By Daniel Aronowitz, Encore [formerly Euclid] Fiduciary

KEY POINTS: (1) The Hy-Vee Case is Another Example of an Excess Fee Lawsuit Using Fake Fee Amounts Compared to the Four Lowest Fee Plans Plaintiff Lawyers Can Find: The fiduciary malpractice complaint alleged excessive recordkeeping fees based on (a) false fees [$63+ alleged versus $37 actual] (b) compared to misleading benchmarks [$14-30 from just seven plans]. The case is yet another example confirming that courts must allow the truthful recordkeeping fees and market-wide benchmarks in order to evaluate the fiduciary “context” required under the Hughes v. Northwestern pleading standard.

(2) False Claims of Deficient Fiduciary Process: The initial complaint alleged harm from the “[t]he devastating effect of unchecked recordkeeping and administration fees.” But the true facts showed that the plan monitored recordkeeping fees with the help of multiple advisors, conducted a 2020 RFI, reviewed six periodic benchmarks from Fiduciary Decisions, and had a six-year record of substantial fee reductions. This plan sponsor should not have had to defend its fiduciary process in a fiduciary imprudence lawsuit, but the complaint cast the plan in a misleading context.

(3) Large-Plan Recordkeeping is Not Commoditized: The complaint alleged that all large-plan recordkeeping is commoditized, but the plan RFI proved that most recordkeepers could not match Principal’s customized onsite training and additional work needed because of complex payroll systems and private-company stock matches for a transient participant population. The Hy-Vee case is the best example of how large-plan recordkeeping is not a one-size-fits-all commodity.

In March 2022, the prolific Capozzi law firm sued the jumbo Hy-Vee, Inc. defined contribution plan [$2.2b/57,780 participants] for excessive recordkeeping fees. The complaint alleged that “[t]he devastating effect of unchecked recordkeeping and administration fees is seen clearly here.” Plaintiffs calculated this fee to be $63.46 to $67.20 per participant, and compared it to the Fidelity stipulation in the Moitoso case that purportedly valued Fidelity’s recordkeeping services for large plans at $14 per participant, and seven jumbo plans with over 30,000 participants that supposedly paid $21 to $30 per participant. The complaint also alleged that all recordkeeping services for large plans provide the same commoditized range of services. According to the district court, this was enough “to nudge” it over the plausibility pleading standard, even in the Eighth Circuit that values credible benchmarks to allege excessive fees.

But like most excess fee complaints, the lawsuit was brought with false pretenses of alleged fiduciary malpractice based on misleading circumstantial evidence and false facts in order to survive a motion to dismiss. The complaint alleged: (1) a false recordkeeping fee of over $63 when the actual fees had been reduced to $36.93 in 2021 – a vast overstatement of actual fees; (2) a false narrative of a deficient fiduciary process when highly engaged plan fiduciaries sought advice from consultants, frequent benchmarking by Fiduciary Decisions, and conducted a 2020 RFI of all major recordkeepers – a consistent and productive process that reduced fees from $92.64 in 2007 to $36.93 in 2021; and (3) a false claim that Hy-Vee had standard and commoditized recordkeeping services like all large plans, when in fact the company had complex payroll systems, intricate stock-matching requirements, and a transient workforce that required Principal to conduct additional work and onsite services. Indeed, the plan required customized recordkeeping services, including onsite meetings, that a 2020 RFI confirmed could not be matched by most other large plan recordkeepers, including the market-leader Fidelity.

The order granting summary judgment for Hy-Vee issued on March 7, 2024 in Rodriguez v. Hy-vee, Inc., 4:22-cv-00072-SHL-WPK, reveals that the claim of “devastating” high fees was false. Hy-Vee and its insurers had to spend millions of dollars on defense lawyers and fiduciary process experts to defend Hy-Vee’s fiduciary process – all because the plaintiff law firm was allowed to allege a false $63+ recordkeeping fee that was not placed into proper context of what large plans actually pay [because the complaint asked for an inference that fees from seven large plans were indicative of what all large plans pay]. This case is a reminder that most large plans in America are advised by competent and experienced consultants, and have adequate fiduciary processes to protect plan participants. There is no probable cause to sue most large plan sponsors.

