Congress has asked the Governmental Accounting Office (GAO) for insight into whether 401k plan fee disclosures help plan participants. They do not. Participants do not even read or understand fee disclosures.

In 2010, the Department of Labor engaged in a grand experiment to help participants in 401k plans to make more informed decisions by requiring quarterly fee disclosures. It has failed. Many plan participants still do not understand 401k plan fees, and no amount of government intervention is going to change that. There never was a need for participant fee disclosures given that account statements are available 24/7 on sophisticated recordkeeper websites. DOL could have required more information to be provided in daily, monthly, quarterly or annual account statements. But if we are going to require fee disclosures, the outdated fee disclosure rules need to be updated to require a standardized format that provides precise and meaningful fee information – concise fee information with the legalese and exculpatory language stripped away.

The GAO issued a recent report in September to answer Congressional inquiries about fee disclosures. This followed the GAO July 2021 report that concluded, as the title details, that “Many Participants Do Not Understand Fee Information, but DOL Could Take Steps to Help Them.” GAO-21-357, 401(K) Retirement Plans: Many Participants Do Not Understand Fee Information, but DOL Could Take Additional Steps to Help Them Specifically, GAO reported that most plan participants are financially illiterate: 40 percent of plan participant they surveyed did not fully understand fee information, and 64 percent did not know they even pay plan fees. GAO’s 2021 report detailed five recommendations to make fee disclosures more valuable for plan participants, but DOL has taken no action on any of the recommendations.

If Congress wants real analysis of fee disclosures, they should ask a fiduciary insurance underwriter. While there is no evidence that plan participants read or understand fee disclosures, and plan sponsors do not need fee disclosures because they have investment advisors with more robust fee analyses, insurance underwriters appear to be the only human beings that actually read fee disclosures. We read plan and participant fee disclosures in order to underwrite fiduciary risk. If you want to know how to improve fee disclosures, fiduciary underwriters are the most qualified stakeholders in America to do the job.

The following is our analysis of the GAO 2021 recommendations and our own recommendations as to how to fix obvious problems with fee disclosures. We do not pretend that fee disclosures will somehow make Americans financially savvy. And we do not believe that plan participants will start reading them, particularly when they already have daily access to account statements. But in the spirit of a new Presidential administration vowing to fix broken government and make things better for American workers, we offer tangible ideas for recordkeepers to improve fee disclosures.

401k Plan Fee Disclosures

Recognizing the importance of 401(k) plan fees on the retirement savings of plan participants, the Department of Labor (DOL) issued final regulations in 2012 requiring plan sponsors to provide participants with comprehensive fee disclosures. The disclosure requirements were meant to help participants make “informed decisions” about the management of their accounts. Under ERISA rule 404a5 issued in 2010, the plan administrator “must take steps to ensure that [plan] participants and beneficiaries, on a regular and periodic basis, . . . are provided sufficient information regarding the plan and the plan’s investment options, including fee and expense information, to make informed decisions with regard to the management of their individual accounts.” Rule 404a5 requires disclosures to plan participants; and rule 408b2 requires fee disclosures to the plan itself.

The key difference between the 408b2 plan fee disclosure and the 404a5 participant fee disclosure is that the plan fee disclosure provides perspective on the average size of the accounts and overall administrative and investment fees paid by the plan. This includes better information as to how revenue sharing is applied, including any credits back to plan participants. But the plan fee disclosure does not require the recordkeeper to place any of their fees into context compared to what they charge other plan sponsors.

