comparable to the funds the Plan actually offered.” The benchmark is meaningful only if the goals and strategies are comparable. For example, the American Funds Target Date Retirement Funds used by plaintiff is a “through” retirement investment, and thus is not a fair comparison for the JPMorgan “to” retirement TDFs.

The Court spent more time explaining why a meaningful benchmark is required to allege excessive recordkeeping fees. The Court was persuaded that the plan had continually reduced recordkeeping fees from $101 in 2014, $85 in 2015, $68 in 2017, and then $53 in 2020. As noted previously, the Capozzi law firm had misrepresented that the 401k Averages Book – which the complaint represented as “the oldest, most recognized source for non-biased, comparative 401(k) average cost information” – shows a $200m plan with a $5 per participant recordkeeping fee, arguing that the much larger $560m Barrick Gold plan should have done much better than $5 per participant. The defense had argued that the $5 direct recordkeeping fee left out the $160 in revenue sharing for the same $200m plan in the 401k Averages Book. The Court nevertheless relied on the Matousek v. MidAmerican decision by the Eighth Circuit that held that the 401k Averages Book is not a “meaningful benchmark” because it leaves out transaction costs like loans and distributions. We are disappointed that the Court failed to call out the misrepresentation of the 401k Averages Book, but at least the Court did not allow the bogus use of the 401k Averages Book that is used in many cases.

The Euclid Perspective

The key takeaway from the Barrick Gold case is how to defend false excess fee claims that involve revenue sharing. Defense lawyers must present the true evidence and not accept “as true” the false claims in the complaint. Plan sponsors must take the position that a claim of excess recordkeeping or investment fees must be based on the actual fees in plan documents – not what plaintiff lawyers conjure up to create false issues of fact. If plaintiffs are going to claim excess recordkeeping fees, then they must be required to use the plan recordkeeping contract or the fee disclosures from the recordkeeper – not contrived, intentionally false math. But that is what happens in nearly every case. We must call out the con game of false fee claims.

The second key takeaway is the requirement of a meaningful benchmark. Every plan in America cannot possibly have excessive fees. There has to be a legitimate comparison. We live in a post-truth era in American society, and the claims of excess fees compared to the $200m plan example in the 401k Averages Book is no different. It is a fraud on the judicial system to misrepresent the $165 per participant fee in the 401k Averages Book as $5 per participant. We must force Cappozi Ader to show legitimate documentation of any plan in America with a $5 recordkeeping fee, or require them to pay sanctions for wasting the time of America’s court system and requiring American corporations to spend millions of dollars to defend meritless claims of fiduciary imprudence.

Just in case you want to see it for yourself, here is the chart from the 20th Edition of the 401k Averages Book that is cited in the Barrick Gold complaint by the Capozzi Adler law firm:

We do not understand why defense firms do not include the actual chart in motions to dismiss. This 401k Averages Book chart shows that the average participant in a $200 million plan with 2,000 participants pays $666 in recordkeeping and investment fees. It shows that plan recordkeeping is paid almost exclusively from revenue sharing with only a marginal $5 direct recordkeeping fee. The total recordkeeping fee for the average participant in the $200m plan is $165 per participant – not the $5 per participant amount claimed by Capozzi Adler.

We consider $165 per participant to be high for a $200m plan. But if that is what Capozzi Adler wants as its benchmark, then nearly every Capozzi Adler case alleging excessive recordkeeping fees is implausible and should be dismissed, because the recordkeeping fees of nearly every $500m+ plan in America is well below $165 per participant. If you accept the Capozzi Adler premise that large plans with greater leverage should pay less than smaller plans with less leverage – and we generally accept that premise if the quality of recordkeeping services is the same – then large plans should be judged against the correct and truthful $165 average paid by $200m plans.

The continued fraud of claiming that small plans pay only $5 [and $13 in more recent complaints using updated versions of the 401k Averages Book] per participant in recordkeeping fees is no different than claiming that voting machines were rigged without proof. A lie is a lie, and the misrepresentation of the 401k Averages Book has gone on too long. We wish the Tenth Circuit had called out the lie, but at least they shut down a dishonest case.

Disclaimer: The Fid Guru Blog is intended to provide fiduciary thought leadership and advocacy for the plan sponsor community in areas of complex fiduciary litigation. The views expressed on The Fid Guru Blog are exclusively those of the author, and all of the content has been created solely in the author’s individual capacity. It is not affiliated with any other company, and is not intended to represent the views or positions of any policyholder of Euclid Fiduciary, or any insurance company to which Euclid Fiduciary is affiliated. Quotations from this site should credit The Fid Guru Blog. However, this site may not be quoted in any legal brief or any other document to be filed with any Court unless the author has given his written consent in advance. This blog does not intend to provide legal advice. You should consult your own attorney in connection with matters affecting your legal interests.