Given this reality that many plan fiduciaries are sued based on false excess fee claims, the federal courts must give the benefit of the doubt to plan fiduciaries when accused of fiduciary malpractice, and require a higher threshold in order to sue for fiduciary malpractice. We need a business judgment rule that presumes good faith management of plan assets – not the current assumption that the trial bar is somehow correct when they repeatedly and arbitrarily claim fiduciary mismanagement. At a minimum, plan fiduciaries must be allowed to present (1) accurate evidence of the recordkeeping fee at the complaint stage, and (2) compare it to a credible national benchmark, not just a handful of out-of-context random plans. This type of accurate evidence and context is needed to weed out meritless cases that are based on false facts and misleading circumstantial evidence.

For all of these reasons, the Hy-Vee case is worth studying to understand the prejudicial effect of allowing the trial bar to serve as America’s fiduciary regulators of plan fees and investment performance.

The Hy-Vee Court Denies the Motion to Dismiss and allows excess recordkeeping claims, but grants summary judgment two years later based on a full record, including expert testimony.

The Hy-Vee excess fee case was one of the first cases to be reviewed after the Eighth Circuit ruled in Matousek v. MidAmerican Energy Co., 51 F.4th 274, 278 (8th Cir. 2022), that plaintiffs asserting imprudent investment and plan administration claims must plead a “sound basis for comparison – a meaningful benchmark” to sustain their claims. The MidAmerican complaint, which was filed by the same Capozzi Adler law firm, alleged an over $500 per participant recordkeeping fee, but the district court allowed the plan fiduciaries to introduce evidence of the correct recordkeeping from participant disclosures because it was “embraced” by the allegations in the complaint. The true recordkeeping fee was only $32 per participant – over fifteen times lower than what was alleged. The appellate decision upholding the dismissal of the case is known for requiring a reliable benchmark upon which to judge an excess recordkeeping or investment fee claim. But the key to the case was that the district court allowed the defense to proffer actual proof of the plan’s fees before the court ruled whether the excess fee claim was plausible. To do otherwise would allow plaintiffs to claim excessive fees based on unreliable, and in many cases, false data. Yet this is what happens in many cases in which courts give the benefit of doubt to the plaintiff at the pleading stage.

The complaint in Hy-Vee contained a similar misrepresented recordkeeping fee, which was compared to the Fidelity $14 discovery stipulation and seven random large plans. Despite the requirement in the Eighth Circuit in MidAmerican that an excess fee complaint must be compared to meaningful benchmarks, the district court nevertheless held that the plaintiffs had provided meaningful benchmarks from the Fidelity case and the chart of seven large plans. The district court also accepted the premise that all recordkeepers offer the same set of services to all large plans. We analyzed the decision and demonstrated how it did not follow the MidAmerican pleading standard in a prior blog post. See https://encorefiduciary.com/a-deep-dive-into-the-hy-vee-excessive-fee-case/

After full discovery, including expert testimony from both sides, the court characterized the case as a plan that “substantially reduced the recordkeeping fees charged to plan participants,” but Plaintiffs “accuse Defendants of breaching their fiduciary duties, arguing that a prudent fiduciary would have achieved even greater fee reductions.” The court granted summary judgment because it found that no reasonable factfinder could conclude that Hy-Vee plan fiduciaries breached their fiduciary duties. The summary judgment finding was based on: (1) an independent consultant (DeMarche) providing information and advice to the plan committee to evaluate recordkeeping fees; (2) the topic of recordkeeping fees was raised repeatedly at plan committee meetings; (3) Hy-Vee obtained six separate benchmarking reports from Fiduciary Decisions between 2018 and 2022, all of which showed that Principal’s recordkeeping fees were lower than the benchmark; (4) the recordkeeping fee went down four times between 2016 and 2022; (5) the committee conducted a competitive RFI in 2020 during which nine of ten potential alternatives to Principal for recordkeeping services either chose not to respond at all (due to concerns about the complexity of Hy-Vee’s Plan), or provided a bid for recordkeeping services higher than Principal’s; and (6) Principal ended up matching the pricing offered by the one bidder – Voya – whose bid was lower. The court ruled that this showed that the Hy-Vee pan committee has an “adequate process” to monitor and evaluate the reasonableness of recordkeeping fees.

