By Daniel Aronowitz, Encore [formerly Euclid] Fiduciary

KEY POINT: In its new 2024 24th edition of the small-plan recordkeeping fee survey, the 401k Averages Book changed how it documents the recordkeeping fee for smaller plans by including indirect, asset-based recordkeeping fees from investments in the fee benchmark. This should eliminate the deceptive claims used in many excessive fee lawsuits that mispresent the 401k Averages Book benchmarks by excluding the substantial indirect fees paid by smaller plans.

The premise of most fiduciary imprudence lawsuits alleging excessive plan administration fees is that the plan fiduciaries failed to leverage the size of the plan to lower plan fees. We have repeatedly documented that many excessive fee lawsuits allege fees that (1) overstate what the plan participants actually pay, and (2) then compare the inflated fee amounts to false and misleading “benchmarks” supposedly paid by other plans.

A favorite benchmark of several leading plaintiff law firms involves a comparison to the 401k Averages Book, which surveys the plan administration of fees of plans with $200m in assets and below. Dozens of lawsuits have used the same annual chart from the 401k Averages Book documenting the fees of a $200m asset plan with 2,000 participants. For example, in Matney v. Barrick Gold, the complaint alleged that the 401k Averages Book – which the complaint represented as “the oldest, most recognized source for non-biased, comparative 401(k) average cost information” – found that $200m plans only pay $5 per participant for recordkeeping fees, and thus larger plans like Barrick Gold’s $560 million plan with more leverage should pay substantially less than $5m per participant.

That sounds very logical, except the data from the 401k Averages Book is vastly misrepresented. And there is no $200m plan in America that has only $5 in recordkeeping per participant. In fact, based on extensive Encore research, there is not a single plan in America with a $5 per participant recordkeeping fee. The citation to the 401k Averages Book is intentionally misrepresented, because even if $5 is the correct direct recordkeeping fee, the chart in the book shows that the same plan paid over $160 in indirect revenue sharing for a total of at least $165 per participant. An excess fee case representing to a federal judge that large plans should pay less than $5 per participant for plan recordkeeping is absurd.

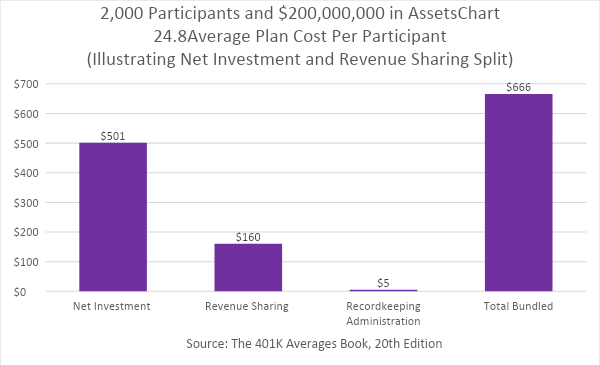

Plaintiff law firm have never provided the actual chart from the 401k Averages Book in their excess fee complaints. If they did, it would expose the con game of excess fee lawsuits. Here is the chart from the 20th edition of the 401k Averages Book published in 2020 that has been misrepresented in many lawsuits:

This 401k Averages Book chart shows that the average participant in a $200 million plan with 2,000 participants pays $666 in recordkeeping and investment fees. It shows that plan recordkeeping is paid almost exclusively from revenue sharing with only a marginal $5 direct recordkeeping fee. The total recordkeeping fee for the average participant in the $200m plan is $165 per participant – not the $5 per participant amount claimed in the Barrick Gold and many other excess recordkeeping fee imprudence cases.

In 2022, the 22nd edition of the 401k Averages Book showed a $13 direct recordkeeping fee, but the actual recordkeeping paid by plan participants was the $165 when you include the substantial revenue sharing. That is the same $165 number as the 2020 statistics. But plaintiffs in many lawsuits misrepresented that the fee was only $13, ignoring that most of the recordkeeping fee was paid through revenue sharing.

