Morningstar has issued a public report debunking the claims in the eleven lawsuits alleging that plan fiduciaries committed fiduciary malpractice by failing to switch out of BlackRock LifePath target-date funds (TDFs) in favor of higher performing investments. New 401(k) Lawsuits Go Too Far | Morningstar The Morningstar report conclusively refutes any claim that BlackRock LifePath TDFs have experienced deficient performance, including irrefutable evidence that BlackRock TDFs outperformed 75% of peer funds, and three out of five of the purported comparator funds in the complaints. Morningstar’s primary theme is its fear that “questioning if a plan sponsor fulfilled its fiduciary responsibilities based largely on past performance can incite frequent swapping of investment options when they aren’t top performers to avoid similar lawsuits in the future.” We cannot improve on the Morningstar’s report, and encourage every plan fiduciary concerned by the new wave of hindsight imprudent investment cases to read the report, but will do our best to capture the main points.

Morningstar notes that the BlackRock underperformance cases are made with “the benefit of hindsight.” ERISA is not supposed to allow claims based on hindsight. To the contrary, fiduciary imprudence is judged based on whether fiduciaries followed a prudent process. The results-based BlackRock lawsuits are deficient as a matter of law, therefore, because they make no effort to prove an imprudent process – just circumstantial claims that the alleged lower performance of BlackRock TDFs is somehow evidence of an imprudent fiduciary process. As Morningstar aptly explains, “[t]he argument hinges on whether the sponsors should have swapped to a top-performing target-date series in the past without knowing whether previous performance trends would persist.” It is a rhetorical point, but as shown below, Morningstar’s report conclusively proves that it was not imprudent to maintain BlackRock LifePath TDFs in institutional retirement plans. To the contrary, swapping out of the BlackRock funds to chase the higher returns of top-performing funds would have harmed plan participants. The reality check provided by Morningstar is that BlackRock LifePath TDFs are solid, long-term performers, and the claim of “deplorable” performance is false.

The Actual Performance of BlackRock TDFs Was Higher than 75% of all TDF Series, and Higher than Three of the Popular TDF Series Alleged in the Complaint

The eleven BlackRock LifePath TDF lawsuits are full of hyperbole claiming that the BlackRock TDFs have suffered “repeatedly inferior returns”:

- “an imprudent decision that has deprived Plan participants of significant growth in their retirement assets.”

- Plan fiduciaries “appear to have chased the low fees charged by the BlackRock TDFs without any consideration of their ability to generate return.”

- “irrational decision-making process.”

- “vastly inferior retirement solution and could not have been justifiably retained in the Plan.”

- “there were many TDF offerings that consistently and dramatically outperformed the BlackRock TDFs, providing investors with substantially more capital appreciation.”

- “repeatedly inferior returns”

- “consistently deplorable performance of the BlackRock TDFs”

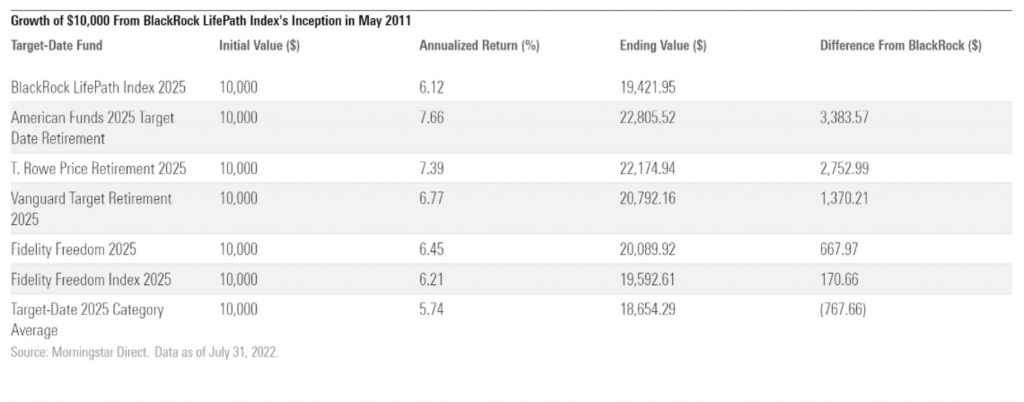

The key claim is that BlackRock TDFs “are significantly worse performing than many of the mutual fund alternatives” offered by other TDF providers. The lawsuits compared BlackRock LifePath Index’s trailing performance starting in 2016 with the five other series with the most assets as of the end of 2021: Vanguard Target Retirement; T. Rowe Price Retirement; American Funds Target Date Retirement; Fidelity Freedom; and Fidelity Freedom Index. As shown below, the hyperbole of these eleven copy-cat lawsuits fails the Morningstar reality check when compared to real world performance data, as opposed to the performance charts in the complaints that are unsubstantiated and fail to cite any reliable source for credibility.