Plaintiff’s counter-arguments involved what the court called “nitpick[ing]” and second-guessing the fiduciary process. Plaintiffs complained that the RFI was not as good as a formal RFP; that Principal services were more than the plan needed; and plaintiffs asserted that the biennial Fiduciary Decisions benchmarking was “skewed” by inaccurate facts. All of this is unfair nitpicking, but you have to remember what plaintiff claimed they would prove in the complaint: a “devastating” lack of any fiduciary process. The complaint was brought with the false pretense that Hy-Vee had no fiduciary process. By contrast, Hy-Vee had a clear process and a history of fee reductions – a far cry from the misleading and false narrative in the complaint that Hy-Vee completely ignored their fiduciary obligations to ensure reasonable plan fees.

This case reinforces four key points that animate most excess fee cases:

- (1) We must allow plan fiduciaries to correct the record at the pleading stage when a complaint is based on false fee amounts;

- (2) We cannot allow complaints to use misleading benchmarks from random plans instead of real context of the entire market of what all large plans pay;

- (3) It is unfair to allow plaintiff lawyers to regulate fiduciary liability unless they can show a clear lack of any fiduciary process. But in a plan advised by competent consultants and a history of consistent fee reductions, it is unfair to use expensive litigation to nitpick the results of a plan’s fiduciary process – yet that is what nearly every excess fee case is about, despite being brought under false pretenses that a plan committee was completely “asleep at the wheel” with no fiduciary process; and

- (4) Recordkeeping is not commoditized for all large plans.

ISSUE #1: The complaint alleged a false recordkeeping fee, which is why plan fiduciaries deserve the ability to correct the record to allow a fair motion to dismiss record in which courts can weed out misleading claims with real “context.”

The complaint is a typical excess fee case with hyperbole of “unreasonably high recordkeeping costs” based on plaintiff calculations from the Form 5500. Plaintiff have the participant fee disclosure and account statements of their clients that list the actual recordkeeping fee. And they have the ability to ask for the recordkeeping contract in an ERISA rule 104 information request. So there is no reason to calculate the recordkeeping fee amount, unless it is a part of an attempt to file a misleading excess fee complaint.

The complaint took the Form 5500 direct fee amount from the recordkeeper, and divided it by the number of participants, and came to that amount of $64.95 for 2020 fees, and similar amounts for prior years. Everyone knows – including the plaintiff lawyers – that the Form 5500 total compensation amount includes transaction fees for individual participants that has nothing to do with the recordkeeping fee. It is dishonest to claim this is how accurate recordkeeping fees are calculated. But it is done in nearly every complaint.

The real fee was reduced to $36.93 in 2021. Nevertheless, plaintiffs got away with a false fee amount of nearly twice that amount and survived the motion to dismiss. Normally that leads to a settlement because of the leverage of the high cost of defense, including expert reports.

If we care about justice, then we need to evaluate claims of excess fees based on the actual fees – not fake fees. The pleading standard cannot be based on assuming that the complaint is “true” when it can be rebutted with the participant account statement, plan document, or the recordkeeping contract. We have too much evidence of excess fee complaints based on false fees. The Hy-Vee case is just another example of a long line of false excess fee complaints. Defense lawyers must be more aggressive in showing these examples as to why courts must go beyond the complaint in order to judge the context required by the Hughes v. Northwestern pleading standard.

ISSUE #2: We Must Require Real Benchmarks of What All Large Plans Pay to State a Claim for Fiduciary Malpractice, and Not Purported Fees From Just a Few Random Plans.

