The Fiduciary Imprudence Lawsuit is Based on Unsupported Speculation That Every BlackRock Investment Follows an Underperforming “Covert” ESG Strategy

By Daniel Aronowitz, Encore [formerly Euclid] Fiduciary

On February 21, 2024, the Northern District of Texas denied American Airline’s Motion to Dismiss the fiduciary imprudence lawsuit claiming that American fiduciaries hired ESG-oriented [plaintiff’s euphemism for “woke”] investment managers for its company-sponsored defined contribution plans who pursue ESG [again, think woke] investment objectives. The amended complaint alleged that the investments of these woke investment managers, namely Blackrock, allegedly underperformed the market, because plaintiff claims it is well-established that all ESG investment strategies are flawed.

The reality is that American Airlines sponsors two jumbo defined contribution plans that contain no ESG investment funds. The amended complaint instead alleges that the funds managed by BlackRock in the plan are “covert” ESG investments, because BlackRock’s ESG mandate is so pervasive that every fund it offers is infected with an ESG drag on performance. The district court nevertheless held that “Plaintiff articulates a plausible theory” that the American Airlines “public commitment to ESG initiatives motivated the disloyal decision to invest Plan assets with managers who pursue non-economic ESG objectives through select investments that underperform relative to non-ESG investments.”

There is nothing “plausible” about the far-fetched theory that the fiduciaries of American’s 401k plans retained BlackRock because all of its investments pursue “leftist political agendas.” It is pure speculation – exactly what the Supreme Court has said does not meet the plausibility standard for filing ERISA fiduciary breach claims.

An Open Borders Pleading Standard: A helpful way to think about the federal pleading standard is to compare it to our country’s immigration policy, which is very appropriate for a case that is part of the anti-ESG retaliation campaign against BlackRock. You can have an open borders immigration policy and let in all migrants, and consider their asylum claims later; or you can impose a higher level of scrutiny of asylum claims before you let the migrant into the country. It a generous boon to the migrant – giving them all the benefit of the doubt on their asylum claim – if you let them into the country without any scrutiny.

It is the same with the ligation pleading standard. The motion to dismiss test applied in the American Airlines case is an open borders pleading standard. It gives the benefit of the doubt to the plaintiff to prove even the most outrageous and speculative claims at a later stage of the case. It is a free pass into litigation – like a free pass into the country with an open borders immigration policy. This judge had already allowed complete discovery in the case before he ruled on the motion to dismiss, so we hope that he follows the law and ends this frivolous case on summary judgment. But we should not pretend that this case meets the plausibility standard articulated by the Supreme Court in the Hughes v. Northwestern case, because it does not.

The Plausibility Pleading Standard

To understand the prejudice to American Airlines in being forced to defend such far-fetched and politically motivated fiduciary disloyalty claims, particularly when it sponsors plans with no ESG investments, you have to understand the difference between notice and plausibility pleading. The difference is whether asserted claims in a lawsuit are possible versus plausible.

As shown below, there is nothing plausible about a lawsuit that rests on multiple levels of attenuated and speculative suppositions: (1) that American Airlines follows a woke ESG agenda that harms economic prospects; (2) that the corporate-ESG policy infected the fiduciary decisions of the independent plan fiduciaries; (3) that woke fiduciaries, who declined to choose from thousands of ESG investments in the open market, instead chose Blackrock because it is a woke investment manager that pursues investments that are not in the economic best interests of plan participants; (4) that Blackrock is so woke that even its non-ESG investment options are infected with ESG strategies that underperform the market; and (5) that the BlackRock’s covert ESG funds in the American plans underperformed and harmed its plan participants because all ESG investments underperform non-ESG counterparts. And to the extent that the lawsuit has morphed into a claim that plan fiduciaries need to leverage their plan assets to influence the proxy voting of investment managers, there is no plausible or even possible impact on the performance of the investment options in the American plans.

Notice Versus Plausibility Pleading Standards: For most cases, notice pleading applies, which only requires the barest threadbare of a claim to survive dismissal. This is based on Federal Rules of Civil Procedure 8, which only requires a “short and plain statement of the grounds for the court’s jurisdiction.” (emphasis added). The Supreme Court in 1957 summarized that a federal complaint was sufficient and should not be dismissed unless “it appears beyond doubt that the plaintiff can prove no set of facts in support of his claims which would entitle him to relief.” Notice pleading only requires the alleged claim to be possible. Example: You crashed your car into my car; you are 100% at fault; and I now have a permanent neck injury.