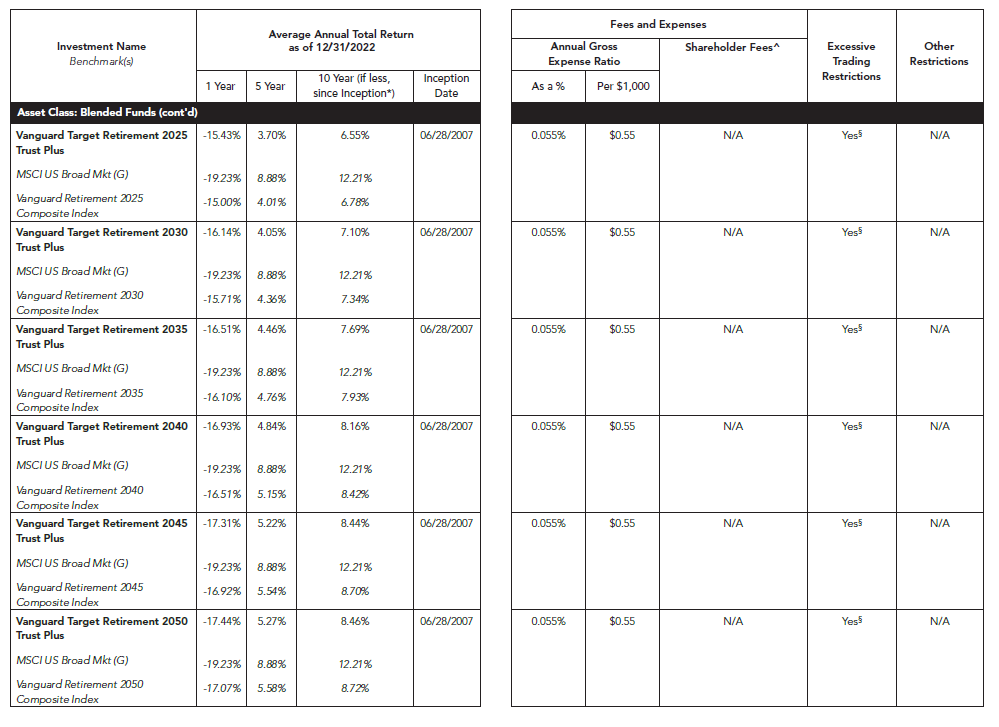

By contrast, the participant fee disclosure provides investment performance results compared to an index benchmark that is not included on the 408b2 plan fee disclosure. The plan fee disclosure is thus better suited to understand total plan fees, and the participant fee disclosure is better suited to understand investment performance. You need both the plan and participant fee disclosure to gain a comprehensive understanding and perspective of the fees and investments of the plan. That is why fiduciary insurance underwriters look at both types of fee disclosure to make a judgment as to whether the plan fiduciaries follow a best-in-class fiduciary process. We see no reason why the plan and participant fee disclosures could not be merged into one comprehensive fee disclosure, so that participants can better understand total plan fees with the better perspective provided to plan sponsors.

The GAO Reports and Recommendations to Improve Fee Disclosures

In July 2021, over a decade after DOL announced the fee disclosure requirements, the United States Government Accountability Office issued a comprehensive report to Congress that attempted to evaluate whether fee disclosures were helping plan participants understand plan fees. As noted above, the answer was negative, but provided five recommendations for DOL to help improve fee disclosures.

After noting that many plan participants do not understand the fee information in the DOL-required fee disclosures, they made five recommendations for DOL to help plan participants:

- (1) fee disclosures for participant-directed individual retirement accounts should use a consistent term for asset-based investment fees (e.g. gross expense ratio);

- (2) quarterly fee disclosures should provide participants the actual cost of asset-based investment fees paid;

- (3) EBSA should take steps to provide participants important information concerning the cumulative effect of fees on savings over time (including citations to the DOL website where it graphically shows the effect of fees on retirement savings);

- (4) fee disclosures should include fee benchmarks for in-plan investment options; and

- (5) Fee disclosures should include the ticker information for in-plan investment options.

The DOL has not addressed any of these 2021 recommendations, but has stated publicly that they would consider them in 2024.

We do not object to any of these recommendations, but do not believe that they will have any meaningful impact on helping plan participants understand their plan fees. The key point that GAO is making in the first two recommendations is that fees are not clear when they are asset-based, as opposed to fixed on a per-participant basis. Revenue sharing adds an additional roadblock to transparent fee disclosures. This is yet another reason why the participant fee disclosures should be merged with quarterly participant account statements, because universal fee terminology will not solve the issue of how much participants are paying in asset-based account without reference to their investment choices and account balances.

We agree that terminology should be consistent, but that is better achieved by requiring all recordkeepers use the same fee disclosure format [or again, adding fee disclosure requirements to participant account statements]. We also agree it would be helpful to benchmark fees for in-plan investment options. But the best way to do that would be to compare plan investments to the ICI average-fee benchmark, or something that puts the investment option into context. Again, we think there needs to be guidance to recordkeepers to ensure a standard and uniform approach.

GAO September 2024 Report to Congress

Following the GAO’s 2021 report, Senators Patty Murray and Bernie Sanders and Congressman Robert C. “Bobby” Scott asked GAO to report on the perspective of plan sponsors and service providers on DOL’s fee disclosure regulations. After three years of investigating, the GAO issued a report on September 27, 2024. We do not understand the purpose of the exercise, as the new report does not add anything of value.