We do not believe that the district court should have allowed the case to proceed past the motion to dismiss, because it did not provide meaningful benchmarks as required by the MidAmerican decision. But to the extent there was any difference in meeting the benchmark requirement between the two cases, the Hy-Vee complaint contained a comparison to seven random large plans. This is the tactic in nearly every case filed, so the question is important. The question for all excess fee cases is whether it meets the plausibility pleading standard to compare a plan’s fees to fees of a handful of random plans. More specifically, is it enough for plaintiffs to find a few low-fees plans to accuse plan fiduciaries of imprudence, or do you need to provide context of what all large plans pay in the actual marketplace? If you do not need to show context as to what all plans pay, then you are allowing a fiduciary malpractice complaint based on evidence of the lowest possible fees that a plaintiff law firm can find. No rational person would consider that fair. But this is exactly what happened in this case, and what is happening in every case that a court is allowing to proceed.

The entire fiduciary malpractice case against Hy-Vee’s plan fiduciaries was based on the expert testimony of Veronica Bray. She based her testimony on calculating the fees of only four large plans [Hershey Company; ADT Security; WPP Group USA ; and SAP American, Inc.] from Form 5500 data. She did not produce a full-market database of what other large plans pay that are similar in size to the Hy-Vee plan. The court noted that she used different calculations for the four large plans. She “used a different method for calculating those fees than she did to calculate the fees for the Hy-Vee Plan. For three of the four comparators, she calculated fees on a per-participant basis by dividing total fees by the number of total number of participants, whereas for Hy-Vee she divided total fees by the number of participants with account balances.” Her numbers were “skewed in favor of making Hy-Vee’s fees seem higher than those of the comparators.” She gave no context of whether the plan’s recordkeeping fees were actually excessive relative to the market as a whole. As the court summarized, “the factfinder simply knows there are four plans with lower recordkeeping fees. In and of itself, this says very little about the market for recordkeeping fees like Hy-Vee’s.”

The court recognized that the plaintiff expert was relying on “four outliers.” The judge recognized that allowing evidence of just four plans would allow a finding of fiduciary malpractice based on “the cheapest four or five large plans in the entire country.” That is not fair. “Stated differently, it is a mathematical reality that some subset of a given class of 401(k) plans will have smaller recordkeeping fees than all others. It does not follow, however, that all fiduciaries of 401(k) plans that are not in that subset have arguably breached their fiduciary duties to a sufficient degree that requires a trial.” “The plaintiff also must produce evidence showing, among other things, where the defendant’s plan falls in the market as a whole for similar plans.” (emphasis added).

We agree, but this ruling should have come earlier at the motion to dismiss stage. It is not fair that Hy-Vee had to spend what we estimate to be at least five million dollars or more to seek vindication at the summary judgment stage. If anything, the complaint alleged seven jumbo plans with lower fees, and the expert found only four outlier plans – plaintiffs’ evidence got even weaker as the case progressed. The same ruling should have been rendered at the initial pleading stage, because the complaint was based on a few outlier plans, and not what the actual market pays for recordkeeping services.

There is a reason the trial bar never places plan fees into the context of the market as a whole. It is because the formula for an excess fee case is (1) fake fees (2) compared to fake benchmarks. In nearly every case, the real fees compared in context to a whole-market benchmark would disprove the case.

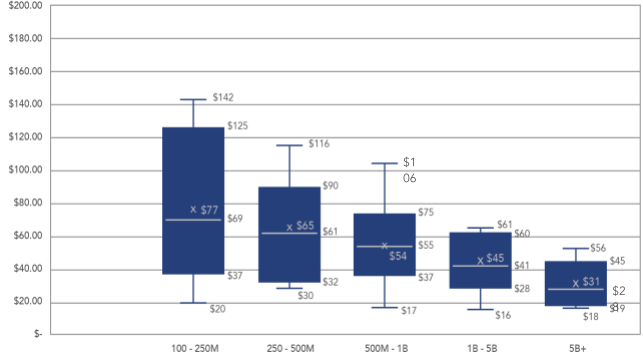

Here is our database of large-plan recordkeeping fees for the 2020 plan year based on assets:

The Encore database reveals that 80% of plans with $1B-5B in assets had recordkeeping fees between $28-60. The Hy-Vee recordkeeping fee of approximately $37 was inherently reasonable based on the entire market, and that is before you analyze and compare actual recordkeeping services. The record proved that the plan was more complex and Principal provided additional onsite services that even Fidelity and eight other companies could not match. The Hy-Vee plan recordkeeping fee was reasonable. But Fiduciary Decisions had already told the plan fiduciaries that fact six separate times. This plan should never have been sued for fiduciary malpractice based on a false fee amount that was compared to a few outlier large plans with unreliable data.

ISSUE #3: It Is Unfair to Allow the Trial Bar to Allege Deficient Fiduciary Process When They Are Relying on Circumstantial Evidence of A False Recordkeeping Fee Compared to a Misleading Benchmark.

Like most cases, the Hy-Vee excess fee complaint was brought under the false pretenses that because the recordkeeping fee was so outrageously high, plaintiffs were thus entitled to an inference that Hy-Vee plan fiduciaries had a deficient fiduciary process. That is nonsense. We now have hundreds of cases to prove that this prejudicial narrative is false and unfair.

We would not allow federal prosecutors or the Department of Labor to prosecute fiduciary malpractice cases based on such flimsy evidence. Simply put, the trial bar is not a fair arbiter of what fiduciary process should look like. They are after money, not justice. Given their track record, they must be required to have better evidence before they can seek an inference of fiduciary malpractice. They should be required to do upfront due diligence as to whether the plan had advisors and how they plan benchmarked recordkeeping services.

Plaintiff lawyers can nitpick and second-guess that Hy-Vee fiduciary process should have been more intense or achieved even better results. But that should not be enough to get an inference of fiduciary malpractice. When a plan has consultants, annual benchmarking from a reliable third-party resource, and a history of consistent fee reductions, there are no grounds for an inference of fiduciary malpractice. Otherwise, you are allowing fishing expeditions, all designed to leverage a settlement based on the high cost of defense and the outrageous damage models. “Expert” Veronica Bray testified to damages of over $13 million – all in a case in which Fiduciary Decisions, the leading recordkeeping fee benchmark company, had already validated six different times that Hy-Vee has below-market recordkeeping fees. We would not tolerate the DOL prosecuting unfair claims. Why do we have a more tolerant standard for the trial bar?

ISSUE #4: All RK services are not commoditized.

To the extent that some courts have dismissed excess investment and recordkeeping fee claims, it has been based on the requirement for plaintiffs to compare alleged excessive fees to a meaningful benchmark based on a fair comparison of services rendered. The service providers for retirement plans have made no effort to establish that plan recordkeeping fee services are differentiated. They continue to sit back and watch their clients get sued. This has allowed the trial bar to claim that large-plan recordkeeping fees are commoditized. It was enough to nudge the Hy-Vee case over the pleading standard. It works in many other cases as well.

The significance of the Hy-Vee case is that we have a full record of differentiated recordkeeping services for a jumbo defined contribution plan. The Hy-Vee plan required additional work by Principal for several reasons. First, the Hy-Vee private stock component required participant validation. Second, Hy-Vee has a “fairly transient employee population,” which required a higher level of work to reconcile information, and an automatic sweep analysis, as well as 34,000 participant terminations in just 2022 alone. Principal provides custom monthly reporting relating to the Stock Fund and a variety of payroll services, which is further complicated by the fact that Hy-Vee submits two payroll files. The large files require “numerous resources to process.” Hy-Vee also converted from an in-house payroll system to Workday in 2022. When Hy-Vee conducted the recordkeeping RFI in 2020, Fidelity and eight other companies refused to bid because Principal was “bending over backward” to accommodate and provide custom solutions. The main difference was the use of proprietary funds and the requirement of on-site representation and custom programming. In addition, the plan required a higher amount of physical mailings.