Without amending the Federal Rules of Civil Procedure, however, the Supreme Court adopted a stricter “plausibility” pleading standard in the Bell Atlantic Corporation v. Twombly, 550 U.S. 544 (2007) antitrust case. It then applied this higher standard in the Ashcraft v. Iqbal, 556 U.S. 662 (2009) 9-11 prisoner case. In Twombly, the Supreme Court held that “[w]hile a complaint attacked by a Rule 12(b)(6) motion to dismiss does not need detailed factual allegations, a plaintiff’s obligation to provide the ‘grounds’ of his ‘entitlement to relief’ requires more than labels and conclusions, and a formulaic recitation of the elements of a cause of action will not do. Factual allegations must be enough to raise a right to relief above the speculative level.” Bell Atlantic v Twombly, 550 U.S. at 555 (emphasis added). The Twombly/Iqbal pleading standard specifies that a complaint must be plausible on its face, and must bring forth sufficient factual allegations that nudge a claim across the line from conceivable to plausible. In other words, a complaint must not simply allege facts that are merely possible, but the alleged facts must be reasonable and likely to occur.

In Iqbal, elaborating on the Twombly pleading standard, the Court made clear that the “plausibility” required under Rule 8 demands more than the “mere possibility of misconduct.” Moreover, if the facts in the complaint are “not only compatible with, but indeed … more likely explained by lawful … behavior,” then the pleading will be insufficient. See Iqbal, slip op. at 15–16. The Court found that to allege a cause of action, a plaintiff must plead facts that “plausibly suggest an entitlement to relief.” Id. at 17.

Starting in 2006 with the original excess fee case, the trial bar filed dozens of fiduciary imprudence cases, asserting in each case that they met the pleading standard simply by alleging that the plan incurred excessive fees or deficient investment performance to support an inference of fiduciary imprudence. They claimed that the notice pleading standard of Rule 8 applied, and their complaint did not need any context or proof to allege fiduciary imprudence, such as evidence of the fiduciary process in negotiating the allegedly excessive recordkeeping fee, or comparison to legitimate benchmarks to give context and perspective as to whether the plan fees are excessive. Every case was based on circumstantial evidence of a disfavored outcome.

But the Supreme Court in Hughes v. Northwestern rejected the bare-minimum notice pleading standard, and held that fiduciary imprudence claims under ERISA must meet the higher plausibility pleading standard used in the Twombly antitrust case. The reason is that a claim of fiduciary malpractice is usually based on circumstantial evidence, and those type of claims require a higher level of proof to gain access to the federal court system. But the reasoning really doesn’t matter, it is the law of the land: a complaint alleging fiduciary imprudence must be plausible and supported by actual facts in order to survive a motion to dismiss. No unsupported speculative inferences based on circumstantial evidence of a disfavored outcome is allowed.

Against this backdrop, we now review the fanciful allegations in the ESG fiduciary imprudence claim against American, and how the judge pronounced these speculative theories as “plausible.”

Spence v. American Airlines, Inc. – A Pivot from the Challenged Fund Theory to a Challenged Manager Theory – And Then Another Pivot to a Proxy Intervention Theory