The GAO supplemental fee disclosure report summarizes its interviews with thirteen plan sponsor and service provider “stakeholders.” A majority of the thirteen stakeholders think that 401k plan fee disclosures are difficult to understand, especially for smaller plan sponsors. Some unidentified stakeholders think fee disclosures are useful, while others do not. Some think it increases participant litigation. Not a worry, according to the GAO, because “DOL officials said that these lawsuits can play an important role in helping to ensure participants do not pay unreasonable fees.” We find that remark frustrating, because the DOL is validating rampant litigation abuse against conscientious plan sponsors. But at least we know were DOL stands.

How to Improve Plan Fee Disclosures – From the Perspective of an Insurance Underwriter

The following are our three suggestions to improve fee disclosures.

Improvement #1: Develop simplified and streamlined fee disclosure with all legalese eliminated. The standardized template needs to address how to account for fees on an asset-basis or when fees are paid through revenue sharing.

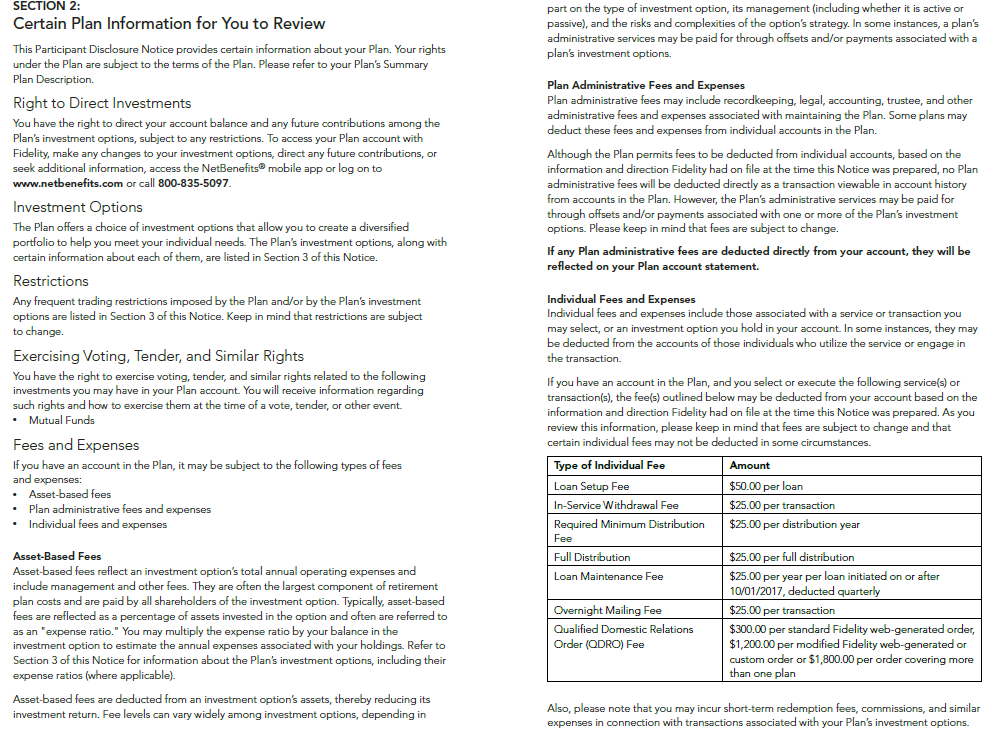

We require a uniform Form 5500 filing, but allow recordkeepers to issue their own fee disclosures to plan sponsors and participants. That doesn’t make any sense. Every recordkeeper has developed their own fee disclosure template. Most contain pages of irrelevant legalese and language only designed to protect the recordkeeper from liability. The obvious start is to eliminate all legalese. Recordkeepers are so worried about legal exposure that they include pages of irrelevant and distracting exculpatory language.