According to Morningstar, plan sponsors had the choice of 60 target-date mutual fund series available in 2016 – not just the six funds that would end up being the most popular six years later. Out of these sixty options, BlackRock LifePath Index’s “cheapest share class topped 73% and 76% of peers when averaging its percentile rankings across every vintage over the three- and five-year time periods through July 2022. Notably, it outperformed Vanguard and both of Fidelity’s series.” This shows that the BlackRock LifePath TDFs have outperformed nearly three out of four available target-date series. That should end the imprudence lawsuits on the spot. The hysterical claims of “repeated inferior performance” lack any valid basis, and certainly fails to give the courts proper context as to how BlackRock LifePath funds have performed compared to the broad market offerings.

The Morningstar data also casts doubt on the Miller Shah evidence – performance charts with no source cite to validate their credibility. The very credibility of the Miller Shah performance charts is doubtful given that Morningstar states that the LifePath TDFs have outperformed Vanguard and both Fidelity TDFs (active and passive versions) – three of five TDFs alleged in the complaints. As to the remaining two TDF series that had better performance than LifePath funds – T. Rowe Price and American funds – Morningstar makes the key point that using hindsight to compare the BlackRock LifePath TDFs to only “two [peer funds] that had the best track records as of the end of 2021, sets an unrealistically high bar for sponsors choosing investment options for their plans.” [emphasis added by Euclid].

To-Retirement TDFs Like BlackRock LifePath Cannot Be Compared to T. Rowe Price and American Funds Through-Retirement TDFs

Under the heading that “There’s More to Picking a Target-Date Strategy Than Past Performance,” Morningstar next analyzes the difference between the BlackRock LifePath to-retirement and the American Funds/T. Rowe Price through- retirement strategies. A “to” glide path stops lowering stock exposure at the target retirement date, whereas a “through” glide path continues to a lower stock exposure for ten to fifteen years after the retirement data. The key difference between these approaches is typically the amount of stocks they own at the target retirement date. Morningstar explains that the median “to” glide path had a 35% allocation to stocks at retirement, whereas the median “through” glide path had a 52% allocation to stocks.

The BlackRock lawsuits allege that the underperformance of the BlackRock LifePath Index 2025 vintage that is closer to retirement should have triggered a change based on higher performance of the limited comparison peer group. Morningstar explains that any underperformance to these “hand-picked peers” is because these “through” approaches of the comparisons “have a higher exposure to equities close to retirement.” The Morningstar summation is worth quoting verbatim: “Although BlackRock’s 2025 vintage has underperformed those peers, it’s because it follows a “to” approach, which means it has less equity exposure as it gets closer to the target-retirement date.”

This Morningstar performance chart from 2011 to the present shows that the BlackRock LifePath 2025 vintage out-performed the Morningstar Target-date 2025 Category Average by a significant amount, but trailed the through-retirement comparators marginally based on the equity differential between to-retirement LifePath glide paths and the through-retirement comparators. To underscore this crucial point, Morningstar states that “BlackRock’s underperformance [of the near-retirement vintages] versus the five peers can largely be attributed to its lower allocation to stocks.” Morningstar does not give the LifePath 2025 to-retirement percentage of equities, but Euclid data confirms that BlackRock has only 40% equity exposure in the 2025 vintage compared to the 2025 through retirement 52% average cited by Morningstar. But even with the conservatism of a 12% less equity exposure, the BlackRock 2025 TDF vintage performed well.

