By Daniel Aronowitz

The same cadre of plaintiff law firms have filed hundreds of lawsuits alleging excessive recordkeeping fees, but a California firm is trying a new and more brazen tactic: demanding settlements based upon threats of litigation. The Lieff Cabraser Heimann & Bernstein law firm is sending copycat ransom letters to large American corporations demanding settlements based on contrived assertions of excessive recordkeeping fees compared to misrepresentations of the 401k Averages Book. The opportunistic plaintiffs’ firm is branching out from its trademark vaping, opioid drug and teen social media addiction litigation to cash in on the jackpot of ERISA class action litigation.

Calling himself one of the few lawyers nationwide qualified to take an ERISA class action to trial, firm partner Daniel M. Hutchinson is sending the same threat letter to multiple large corporate defined contribution plans. The letters demand that the plans settle over purported excessive recordkeeping fees and underperformance of plan investments to avoid costly litigation. The premise of his threats – with nearly identical letters to each company – is that (1) courts allow these cases to proceed to discovery even without proof of imprudence; (2) these cases are super expensive to defend; (3) it is hard for plan sponsors to prove that they acted prudently in managing plan administration costs; (4) most cases eventually settle; and (5) the plan fiduciaries should, therefore, write a huge check to avoid litigation. He is also sending ERISA rule 104 information requests to other plans in what appears to be the early preparations for a Schlichter-type blitzkrieg against many large corporate plans.

From what we have reviewed, these threats have no merit and are another example of widespread justice system abuse in the United States. But since there are no consequences for filing meritless litigation in America, it is another crass and craven attempt by the class action plaintiffs’ bar to conduct economic vandalism of corporate America.

The Lieff Cabraser Shakedown

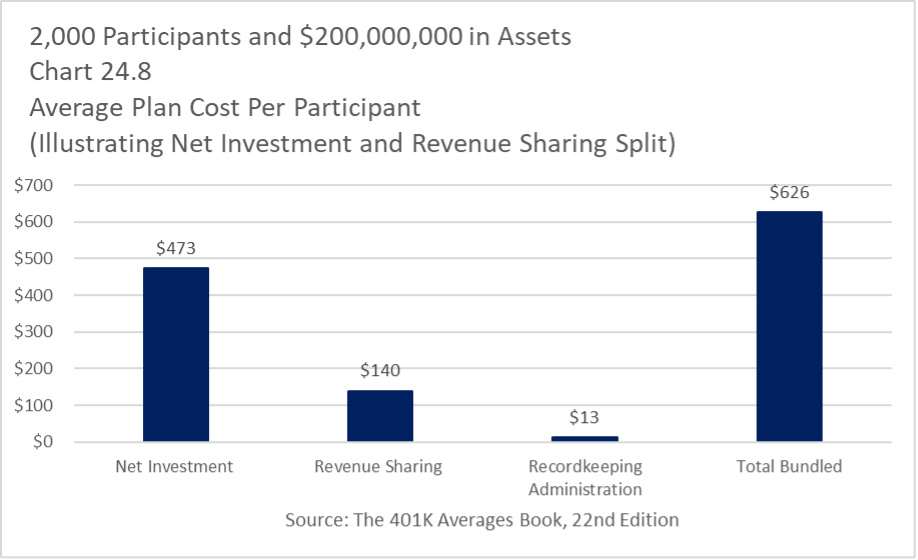

The threat letters all follow the same format, and have the same type of unsupported claims asserted in the firm’s sole excessive fee lawsuit filed to date, which is Carimbocas v. TTEC Services Corporation (Aug. 25, 2022, D. Colo.). The letter starts with an assertion as to the amount of the recordkeeping purportedly charged by the plan. But like a significant majority of excess fee lawsuits, the recordkeeping fee asserted in the threat letter is overstated. The letter then compares the targeted plan’s fees to the $200m example in the 401k Averages Book, claiming that larger plans with more leverage should pay less in recordkeeping fees than small plans. But like dozens of lawsuits that rely on the 401k Averages Book as the purported bench, the citation is intentionally misstated by omitting the revenue sharing used to pay recordkeeping costs. Each threat letter states that “the 401(k) Averages book reports that plans with over 2,000 participants and $200 million in assets have an average of $13 in recordkeeping and administrative fees.” The letter then cites to In re Omnicom ERISA Litig., Case No. 20-CV-4141 (CM), 2021 WL 3292487, at 15 (S.D.N.Y. Aug. 2, 2021) in which “Plaintiffs’ essential allegation it that, because the Omnicom Plan is much larger than the ones evaluated in the Averages Book, it has a stronger bargaining position than those plans and so should have been able to secure a much larger participant fee.” The letter then cites other cases that are supposedly in “accord” with the Omnicom decision, including Allison v. L. Brands, Inc., No. 2:20-CV-6018, 2021 WL 4224729 (S.D. Ohio Sept. 16, 2021), and a string of cases that Lieff Cabraser contends denied motions to dismiss recordkeeping fee claims relying on the 401k Averages book, including Garthwait v. Eversource Energy Co., No. 3:20-CV-00902 (JCH), 2021 WL 4441939, at *8 (D. Conn. Sept. 28, 2021).