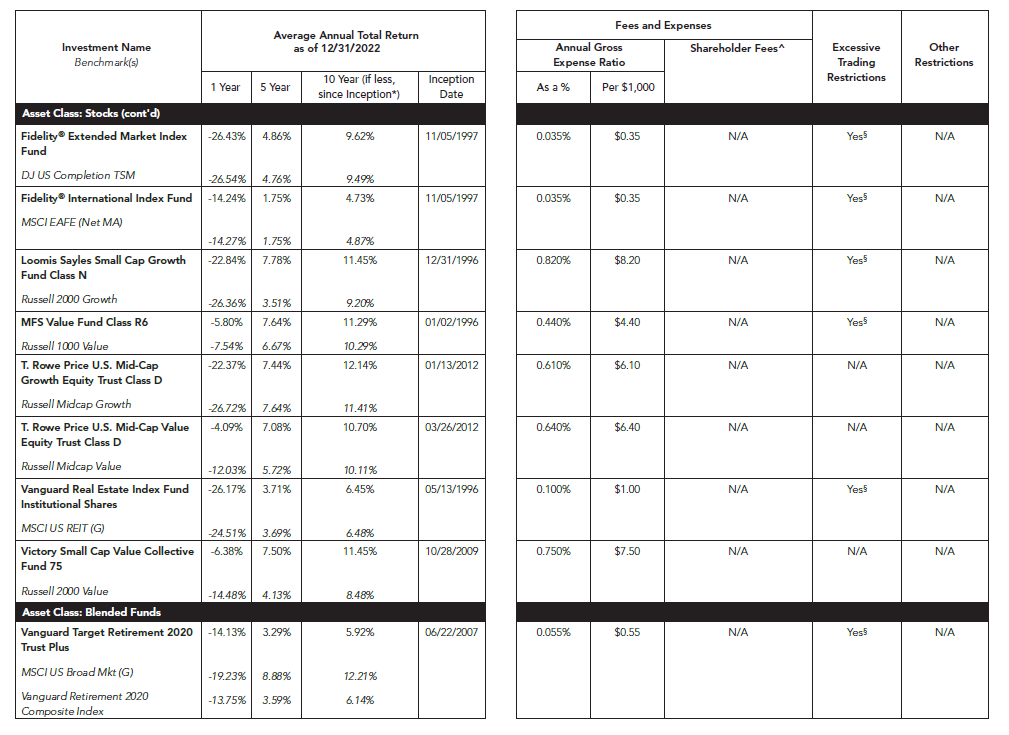

DOL should step and in and remove all of the irrelevant legal protections and disclaimers. If there is a standardized format, then there should be no fear of liability. The current Fidelity participant fee disclosure is twenty pages. Empower’s fee disclosure is eleven pages. They are too long. There is no quick summary of the fees participants pay. Fee disclosures need to be streamlined to two or three pages that focuses solely on plan administration and investment fees. There should be a short chart summarizing the key plan administration and investment fees.

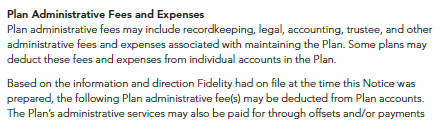

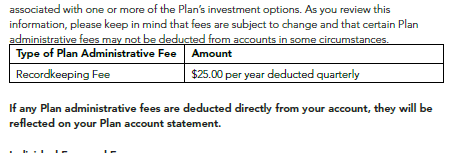

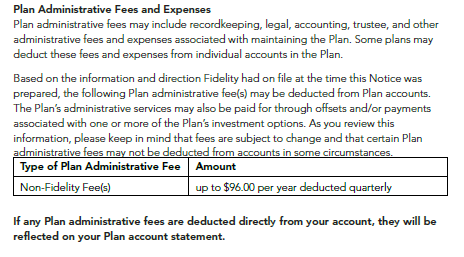

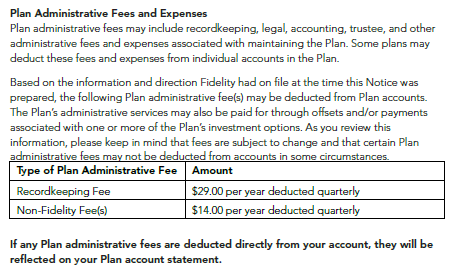

Participant fee disclosure work best when the recordkeeping fees are on a per-participant basis. Here are two Fidelity examples of recordkeeping fees on a clear, per-participant basis that makes sense:

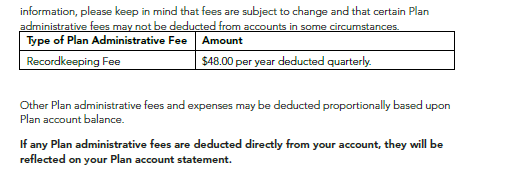

But here is an example that is confusing. What does it mean that “up to $96.00 is deducted quarterly,” and why is it labeled “Non-Fidelity Fee(s).” This only adds to confusion.