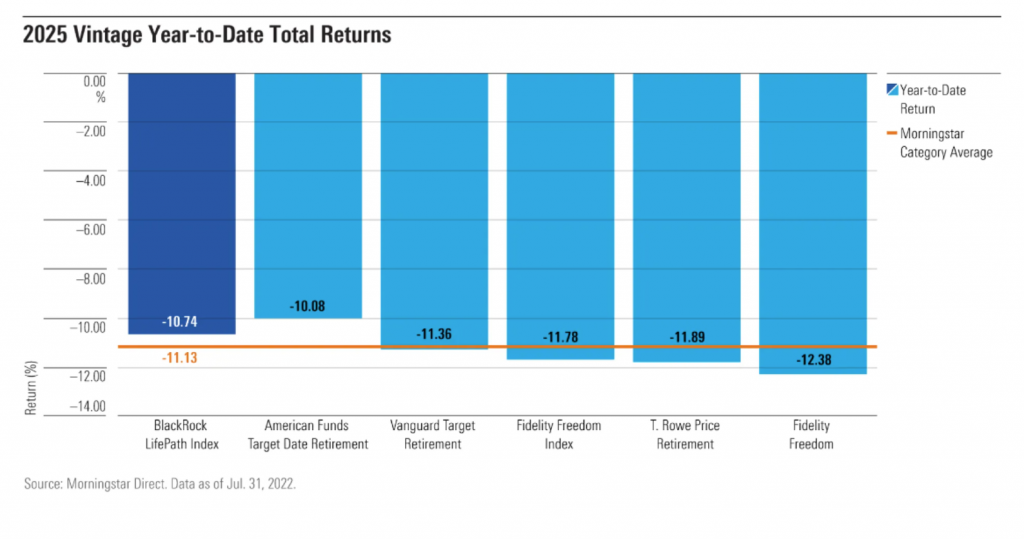

BlackRock LifePath Offered a More Conservative Approach that Benefited Shareholders in 2022 in the Market Downturn

Morningstar next argues that “it’s not fair to fault a plan sponsor for selecting a series with a more conservative approach near retirement.” But that is exactly what the Miller Shah lawsuits attempt to do. Morningstar explains that “[o]ver the past decade, more-aggressive target-date series have been rewarded as stocks and other risk assets have generally gone up,” but there was no way to know that would happen because fiduciaries cannot predict the future. While BlackRock’s conservatism was not rewarded in the long bull market, “Blackrock’s more conservative approach has benefited shareholders” in the current 2022 market downturn. Of the most popular funds, BlackRock LifePath and American Funds were the only TDF series out of the six most popular funds to deliver “shallower losses compared with the average category peer through July.” The BlackRock LifePath TDFs are outperforming in a down market cycle.

Morningstar Advises that Plan Fiduciaries Should “Trust the Process” and Not Chase Higher Performance

Morningstar next debunks the Miller Shah claim that plan fiduciaries should have aborted the BlackRock LifePath funds based on three- and five-year total return numbers. Morningstar explains that the “best target-date teams are regularly making improvements and enhancements as part of their processes.” For example, in 2014, BlackRock was one of the first firms to increase the equity allocation early in the glide path. Morningstar explains that the BlackRock glidepath changes “made any performance comparisons . . . less meaningful.” More importantly, Morningstar asserts that you cannot make proper due diligence decisions based on an outdated glide path after process changes. In fact, Morningstar discloses that in 2020, T. Rowe Price changed its Retirement Series’ glide path to be like BlackRock’s for younger investors, “showing the merit of [BlackRock’s] approach.”

Finally, Morningstar states that any plan fiduciary that had switched BlackRock LifePath to any of the five other TDF series would have been “worse off”:

“Looking at the past five years, if a plan sponsor switched target-date series to one of the proposed series, younger investors, for the most part, would have been worse off. American Funds and BlackRock’s performance were toe-to-toe, with BlackRock trailing by 0.03 percentage points. BlackRock’s larger equity allocation further from retirement helped boost results.” This debunks the core claim of the Miller Shah lawsuits that plan fiduciaries should have switched to other popular funds.

Under the heading of “Fiduciary Responsibility vs. Fortune-Telling,” Morningstar sums up its report with two critical points. First, “[s]wapping an underperforming fund for a top-performing fund has rarely led to good results.” Morningstar is concerned that allowing lawsuits based on past returns against “a hand-picked group of peers” could set a “dangerous precedent” for plan sponsors. If plan sponsors are worried about performance lawsuits any time a plan investment is not a top performer, it could lead to performance-chasing that leads to bad results. Second, in a point that Euclid has made in its prior analysis of these lawsuits, “[i]f the lawsuits are successful, this can lead plan sponsors facing similar questions on every fund offered in their 401(k) lineups.” If top-rated BlackRock LifePath funds can be challenged, then no plan sponsor is safe.