On June 2, 2023, Kansas lawyers who specialize in EpiPen products liability litigation teamed up with a Texas law firm that specializes in political litigation in a complaint captioned Bryan P. Spence v. American Airlines, Inc., No. 4:23-cv-00552-O [N.D. Texas filed June 2, 2023]. The initial complaint alleged that plan fiduciaries for the American Airlines 401(k) Plan and American Airlines 401(k) Plan for Pilots breached their fiduciary duties “by investing millions of dollars of American Airlines employees’ retirement savings with investment managers and investment funds that pursue leftist political agendas through environmental, social and governance (ESG) strategies, proxy voting, and shareholder activism – activities which fail to satisfy these fiduciaries’ statutory duties to maximize financial benefits in the sole interest of the Plan participants.” Without any proof, the lawsuit claimed that ESG funds are more expensive, and have “underperformed the broader market by more than 250 basis point per year, an average 6.3% return compared with a 8.9% return.” The key claim in the lawsuit – the Challenged Fund Theory – was that “[d]efendants have selected and included a number of ESG funds as investment options under the Plan, including, but not limited to,” twenty-five mutual funds in a list ranging from American Century Sustainable Equity Fund I to the USAA Sustainable World Fund. In addition, the Complaint asserted in paragraph 65 that “[d]efendants have also included in the Plan funds that are not branded as ESG funds, but are managed by investment companies who have voted for many of the most egregious examples of ESG policy mandates, on issues such as divesting in oil and gas stocks, banning plastics, requiring ‘net zero’ emissions, and imposing ‘diversity’ quotas in hiring.” In paragraph 66, the Complaint alleged that the American Airlines plans included investment options from eighty-six investment advisors with non-branded investment options that voted on leftist ESG policies. This second claim is the Challenged Manager Theory.

American Airlines promptly filed a motion to dismiss on the grounds that the company-sponsored plans do not have any ESG investment options, let alone twenty-five ESG funds. [In fact, to the extent that truth matters, the plans do not even offer twenty-five investment options.] The company also sought dismissal because the sole plaintiff lacked standing given that he was not even invested in the brokerage window in which he could have elected ESG investments.

On August 25, 2023, the same sole plaintiff filed an Amended Class Action Complaint that appeared to abandon their Challenged Fund theory that American has twenty-five ESG funds, and instead pivoted to focus solely on Challenged Manager Theory. The fiduciary breach claim for disloyalty and the duty to monitor is that the American plan fiduciaries “have breached their fiduciary duties in violation of ERISA by investing millions of dollars of American Airlines employees’ retirement savings with investment managers and investment funds that pursue political agendas through environmental, social and governance (ESG) strategies, proxy voting, and shareholder activism – activities which fail to satisfy these fiduciaries’ statutory duties to maximize financial benefits in the sole interest of the Plan participants.” The complaint continues that by pursuing “unrelated policy goals,” many of ESG funds “are more expensive” for plan participants than non-ESG investment funds, underperform financially compared to non-ESG funds, and engage in shareholder activism to achieve ESG policy agendas rather than maximize the risk-adjusted financial returns for Plan participants.

The Challenged Manager Theory is that American fiduciaries selected and included as investment options funds that are managed by investment companies who pursue ESG policy agendas through proxy voting and shareholder activism. “Many of these funds are not branded or marketed as ESG funds; however, the actions of their investment advisors and managers give risk to the same ERISA violations as those funds that do market themselves as ESG funds.” The complaint continues that “Defendants selected the ESG funds and included them as investment options with knowledge of their nonfinancial investment objectives, higher costs of owning ESG funds, poor financial performance of ESG funds, and fund managers’ shareholder activism to achieve social policy changes rather than maximize the risk adjusted financial returns for investors.” Rather than pursue the best interests of the plan participants, the goal of plan fiduciaries was to “achieve social policy change.”

The complaint does not provide the amount invested in any investment option in the plan. It does not provide the investment return of any investment option in the plan. And it does not compare any American investment option to any non-ESG comparator. In fact, the only mention of actual investments purportedly offered in the plan are the five investment options that Bryan Spence personally invested: the custom Target-Date 2045 (Tier 1) managed by various un-named investment managers, and five other investments managed by BlackRock [U.S. Large Cap Stock Index (Tier 2); U.S. Mid Cap Stock Index (Tier 2): International Developed Markets Stock (Tier 2); Emerging Markets Stock (Tier 2); U.S. Bond Index (Tier 2)]. But the amended complaint fails to mention the performance of any of these funds – just unsupported claims that they somehow underperformed unstated non-ESG investment options.

The complaint alleges that environmental, social and governance (ESG) investing is an investment strategy aimed at influencing societal changes. According to the amended complaint, “ESG mandates drag down corporate performance.” And “ESG funds have an established record of underperformance.” The only support for these statements is a citation to a paper published in the University of Chicago’s Journal of Finance. The Amended Complaint reiterates from the original complaint without citation that ESG funds have a 250 bps drag of underperformance [6.3% versus 8.9%].