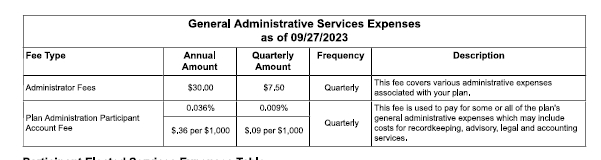

Another problem with fee disclosures is when they have two types of plan administration fees. The below Empower disclosure has separate “Administrator Fees” and “Plan Administration Participant Account Fees.” What is the difference? We assume the second type of fee is not for recordkeeping fees, but rather additional plan sponsor costs of plan administration that are charged to plan participants. That is totally legal, but why not explain it better? Why not call the first fee a “recordkeeping fee” paid to the recordkeeper, and more clearly articulate that the additional account fee is to reimburse the plan sponsor for plan administration costs? If the goal is fee transparency, it is not achieved in this common example:

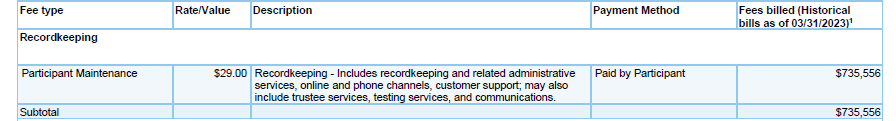

That is an example from Empower. Now consider the same issue from Fidelity. We first cut out the fee disclosure from the 404a5 disclosure showing $29.00 to Fidelity + $19.00 paid to some non-Fidelity entity [we assume the plan sponsor, but cannot confirm]. Then we immediately compare it to the 408b2 disclosure to the plan sponsor, which only shows a $29.00 fee. The point is that the fee disclosure to the participant is less clear than the fee disclosure to the plan sponsor.

Compare to the 408b2 plan fee disclosure:

Finally, fee disclosures work when the recordkeeping fee is on a fixed, per participant basis. But it doesn’t work when there is revenue sharing or the fees are on an asset-basis. That is when account statements are more valuable than participant fee disclosures. Here is a Fidelity participant fee disclosure when there is an asset-based fee. Participants would have no clue what fee is being charged in this example:

Or this example:

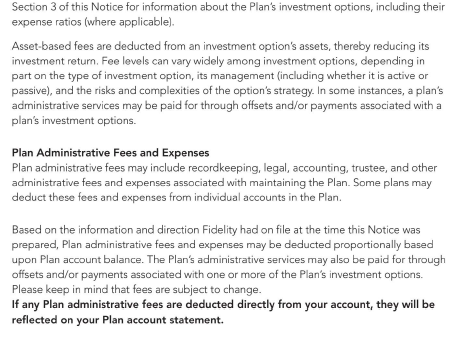

The above are examples of the recordkeeping portion of the fee disclosure. Most recordkeepers do an excellent job of disclosing investment fees, because most recordkeepers use the DOL proposed investment fee format in the rule 404a5 regulation. But again, standardization is necessary. The worst fee disclosure is issued by Merrill Lynch. Here is a section of a fee disclosure for a jumbo plan issued by Merrill in the investment fee section:

The standard Merrill Lynch fee disclosure does not disclose investment fees – every investment is listed as zero percent fees. If you needed proof that no one reads fee disclosures, this is it. Merrill Lynch routinely issues fee disclosures with investment fees listed as zero. No one seems to notice. We are fairly certain that the listed investment advisors are not offering free investments. At a minimum, it shows that DOL must require uniform fee disclosures, and then actually monitor compliance with the rules.

In sum, DOL needs to impose a standardized format that is concise and precise, and without pages of legalese. Participants need a format that is more like a participant account statement, but with clear fees that are placed into context and perspective.