The threat letters then spend two pages of the typical soapbox summary by plaintiff law firms of their take on ERISA fiduciary law, which characteristically leaves out that ERISA judges fiduciary prudence based on process and not results. The letter then argues that ERISA class actions are difficult to dismiss because of “the burden of proof to demonstrate compliance falls on the defendant once a plaintiff has cleared the relatively low hurdle of alleging a fiduciary breach.” To support the low plausibility hurdle, the letter cites to an outdated April 5, 2022 Bloomberg Law article citing a dismissal rate of twelve out of 170 lawsuits, and the AIG Whitepaper, Understanding the Rapid Rise in Excessive Fee Claims, which notes that “the nature of most ERISA excessive fee cases make it very difficult for defendants to achieve a dismissal.”

The threat letters next assert that the costs of discovery is “very high” because proof of a prudent procedural process is “technical and highly factual” and requires “multiple experts and a large volume of documents and data.” For these reasons, the letter asserts, “most ERISA lawsuits challenging excessive fees typically settle,” citing to another Bloomberg Law article from August 23, 2022 titled Suits Over 401(k) Fees Nab $150 [Million] in Accords Big and Small Lawsuits Spur Wave of Early Plaintiffs Wins. Hutchinson acknowledges that his target plan sponsor “will surely maintain that Plan fiduciaries acted prudently at all times,” but “[i]n recent years, similar cases have settled and established a ‘market rate’ for this type of ERISA claim.”

The letters conclude with the warning that Daniel Hutchinson “at LCHB is one of a limited number of attorneys nationwide to prosecute an ERISA breach of fiduciary class action through trial and appeal.” Consequently, he recommends that the parties settle prior to litigation because “[t]his may be the last time that the parties have total control over the outcome of this matter without leaving it up to the Court.” We have even seen another law send this same threat letter template to a governmental plan for violating ERISA. This law firm, which we assume either plagiarized Lieff Cabraser’s work product or is working in tandem with the firm, failed to even delete the references to ERISA, which does not apply to governmental plans.

The Euclid Perspective

The plaintiffs’ bar is getting more brazen in its abuse of ERISA, and this gambit needs an effective response by the plan sponsor community. The fact that a law firm feels emboldened to send threat letters to the committees of high-quality retirement plans without any proof of a fiduciary process defect based solely on a recordkeeping fee amount (that is usually wrong) is a reminder that there are no consequences for filing meritless litigation. That has to change. Plan sponsors must (1) demand a higher standard to allege fiduciary prudence under ERISA in federal courts that is consistent across the entire country; and (2) demand sanctions and consequences for threatening meritless litigation without actual evidentiary proof.

(1) Federal Courts Must Reject Fiduciary Imprudence Claims That Have No Evidentiary Proof.

The entire premise and temerity of the Lieff Cabraser threat letters is that the legal standard to filing a fiduciary imprudence case is very low. The Lieff Cabraser threat letters have no proof that any of the plan sponsors being targeted acted imprudently. Instead, the letters make clear that the entire ploy is based on leveraging a low pleading standard; that it is very difficult to get a fact-intensive case dismissed; and the high cost of defense leads to settlements. But that is why courts must enforce the plausibility standard to judge whether recordkeeping fees are excessive and the result of an imprudent fiduciary process. Without a fair pleading standard, plan fiduciaries are subject to what amounts to litigation terrorism. The Lieff Cabraser premise is that plan sponsors have to prove they were prudent – as they are guilty until proven innocent – as opposed to plaintiff lawyers having to prove they have a right to assert a legitimate claim of fiduciary imprudence. The litigation theory is backwards. Plan sponsors must demand a nationwide, uniform plausibility standard that requires concrete proof of imprudence before a plaintiff law firm can allege violations of ERISA.