The main addition to the Amended Complaint was the focus on the purported ESG activism of BlackRock. According to the complaint, the American “Defendants have included funds in the plan that are managed by investment managers that pursue nonfinancial and nonpecuniary ESG policy goals through proxy voting and shareholder activism.” “These investment managers have voted for many of the most egregious examples of ESG policy mandates . . . which do not contribute to profitability or increasing shareholders’ returns.” More specifically, “Defendants have included investment options that are managed by managers that pursue nonfinancial and nonpecuniary ESG objectives, including Blackrock Institutional Trust Company, which manages the majority of Plaintiff’s investments in the Plan as well as the investments of other plan members.”

The amended complaint concludes by alleging that BlackRock investments have inferior returns based on its commitment to implementing an ESG engagement and voting strategy across all assets under management. “A governance engagement strategy primarily focused on BlackRock’s climate agenda necessarily overlays ESG factors on the core index portfolios that comprise a substantial part of the Plan participants’ investments.” BlackRock’s “engagement strategy,” in which a “net zero” climate agenda is a significant or main consideration, covertly converts the Plan’s core index portfolios to ESG funds.” (emphasis added). In fact, the complaint states nineteen state attorneys general wrote to BlackRock last year asserting that the company was violating its fiduciary and legal obligations. [But leaves out that the same Texas court rebuked the position of the same state attorney generals that all ESG initiatives are self-defeating for corporate returns. Specifically, the Texas district court dismissed the lawsuit objecting to the Department of Labor’s ESG rule allowing plan fiduciaries to consider ESG factors when appropriate to act in the best interests of plan participants.] Finally, the Amended Complaint alleges that BlackRock’s ESG activism threatens Plaintiff’s and the other Plan participant’s investment returns, which depend on the energy sector.