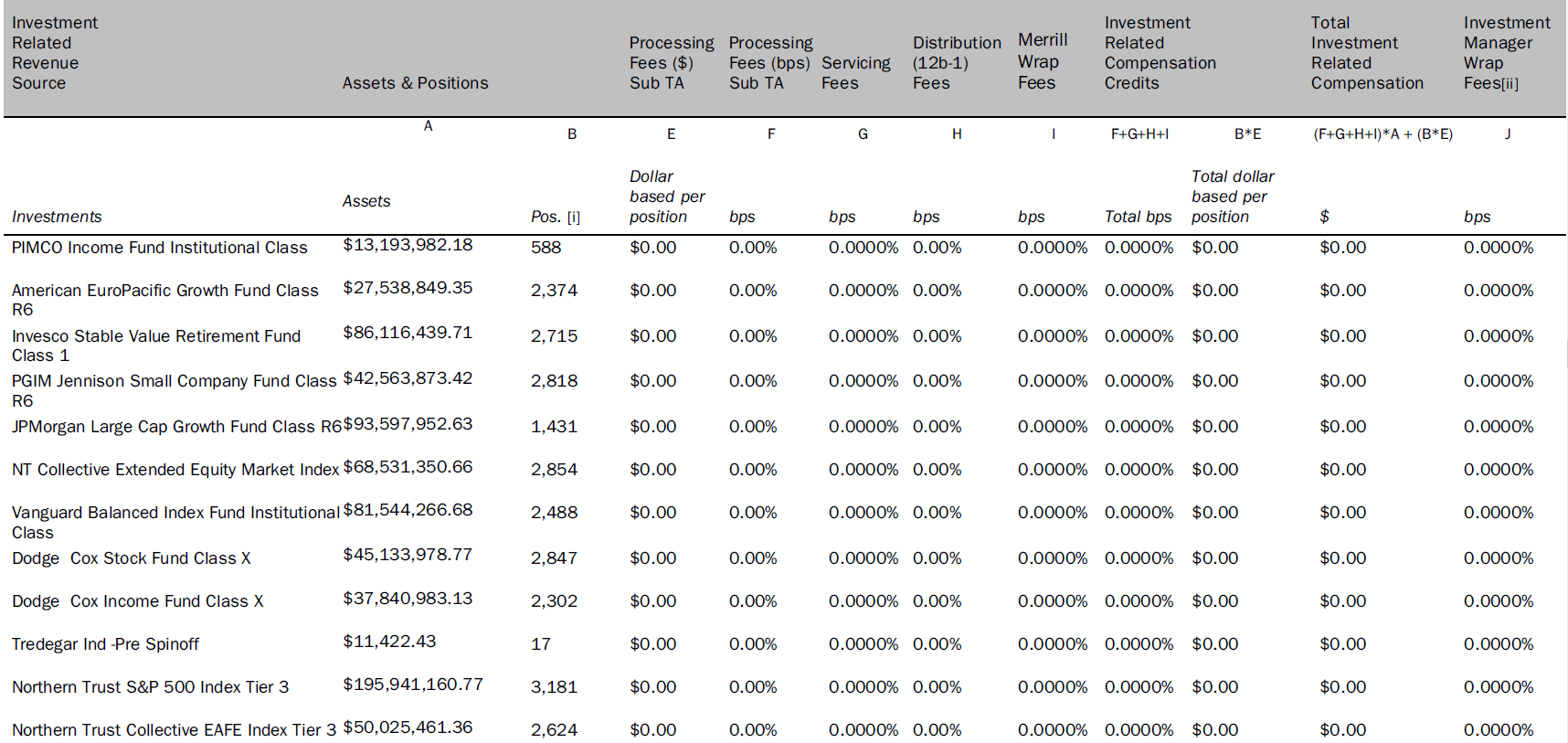

Improvement #2: Change the requirement that investment performance is compared to a generic index fund.

Rule 404a5 requires that “[f]or investment options that do not have a fixed rate of return, the name and returns of an appropriate broad-based securities market index over 1-, 5-, and 10-year periods (matching the Performance Data periods) must be provided. (emphasis added). DOL received objections to the market index requirement in the notice-and-comment time period. But DOL rejected this feedback, wanting to make sure benchmarks would “not [be] subject to manipulation and recognizable and understandable to the average plan participant.” That is why they required a benchmark to a “broad-based securities market index.” But it is not fair to benchmark active funds to index funds. If the DOL wants to avoid self-contrived benchmarks, they should at least allow a market index, or comparable S&P active funds, and then allow the plan sponsor’s preferred benchmark for an additional comparison. DOL should at least allow the plan fiduciary committee to show the benchmark they are using to compare the performance of the option.

Here is a Fidelity chart showing how the market index comparison works for index options, but not for actively managed options.

Improvement #3: Require any plaintiff lawyer suing on behalf of plan participants for excessive fees to use participant fee disclosures and account statements to establish exactly what participants pay.

Finally, if plan fee disclosures matter, then plaintiff lawyers suing for purported excessive plan fees need to allege the actual fees being charged. The Fid Guru Blog has chronicled many cases in which officers of the court are alleging false fees to support purported fiduciary breaches. Every plan participant receives participant account statements and fee disclosures. Plaintiff lawyer must be required to base any fiduciary breach allegations on the actual fees paid by their plan participants. Fee disclosure either matter or they don’t. We cannot allow plaintiff lawyers to pretend like their clients have not received accurate fee information.