Additional Evidence Debunking the Miller Shah BlackRock Imprudence Lawsuits

The Morningstar performance data casts doubt on the veracity of the Miller Shah performance charts claiming that BlackRock funds had “consistently deplorable” performance. As noted above, even if the hindsight comparisons were somehow legitimate under fiduciary law, the complaints make no effort to validate the numbers in the comparison charts. We believe that plaintiffs are using the higher fee mutual fund versions of the BlackRock funds, whereas each of the plans likely purchased lower-fee CIT and other share class. This already invalidates the performance comparison, because each plan with lower-fee investments will automatically have higher returns. As plaintiff law firms have told us over 400 times in excessive fee lawsuits, even a 5-10 bps differential on a compounded basis will make a big difference in the long term. That same principle applies when they illegitimately compare higher priced investments than in the plans being sued. The difference between the lowest 5 bps fee for LifePath compared to the 14 bps retail rate is significant.

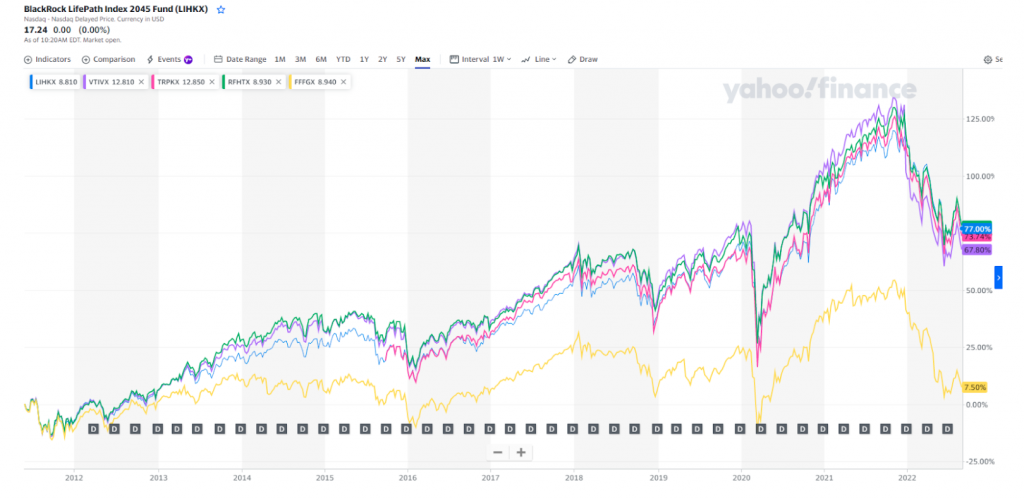

But if you can somehow put all of these troubling issues aside – and you cannot – and try to play along with plaintiffs’ comparisons of BlackRock TDFs to the Vanguard, T. Rowe Price, Fidelity and American Funds target-date offerings, the question is whether plaintiffs are right. Any investor at home can do the rudimentary performance analysis. Morningstar gave specific performance data for 2025 vintages, but we did the analysis for both 2045 and 2025 vintages of the most popular target-date funds to give the full perspective. Our charts compare the vintages for employees close to retirement (2025) like Morningstar did; and for plan participants farther away from retirement (2045). But you can compare any vintage you want in a performance chart to do your own fact-checking of these complaints.

If you go to Yahoo Finance, and put in the BlackRock LifePath Retirement 2045 ticker symbol (LIHKX) [these are the institutional share class, and not even the lowest possible CIT-fee shares], you can then click “comparison” and compare LIHKX from 2012 to the present against similar vintages from Vanguard (VTIVX); T. Rowe Price (TRRKX); American Funds (RFHTX); and Fidelity Freedom (FFFGX). The results are much different than alleged in the complaints.

We first compare BlackRock LifePath 2045 vintages against the popular TDFs from 2011 to the present. The charts show that BlackRock LifePath has comparable performance during the entire eleven-year time period.