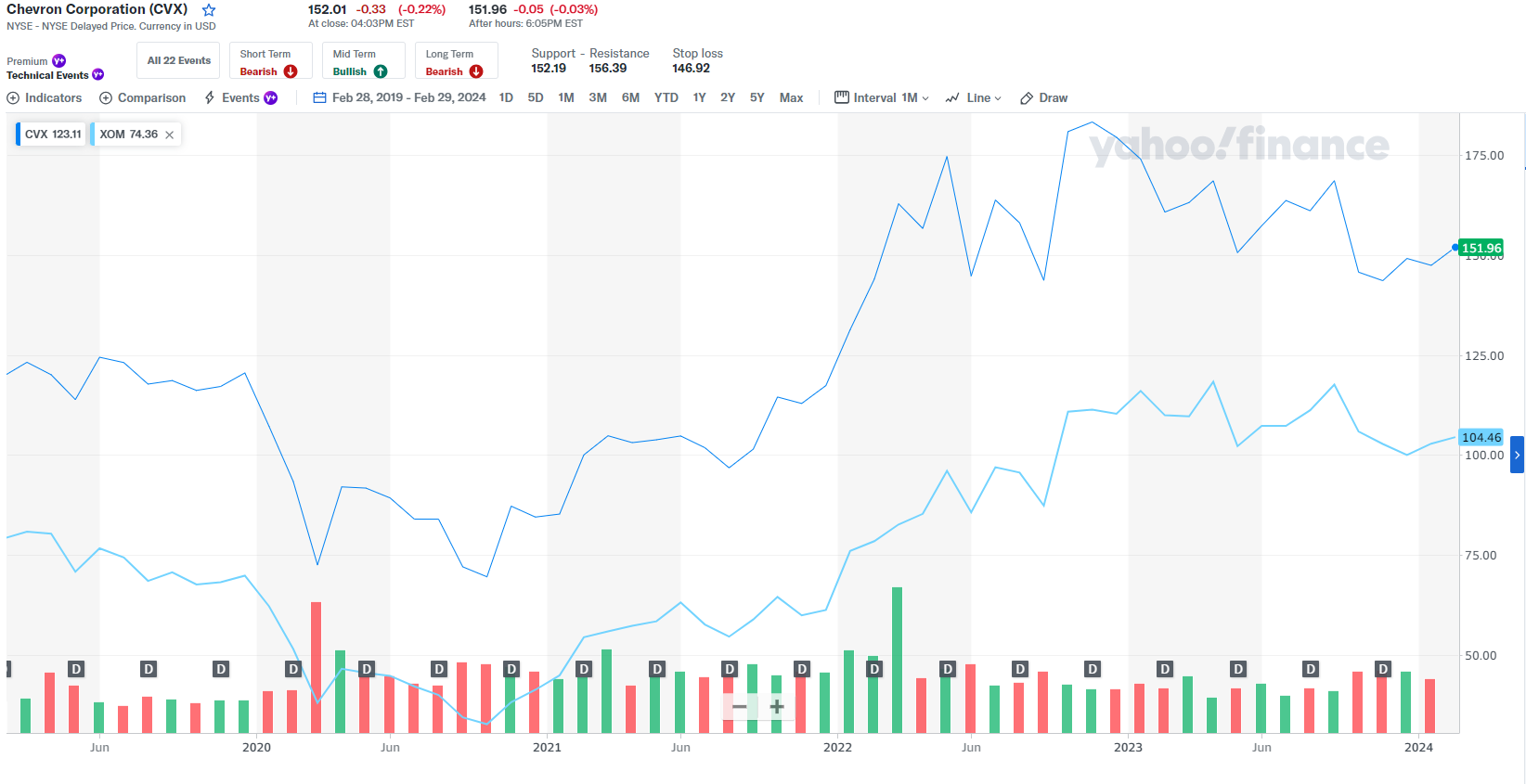

The claim that BlackRock’s proxy voting has negatively impacted the Plan participants’ investment returns is supported by only one example. According to the Amended Complaint, ExxonMobil stock (XOM) dropped 6.92% relative to the S&P 500 after BlackRock voted for the Engine No. 1 director slate for ExxonMobil. Chevron stock (CVX) fell along the same lines. But there is no perspective as to the current state of either stock, which both recovered and had excellent returns in 2022 as energy stocks led the market. [We further note that if the BlackRock funds were actually “covert ESG” funds, they would not even have oil-company stocks in the portfolio, but logic is not the strong suit of this lawsuit.]

Finally, the performance of any American plan investment is never mentioned, and the amended complaint does not even attempt to compare an American plan investment to supposedly better-performing non-ESG investments.

The Pivot to a Manager Intervention Theory: If you read American’s summary judgment motion, you will discover a nuance that is missing from other analyses that we have seen on this case. The main thrust of the Challenged Manager theory is that American fiduciaries should never have selected BlackRock as a manager because of its ESG-aligned strategies. Nevertheless, American notes in its summary judgment motion that Plaintiff is actually arguing through its discovery in the case that American should have used its tiny leverage of BlackRock stock holdings [less than .1%] to pressure BlackRock into changing their proxy votes against climate or other progressive agendas. The irony is that you cannot pressure BlackRock to change its proxy votes unless you own the stock and have a relationship with BlackRock. This Manager Intervention Theory cannot be reconciled with the Challenged Manager claim in the amended complaint that the plan fiduciaries were imprudent in maintaining BlackRock investments. You cannot be guilty of fiduciary malpractice for both (1) choosing a woke manager; and (2) failing to influence the proxy voting of the same woke manager that you should not have chosen in the first place. Never mind all of the arguments that American makes in its motion to dismiss that (a) no other large-plan fiduciary has ever tried to influence proxy voting because it is impracticable given the thousands of annual votes; and (b) even if American had tried, it would not have had enough influence to make a difference in the voting. Moreover, BlackRock voted the same as Vanguard and other managers who are not supposedly woke like BlackRock. Plaintiff’s arguments are thoroughly flawed. But again, the lawsuit is a political assault on the ESG investment movement, not a logical argument.

The Ropes & Gray law firm analyzed Plaintiff’s proxy intervention claim very effectively: “Plaintiff is trying to bring additional anti-ESG pressure to bear on asset managers by insisting that their clients – fiduciaries at employer plan sponsors – have an obligation under ERISA to prevent the external managers from casting proxy votes in support of ESG-related proposals.” https://www.ropesgray.com/en/insights/viewpoints/102j11u/texas-federal-court-endorses-far-fetched-erisa-fiduciary-theory-based-on-esg-prox

Texas District Court Denies the Motion to Dismiss

The Court’s decision starts with recognizing that plaintiffs have expressly abandoned the Challenged Fund Theory that defendants used the plan to invest in ESG funds to “streamline the case and focus on the primary issue.” That is being charitable given that the plan has no ESG funds. Nevertheless, the remaining theory, or the Challenged Manager Theory, is that BlackRock’s “engagement strategy . . . covertly converts the Plan’s core index portfolios to ESG funds.”

