By Daniel Aronowitz

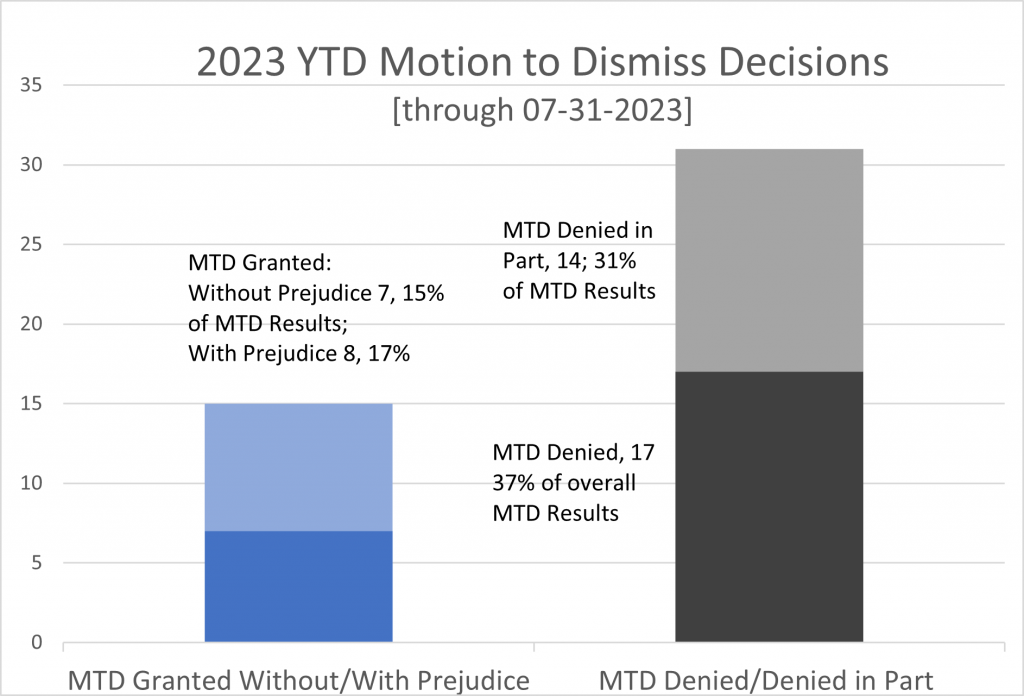

There is a growing perception in ERISA thought leadership that the pleading standard for excess fee and performance litigation has turned more positive to plan sponsors, but the statistics tell a different story. The actual year-to-date results [through July 31, 2023] reveal that plan sponsors are only winning approximately 30% of dismissal motions – even less than the 35% success rate from the prior year. Yet even that is not the whole story, as most of those dismissals are pyrrhic victories, because plaintiff law firms nearly always amend the complaint and the litigation continues. Indeed, only 17% of cases in 2023 have been dismissed with prejudice [8 out of 46], and half of those dismissals with prejudice involve anemic challenges to BlackRock LifePath index funds, cases that never had any merit.

The results show that most excessive fee and imprudent investment cases survive a motion to dismiss. And even when certain claims are dismissed at the pleading stage, it rarely reduces the damages model enough to reduce the settlement leverage created in these cases. Finally, as we note below, the dismissal percentage following the March 2023 Hughes II decision continues to decline as plan sponsors lose traction in the Sixth and Seventh Circuits.