2045 Vintages — Max Chart from 2011:

The BlackRock LifePath results are even better on a six-year lookback:

2045 Vintage – 6 Year, from 1/1/16:

BlackRock LifePath has top performance in the current year:

1 year:

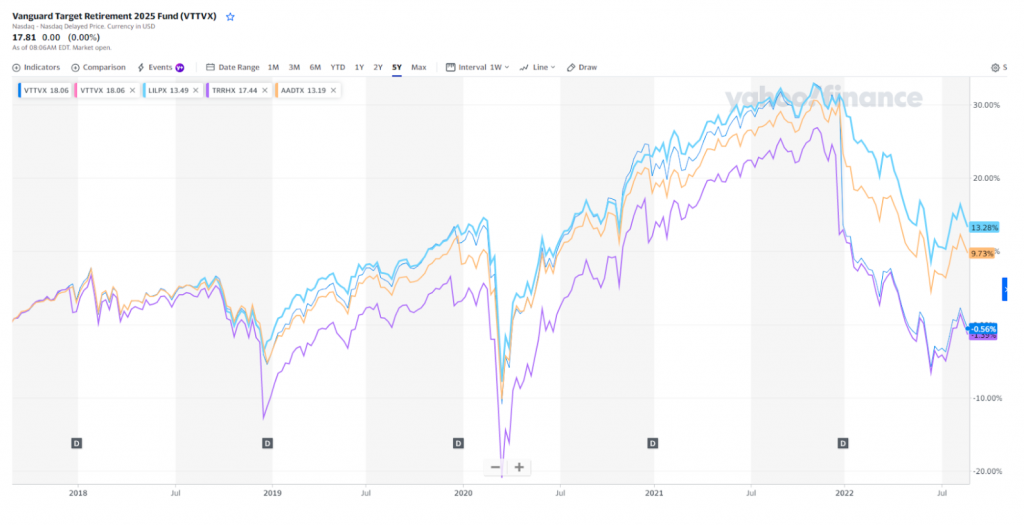

Now, let’s do the same comparison for the 2025 vintages, when a to-retirement TDF series like BlackRock has less equity than the five through-retirement TDFs to which it is being compared. This three-year lookback shows BlackRock LifePath as the performance leader for most of the time period. [VTTVX: Vanguard; LILPX: Lifepath

TRRHX: T. Rowe Price; AADTX: American Funds].

Now look at the Vanguard 2025 vintage compared to the LifePath funds on a five-year look-back, and see how LifePath 2025 TDFs have superior long-term returns than Vanguard and the other popular funds.

Next look at how BlackRock LifePath 2025 vintage has performed better than Vanguard TDFs in the last year by a wide margin [only American Funds TDFs are close]:

The charts speak for themselves, and confirm the Morningstar report. The BlackRock LifePath 2045 are clear winners. The BlackRock 2025 vintages have comparable performance, even with less equity concentration in the portfolio. The point is that there is nothing in the BlackRock LifePath performance history that would support hysterical claims in the Miller Shah lawsuits of “consistently deplorable” performance.

ERISA’s Big Lie

We live in an era of big lies. In the ERISA plan sponsor world, we have our own big lie: eleven lawsuits claiming that any plan fiduciary who chose the Morningstar number-one rated BlackRock LifePath index target-date funds is guilty of fiduciary malpractice. The Morningstar report proves that BlackRock performance was far from “deplorable.” To the contrary, BlackRock vintages for younger investors had top performance similar to the leading American Funds results, and higher than Fidelity and Vanguard results. For 2025 and other vintages closer to retirement, BlackRock out-performed the Morningstar benchmark and approximately 75% of peer funds, even with an intentionally conservative glide path strategy. It underperformed some through-retirement fund results, but only because the through-retirement funds have a higher stock allocation and are not a proper comparator. In sum, the Morningstar report and performance charts expose that the improper hindsight performance claims are just plain false. We thank Morningstar for debunking these lawsuits on the public record.

Finally, plaintiffs cited to the Morningstar 2022 Landscape Report in their complaints. We do not know why, because the report cites BlackRock LifePath as the number one rated TDF series. But this makes the Morningstar “New 401(k) Lawsuits Go Too Far” Report fair game for the record in any motion to dismiss. They opened the door to this independent fact checking, and this should end any doubt as to the plausibility of the eleven lawsuits. They are based on a big lie that BlackRock LifePath performance is deplorable.