As to the breach of the duty of prudence claim, the court held that the plaintiff made plausible claims that American was imprudent by failing to consider “the known poor performance [of ESG funds] relative to . . . similar investments . . . available in the marketplace,” along with the particular “proxy voting and shareholder activism of the investment managers that [Defendants] selected, included, and retain in the Plan.” The court held that at the pleading stage, “Plaintiff need not plead the exact connection between the investment managers’ alleged ESG proxy voting and the financial harm to Plaintiff as a result.” The Court held that an inference of a “flawed process” is possible because Plaintiff alleged that investment managers like BlackRock cast proxy votes causing ExxonMobil and Chevron stocks to fall, thereby reducing Plan participants’ returns on those investments.” American had argued that plaintiff failed to provide a meaningful benchmark from which to allege underperformance, but the Court held that “requiring a benchmark for measuring performance is not required at this stage given the inherent fact questions such a comparison involves,” and the “Fifth Circuit has not imposed a performance-benchmark requirement.” The court stated that it would defer its evaluation to a later stage of the case. Rather, the “specific actions” of selecting and retaining ESG-oriented investment managers “allow the Court to reasonably infer that the Defendants’ process is flawed because it allowed Plan assets to be used to support ESG strategies.”

On the duty of loyalty claim, the court held that the “company-wide ESG policy motivated Defendants’ choice to invest Plan funds with ESG-oriented investment managers is a fact question that is not appropriate to resolve at this stage.” And at this early stage, it is not necessary to show any facts about American or its fiduciaries’ personal motivation. The court held that Plaintiff “articulates a plausible story” that AA’s “public commitment to ESG initiatives motivated the disloyal decision to invest Plan assets with managers who pursue non-economic ESG objectives through select investments that underperform relative to non-ESG investments.” The court concluded that Plaintiff provided “specific facts outlining a plausible theory for how Defendants breached their duty of loyalty by allowing their corporate goals to influence their fiduciary role.”

Analysis

The Court states that the Challenged Manager Theory states a plausible claim under ERISA for breach of fiduciary duty, but a claim based solely on calling plan fiduciaries and BlackRock woke does not meet the plausibility standard that the Supreme Court adopted in Hughes v. Northwestern. The plausibility standard does not allow speculative claims, and this lawsuit is a series of wild and speculative assertions. It is not plausible under Supreme Court standard. Not even close.

Consider the multiple levels of speculation in the amended complaint:

- American Airlines pursues ESG objectives that are not in the economic best interests of the company;

- Plan fiduciaries followed the woke ESG corporate agenda by choosing BlackRock, because BlackRock itself pursues a woke ESG agenda that overrides the quest for the highest financial performance;

- BlackRock pursues a woke, non-economic agenda, and thus all of its investment offerings, including non-ESG funds, are “covert ESG funds”

- All ESG funds perform worse than non-ESG funds, and thus the BlackRock covert ESG funds in the American plan underperformed any available non-ESG investments – no need to provide any comparator fund or benchmark, because all covert ESG funds perform worse than non-ESG funds.

The truth is much different:

- There is no proof that American’s ESG initiatives harm the company’s performance. The ESG initiatives could actually attract customers that want a company that considers the impact on the environment and planet. The ESG initiatives could actually improve the company’s performance.

- American has no ESG funds in the plan, despites thousands of available mutual funds that have an overt ESG strategy. If American fiduciaries are woke, why didn’t they just choose actual ESG investments? According to Bloomberg, in August 2023, American could choose from over 14,500 investment options that pursue an ESG strategy. https://www.bloomberg.com/professional/blog/esg-funds-what-makes-for-good-performance/ Why did they choose a backend strategy of covert ESG funds?

- American Fiduciaries Declined a Recommendation to Add an ESG Fund: According to American’s summary judgment motion, the pilots union asked the plan to consider adding an ESG fund, and they turned it down because of fears of inadequate performance. MSJ n.6. Why would they turn down the opportunity to insert an ESG fund into plan?