Despite years of litigation and hundreds of cases, plaintiffs law firms, including Lieff Cabraser, have no proof of what large plans actually pay for recordkeeping fees. They have mined Form 5500 filings to find ten to fifteen of the lowest fee plans they can find out of the largest 1500 plans in America. But they have not provided any national benchmark study other than the limited NEPC study showing that large plans pay any particular amount, including $35, $25, or $14-21 as many complaints allege [and the NEPC study does not support their claims of super-low recordkeeping fees]. Ironically, one of the large plans being targeted by Lieff Cabraser is listed in the benchmark charts by Capozzi Adler and Walcheske law firms as proof of low recordkeeping fees. Despite over fifteen years and hundreds of excess fee cases, plaintiff law firms have never developed or presented a credible database of what large plans actually pay. All of the claims of imprudence have been based on flimsy and unreliable comparisons to a few random plans. And even then, the fees of many of these purported comparator plans are often misstated and exaggerated.

Moreover, the plaintiff benchmark fee number continues to go down like a limbo contest – starting at $35 per participant, and now $14-21, or $5-13, depending on which version of the 401k Averages Book is being misrepresented by omitting significant revenue sharing. But there has never been any proof that the vast majority of large plans pay under $35 – or any specific amount – per participant – and certainly not enough proof to allege fiduciary malpractice.

To the extent there is a national database, it would be the 401k Averages Book, but that database proves that small plans use revenue sharing, and participants in these smaller plans pay significant recordkeeping fees that are usually over $100 per participant – fees that are much higher than nearly every large $500m+ asset plan in America. The 401k Averages Book proves the opposite of what plaintiffs’ firms have alleged to federal courts: it proves that participants in large defined contribution plans are fortunate to largely avoid revenue sharing and instead typically pay low, per participant plan administration fees.

The attempt to misuse the data of the 401k Averages by Lieff Cabraser and other plaintiffs’ law firms is a farce and a fraud on America’s judicial system. No $200 million plan with 2,000 participants in America has a $13 recordkeeping fee – and neither does the plan described in the 401k Averages Book. The $200m plan in chart 24.8 of the 22nd Edition of the 401k Averages Book had a $140 + $13 = $153 recordkeeping fee:

The TTEC Excess Fee Case: Daniel Hutchinson claims that he is a unique plaintiffs’ lawyer in his ability to try a case to conclusion, and we assume he is talking about his church-plan litigation against the AME Church. But our litigation tracking shows that his sole excessive fee case is the August 2022 filing against TTEC Services Corporation. It would just so happen that the TTEC plan had $200m in assets in 2020, but with 26,000 participants – thirteen times larger than the $200m/2,000 participant plan in the 401k Averages Book. Before we describe his flimsy imprudence evidence, please look back at the chart in which the 401k Averages Book documents that a $200m plan with only 2,000 participants averages over $150 in recordkeeping fees per participant given the substantial revenue sharing.

In TTEC, Hutchinson claims that Merrill Lynch was the plan’s recordkeeper from 2016 to 2019, and charged $46 to $51 annual per participant for recordkeeping services that was funded by revenue sharing. The complaint further alleges that Merrill Lynch charged an account management fee from 2017 to 2019 with an additional amount between $54 and $59 annually for recordkeeping services. Assuming Lieff Cabraser is correct – and there is nothing in their track record to give credence to anything they allege – the total amount would be $100 to $110 per participant. In 2020, according to the TTEC complaint, the plan switched to T. Rowe Price for recordkeeping services at $45 per participant, lowering the fees by over 50%. Without any proof, except citations to the Mass Mutual, Safeway and MIT excessive fee cases in which plaintiff experts testified that $35 per participant was the proper recordkeeping fee in those cases [all involving much larger asset plans], Hutchinson’s complaint alleged that both the Merrill Lynch and T. Rowe Price recordkeeping fees were excessive, even after the plan lowered the fees. But these fees were lower than the $200m plan described in the 401k Averages Book, and the TTEC $200m plan had thirteen times the number of participants than the Book’s example, making it much more expensive to administer. The TTEC plan sued by Lieff Cabraser had significantly lower recordkeeping fees than the 401k Averages Book comparator in every single year between 2016 and 2020 as alleged in the complaint. By Lieff Cabraser’s own benchmark, the TTEC complaint was filed without any factual basis. It is a strike lawsuit designed to extort attorney fees – no different than the ransom letters the firm is now sending to large corporations across America.