Motion to Dismiss Analysis – 2023 YTD Decision Results Compared to 2022

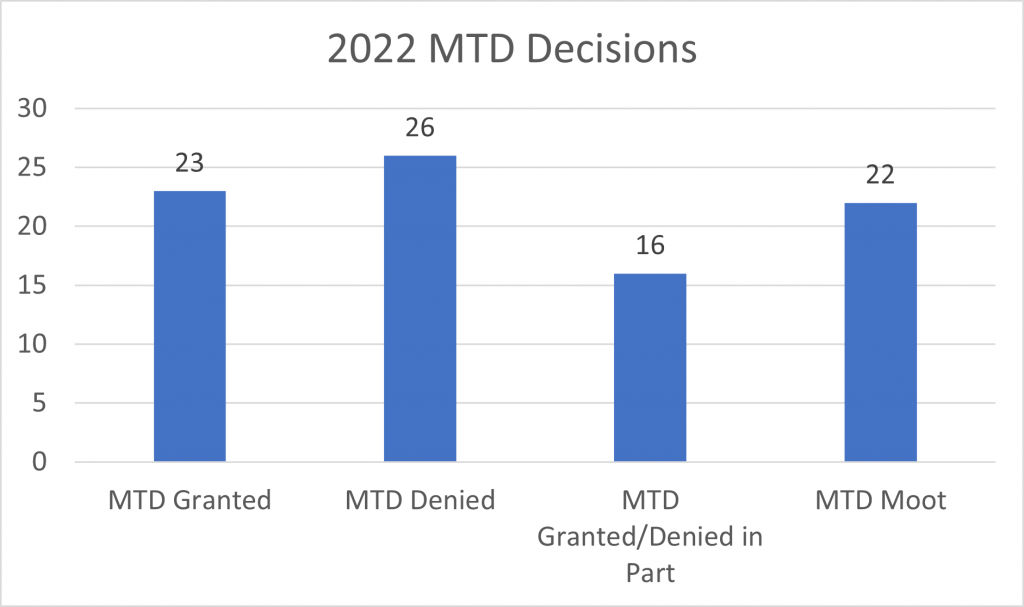

2022 Motion to Dismiss Decision Statistics:

- 23 Motions Granted

- 26 Motions Denied and 16 Motions Granted in part/Denied in part = 42 Losses

- 22 cases Moot because of amended complaint

2022 Summary: 23 Motions Granted and 42 Motions Denied in whole or in part = 65 total

2023 Motion to Dismiss Decision Statistics:

- 15 Motions Granted [8 with Prejudice]

- 17 Motions Denied

- 14 Motions Granted in part/Denied in part

- 11 cases Moot because of amended complaint

2023 YTD Summary: 15 Motions Granted and 31 Motions Denied in whole or in part = 46 total

The Euclid Perspective

We share these statistics to give perspective, but want to start with a disclaimer that not all excess fee and performance cases are the same. The facts of the cases do matter, and often influence how courts ultimately rule. For example, the BlackRock LifePath cases alleging fiduciary imprudence for chasing loss fees at the expense of inferior investment performance have no merit, because the highly rated LifePath funds have experienced long-term excellent performance. Four of those eleven cases have been dismissed with prejudice in less than one year of their filing. Plaintiffs are deservedly losing other cases in which the recordkeeping fees are really low. For example, the Kroger case was dismissed with prejudice because the recordkeeping fee was only $30 per participant and the company subsidized some of that amount, but not until after the initial motion to dismiss was not granted. The Kellogg excess fee case was also dismissed (without prejudice), because the defense proved with fee disclosures that the plan participants were charged increasingly lower fees during the purported class period: $66 from 2016 to 2019; $45 from 2019-2020; and $36 in 2021.

Nevertheless, the pleading standard still favors plaintiff law firms. The overall percentage of dismissals in the first half of the year is even lower than 2022, with only 32% of dismissal motions granted, and roughly half of that amount (17% overall) are being dismissed with prejudice. And when the four BlackRock LifePath cases are taken out, the dismissal rate with prejudice is below ten percent.

The pleading standard continues to evolve through a series of inflection points:

- after the January 2022 Hughes Supreme Court decision plan sponsors lost motions to dismiss on a rate of 5:1;

- after the June 2022 CommonSpirit and August 2022 Oshkosh appellate decisions, plan sponsors began to win approximately forty percent of motions;

- but that momentum has dissipated following the March 2023 Hughes II decision, with the rate now below thirty percent again; and less than 20% dismissals with prejudice.

The most disappointing trend in the evolving pleading standard is the lack of traction in the Sixth and Seventh Circuits following the Hughes II decision in March 2023. Many more claims of excess recordkeeping fees are being allowed to proceed on the flimsy assertion that recordkeeping fees for large plans is a commodity with no differentiation in service standards. The District of Massachusetts has proven to be an ERISA judicial hellhole based on allowing most excess fee and performance cases to proceed to discovery.

In final analysis, the use of a motion to dismiss is an imperfect and weak tool for plan sponsors in combating excess fee and performance cases. But given how difficult it is to win summary judgment in these cases, we have no choice but to continue the long slog of advocating for a pleading standard that weeds out meritless cases.