This was a unique plan with a unique worker base and complex payroll system, all of which required unique services. This record debunks the common refrain in excess fee cases that all jumbo plans are alike and recordkeeping is a commoditized service that can be easily compared.

The Encore Perspective – Fiduciary Imprudence Must Be Based on Probable Cause

We have to decide the standard we want to allow challenges to fiduciary management of retirement plans in this country. Is the goal of ERISA fiduciary regulation to allow any challenge regardless of upfront evidence? If so, this is a huge extra cost in the system. Or is the goal to allow only valid challenges that have a reasonable chance of being right? To put numbers on it, are we going to allow all plans to be sued, or only the less than 5% of plans that might have fiduciary process issues?

Right now, we are allowing any challenge, irrespective of merit. A few courts dismiss cases early, but the pleading standing is a crapshoot, and most courts bend over backwards to give the benefit of the doubt to plaintiffs. Plaintiffs are ostensibly plan participants, but let’s get real: these are lawyer-driven cases in which the plaintiff law firm is the only one who benefits. But even if the cases were legitimately participant driven, the current system of fiduciary responsibility is guilty until proven innocent. That is backwards and cannot be right. That is not justice, even if you are biased towards allowing participants their day in court.

The purpose of ERISA was never to allow random second-guessing of plan fiduciary processes. But that is exactly what is happening. Justice demands some threshold criteria in order to sue. The normal prosecutorial standard in America is probable cause. If we are going to allow plaintiff lawyers to serve as fiduciary regulators, they must be required to show probable cause before alleging fiduciary malpractice.

Hy-Vee had a good process with advice and benchmarking from reliable consultants. You can quibble that it was not perfect [i.e., no RFI from 2012 to 2020], but it was very solid by any measure. They did not deserve to be challenged in federal court and have to defend their fiduciary process. But that is what happened. The plaintiff law firm filed a fiduciary malpractice case based on false pretenses with inflated recordkeeping fees and a flimsy claim that all recordkeeping services for large plans are commoditized. The court got to the right result on summary judgment, but not until Hy-Vee had to spend millions of dollars to vindicate their fiduciary process of annual benchmarks and advice from competent advisors. It was the right result eventually, but at what cost?

Maybe in America we do not care if large corporations have to defend against false claims. And certainly no one cares when fiduciary insurers have to pay millions of dollars. But let’s be honest about what is going on with excess fee claims in federal courts. It is has nothing to do with proper fiduciary regulation or justice. The Hy-Vee case shows that most excess fee lawsuits are a con game designed to enrich the trial bar [and the defense bar] at the expense of diligent plan sponsors. Forgive us for sounding like a broken record, but this will not end until there are financial consequences to the trial bar for filing meritless cases of “devasting harm” based on false facts and contrived benchmarks.

Finally, we spend most of our time highlighting the litigation abuses of the trial bar. But until more cases are dismissed at the pleading stage, it has become clearer that we need to litigate more cases to conclusion. That is the only way to vindicate the fiduciary process of most large plans, nearly all of which are advised by competent consultants. But the cost of defense is too high.

We must figure out how to streamline cases in order to reduce the cost of defending challenges to fiduciary decisions and other judgment calls. This includes preparing early summary judgment motions to allow plan sponsors to vindicate their fiduciary process in a cost-effective way. The ERISA defense bar needs to learn how to defend these routine cases for a reasonable amount, as it should not cost millions of dollars to defend the same tired fact pattern over and over, but it does. Every law firm charges by the hour, with no firm offering a reasonable fixed fee to defend routine cases. We must also question why defense experts charge up to a million dollars or more for the same routine fee and process analysis [with expert fees averaging two million per case when two experts are used]. That is why the trial bar can leverage so many settlements.

Simply put, the reason we cannot litigate more cases to conclusion is that the cost of defense is too high. Maybe it required sophisticated ERISA counsel for the initial cases in 2006, but we have over fifteen years of the same claims filed over and over. We need defense lawyers who can defend these cases for a reasonable amount, and defense experts that can rely on experience from prior cases to prepare a cost-effective defense. That has to change.