- BlackRock investments are not “Covert-ESG” funds: There is no proof that all BlackRock funds are infected with a woke mandate. In fact, most BlackRock non-ESG investments are highly rated by Morningstar and other independent firms, and have excellent investment performance. And that is in comparison to normal funds with no ESG investment objective. But if the BlackRock funds are somehow covert-ESG funds, why did they purportedly have stocks of fossil-fuel companies like Exxon and Chevron? No self-respecting ESG funds would include oil stocks. The covert-ESG fund argument is just plain false and illogical.

- There is no proof that ESG investment do worse. The amended complaint is a diatribe castigating “leftist” corporate policies. The response is extreme right-wing anti-ESG tropes that all ESG and DEI corporate policies are bad. It is something you would hear from Tucker Carlson or the night-time lineup on Fox News. But a lawsuit it not a political speech. This is a court of law, and you are accusing real live human beings of violating their fiduciary duties. You need proof. And there is no proof that all ESG investments have the same political agenda. Nor is there proof that all ESG funds have a non-economic agenda that drag on return. Some ESG-aligned investors believe that ESG-aligned objectives will heighten returns. For every study that claims that ESG investments have worse performance, which was what the court dubiously used to find plausibility of the anti-ESG theory, you can find a contrary survey claiming that ESG enhances investment returns. In one simple Google search, for example, a JP Morgan report concludes that “ESG can offer a path to potentially generate consistent returns in investment portfolios. Indeed, seminal research by Harvard Business School found that high performance on material ESG issues tends to help enhance shareholder value, whereas non-material factors did not prove predictive of future performance.” (citation omitted). https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/how-smart-esg-investing-could-boost-portfolio-returns#:~:text=ESG%20can%20offer%20a%20path,prove%20predictive%20of%20future%20performance

- Quality Investments with Super-Low Fees: According to America’s summary judgment motion, the company-sponsored plans offer super low-cost funds that perform above all benchmarks. According to the motion, the fiduciaries negotiated fees with BlackRock that required Blackrock to share in the securities lending revenue. The fees are so low and the percentage of securities lending revenue provided to American is so high, that BlackRock is requiring any public filings to redact the fee level. MSJ p. 7 [BlackRock’s fees redacted because they are so low]. BlackRock is afraid that other large plans will want the same American deal. And these same fiduciaries are accused of violating their fiduciary responsibility? Good grief. This evidence demonstrates that these are the most astute fiduciaries in the entire country. This is the gold standard of fiduciary prudence. And if you are curious about the actual investment returns that plaintiff would not disclose in the complaint, look up the Morningstar ratings for the BlackRock funds in which the plaintiff invested: U.S. Large Cap Stock Index (Tier 2); U.S. Mid Cap Stock Index (Tier 2): International Developed Markets Stock (Tier 2); Emerging Markets Stock (Tier 2); U.S. Bond Index (Tier 2)]. All have respectable ratings and performance track records. That is why the complaint fails to mention the performance of a single investment, relying instead of conclusory statements that American fees are excessive and the performance is low. The judge bailed them out with a low pleading standard.

- No damages: There are no damages to any plan participant. The only tangible “proof” of any harm to plan participants is the proxy vote tendered by BlackRock in favor of the climate-aligned Engine No. 1 director slate for Exxon and Chevron stocks. But even if Exxon and Chevron stocks went down slightly after the May 26, 2021 vote, both stocks sky-rocketed shortly thereafter, with huge returns in 2022 to lead the entire market. The following chart shows Chevron and Exxon stock performance in the last five years. Chevron outperformed Exxon, but the May 2021 vote is irrelevant to the excellent performance of both stocks. In fact, the high performance of oil stocks in 2022 is the basis for the fiduciary imprudence case against the New York City governmental plans, which pulled out of all oil stocks right before the 2022 high returns.

In sum, there is a near 100 percent chance that this open borders pleading standard would be overturned on appeal. But defendants never get to appeal an unfair motion to dismiss ruling. When they lose a motion to dismiss, the case proceeds. By contrast, when plaintiffs lose at the pleading stage, they get to appeal. All of the appellate decisions on the pleading standard are when a plaintiff’s complaint is dismissed. No case lost by defense gets appealed. We need a new rule that allows interlocutory appeals when a district judge abuses their authority and allows frivolous cases.