Not to belabor the point, but the reason that plaintiff law firms have made no effort to develop a credible database of what large plans actually pay (outside of a few random plans based on misleading Form 5500 data) is because it would debunk nearly every excess fee lawsuit that has been filed. Maybe a few of the 2016 university cases would remain potentially viable, but the rest of the cases would be unmasked as meritless.

(2) The Defense Bar Must Seek Sanctions and Consequences When Plan Sponsors Face Litigation Threats Without Evidentiary Support.

There must be sanctions for filing or threating harassing litigation without proof or evidentiary support. But large defense law firms largely refuse to seek sanctions when their clients face meritless litigation. This timidity has to change. As an example, a plaintiff law firm this year had that temerity to sue American Airlines falsely accused the company’s retirement committee of offering ESG funds when the plan had none, and even the brokerage window claim was frivolous because the participant had not even invested in the brokerage window option. Even if the participant had chosen ESG funds from the brokerage window, how is there a cause of action for a participant voluntarily choosing an ESG fund? It is like trying to hold your employer liable because you got into a car accident because you were driving too fast to avoid being late to work. There was no evidentiary support for these ESG imprudence claims, but also no consequences for the frivolous arguments.

Federal Rule of Civil Procedure 11 provides that a district court may sanction attorneys or parties who submit pleadings for an improper purpose or that contain frivolous arguments or arguments that have no evidentiary support. The Lieff Cabraser law firm is basing its threats of ERISA malpractice litigation solely on the false representation of the 401k Averages Book. ERISA section 502(b) also has a fee-shifting provision that allows a party to be eligible for an attorney’s fee award as long as the party seeking fees has achieved “some degree of success on the merits.” It does not require the defense to be a prevailing party.

Any law firm that abuses the American judicial system by citing farcical misrepresentations of the published 401k small-plan fee study should be sanctioned and face consequences. Lieff Cabraser has no evidentiary support for any claim that large plans in America pay excessive fees in comparison to the 401k Averages Book. Euclid has an extensive database of large-plan recordkeeping fees. We can show any plan faced with a Lieff Cabraser threat letter whether their plan’s recordkeeping fees are reasonable and within the range of what other comparable plans pay. Every single plan that we have seen to date that has received a Lieff Cabraser threat letter has reasonable plan fees and there is no basis upon which to claim that the fees are excessive. Any lawsuit that Lieff Cabraser may file against large plans in comparison to the 401k Averages Book study of a $200m plan will be based on a frivolous argument without evidentiary support.

Judicial system abuse continues to grow in America. We recommend that you read a recent post on the D&O Diary Blog that summarizes a securities fraud lawsuit in which the Florida District Court dismissed a SPAC lawsuit filed against MSP Recovery dba LifeWallet for filing a “shotgun pleading.” https://www.dandodiary.com/2023/09/articles/securities-litigation/plaintiff-law-firms-client-solicitation-practices-to-face-scrutiny/ The Court has asked a magistrate to investigate whether the law firm’s solicitation of potential clients for a complaint that had already been drafted violated bar or local rules involving client solicitations. The defense law firm in that case had claimed that the plaintiff firm “formulated a lawsuit and a specific desire to sue the Defendants and went fishing for clients to make that happen.”

We all know that shotgun pleadings happen in many excessive fee cases, and that is what Lieff Cabraser is threatening. The vast majority of these cases are attorney-generated lawsuits designed to manufacture claims of fiduciary imprudence. The point we are making is that the defense law firm in the LifeWallet securities fraud case got more aggressive and fought back. That is what the ERISA defense bar needs to do as well, starting with pushing back against Lieff Cabraser’s attempted shakedown of large plan sponsors. Demand proof of imprudence, or make sure the law firm knows that there will be consequences for filing a complaint without evidentiary support. Plaintiff law firms are getting more aggressive with dirty and unethical tactics, and plan sponsors must fight back.

Disclaimer: The Fid Guru Blog is intended to provide fiduciary thought leadership and advocacy for the plan sponsor community in areas of complex fiduciary litigation. The views expressed on The Fid Guru Blog are exclusively those of the author, and all of the content has been created solely in the author’s individual capacity. It is not affiliated with any other company, and is not intended to represent the views or positions of any policyholder of Euclid Fiduciary, or any insurance company to which Euclid Fiduciary is affiliated. Quotations from this site should credit The Fid Guru Blog. However, this site may not be quoted in any legal brief or any other document to be filed with any Court unless the author has given his written consent in advance. This blog does not intend to provide legal advice. You should consult your own attorney in connection with matters affecting your legal interests.