You Survived the Motion to Dismiss, Now Prove Your “Plausible” Claims: We disagree with the ruling, but the plaintiff lawyers won. Congratulations. You found a conservative judge that wants to send corporate America an anti-ESG message. You survived the motion to dismiss with your inflammatory claims. Now prove it. You can’t, and you know it. This is not a political speech or a Republican campaign rally. This is a court of law. Here is what you need to prove:

-

- Prove that AA’s ESG policy is designed to lose money. Find a single witness at American to corroborate this false narrative. Here is betting that you can’t.

- Prove that the AA fiduciaries followed the corporate ESG mandate. They didn’t. They could have chosen from thousands of ESG funds. They didn’t choose a single ESG fund. In fact, American notes in its summary judgment motion that a pilot asked the plan fiduciaries to add an ESG fund, but they denied the request.

- Prove that all BlackRock funds are covert ESG funds. Most of these funds are index funds with no discretion to exclude oil stocks or discretion to apply an ESG filter. The very fact that Plaintiff is complaining about the proxy voting on Exxon and Chevron is proof-positive that the funds are not “covert ESG.” Why would a covert ESG fund have Exxon stock? Because the BlackRock funds have no ESG objectives.

- Prove damages to the pilot participants in the plan. The amended complaint contains no performance numbers – just unsupported claims that the American covert ESG funds are over-priced and underperformed. Prove your speculative damages case. You can’t.

-

-

- Prove that Exxon and Chevron stocks went lower long-term because of the new climate-focused directors. Chevron’s stock has been a darling of Wall Street for years, and oil stock led the market in 2022. This disproves any damages theory. But plaintiff has no damages theory. That is why American must be awarded summary judgment.

- Prove that American fiduciaries could have changed BlackRock’s votes in the Exxon director votes. Plaintiff must prove that American, with a tiny fraction of BlackRock’s stock in any one company, could have somehow changed the results of BlackRock’s proxy vote. American could have taken out a whole page in the Wall Street Journal, and it would not have made any difference. Plaintiff knows that, but you said you could prove it.

-

- Prove that Exxon management is a worse-off company than before the vote. Little Engine directors are now on the Exxon board. They want Exxon to make sure that it has long-term viability in a post-fossil fuel world. But Exxon keeps pumping out fossil fuels – and making money. So much money that Democrat politicians use the company as a whipping boy when they want to make a political point. Here is from Exxon’s 2023 year-end press release, touting industry-leading earnings of $36.0 billion, with success in drilling for oil and fossil-fuel replacement initiatives:

-

-

- Delivered industry-leading 2023 earnings of $36.0 billion, generated $55.4 billion of cash flow from operating activities and distributed $32.4 billion to shareholders

- Leading industry in compounded annual growth rate for earnings excl. identified items and cash flow since 2019

- Increased Guyana and Permian production by 18% vs. 2022 and achieved record annual refinery throughput

- Strengthened portfolio with $4.1 billion of non-core asset divestments, and two acquisitions; one that accelerates Low Carbon Solutions and one that will transform the Upstream business

- Launched new MobilTM Lithium business with the potential to supply up to one million EVs per year by 2030

-

Needless to say, Exxon is a thriving company and the stock is worth owning for growth potential. That is why it is included in the so-called “covert ESG” BlackRock funds.

Finally, a Texas federal court called the theory of this case plausible. But now the “plausible” claims must be proven. Good luck with that. We await Plaintiff’s summary judgment opposition to see how they prove their case.

The Encore Perspective

We have all seen many excess fee cases misrepresenting plan fees and comparing false fees to misleading benchmarks. Many of the cases contain false motives to allege fiduciary conflicts – all designed to exploit the low threshold to allege fiduciary malpractice in America. Plan sponsors are helpless because they cannot get an immediate appeal of an unfair motion to dismiss decision. But the American covert ESG case is a new low. It is rank speculation with offensive allegations that American plan fiduciaries and BlackRock are so woke that they are harming the retirement prospects of their plan participants. It is pure speculation that should not be allowed under the federal plausibility standard.

As if we needed a reminder, we must continue to fight for a pleading standard that closes the “border” to frivolous claims. Indeed, this type of litigation abuse will not stop until there are financial ramifications to plaintiff lawyers that file bogus cases.