The Big Change in the 2024 Edition of the 401k Averages Book

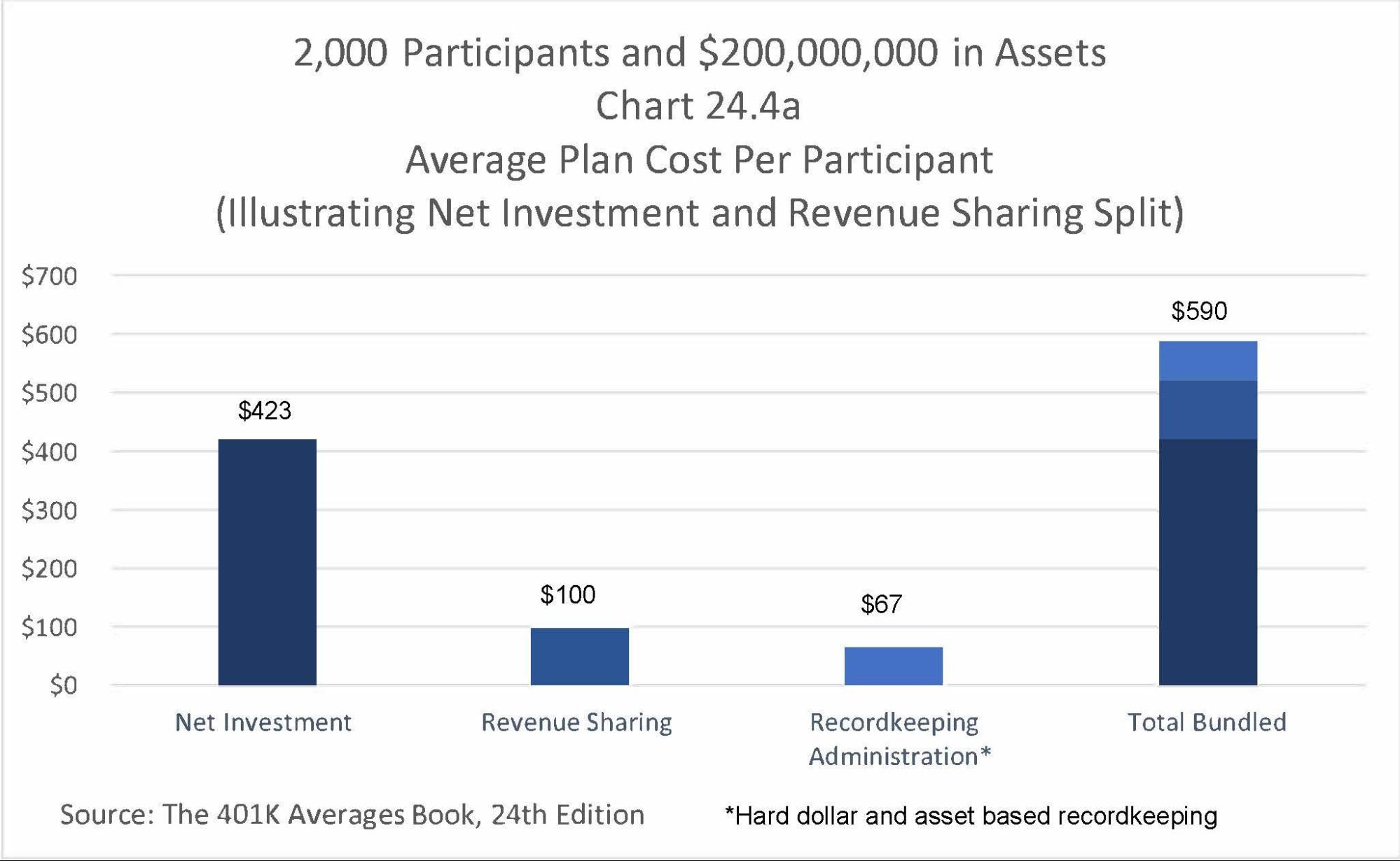

The 2024 Edition of the 401k Averages Book makes a critical change in the way it reports its data. It reports plan data for the same size of plans, including the largest plan with $200m in assets with 2,000 participant. But it no longer isolates and reports just the tiny direct recordkeeping fee of $5-13 that has been distorted by plaintiff law firms in excess fee lawsuits. Instead, the recently published edition combines both direct and asset-based fees for a total number of $67 plus $100 in revenue sharing.

It is not clear how the chart distinguishes asset-based fees and revenue sharing, as revenue sharing is an asset-based fee from invested assets. Nevertheless, if you add $67 + $100, you get $167, or a similar number to prior iterations of the survey. The key point is that the fees paid by participants can no longer be distorted as only $5-13 for a $200m plan.

The survey adds another new component by documenting advisor fees for plans with $200m in assets and below. For the same $200m plan, the 401k Averages Book adds an additional chart that re-characterizes the $167 in $100 revenue sharing + $67 recordkeeping administration to account for the amount which represents payments to plan advisors. Chart 24.4b reveals that the advisor compensation is $70 and the recordkeeping administration is $97. It is the same $167 total, but $70 of the amount is paid to the plan advisor.

The advisor chart reveals a critical difference between small plans and large plans. Most plans under $100m in assets, and many plans up to $250m in assets, pay a significant asset-based charge to a benefits broker or advisory firm. This fee is often 20 bps or more. For the $200m plan, it adds up to $70 per participant. Most large plans have investment advisors that receive fixed compensation, or fees that are 3 bps or less. This is yet another area in which participants in large plans end up paying significantly less fees than smaller plans, like the $200m plan in the 401k Averages Book in which the average participant pays $590 in all-in fees.

The Encore Perspective

The new version of the survey demonstrates that the $200m plan in prior versions of the 401k Averages Book was never intended to benchmark these plans with a $5-13 recordkeeping fee. The plan administration fees were over $160 per participant because of the substantial indirect compensation to the recordkeeper. The claims in the excess fee lawsuits were wildly distorted. We hope that this critical change will eliminate the improper use of the 401k Averages Book in future excess recordkeeping fee cases.

We continue to believe that the only fair benchmark for recordkeeping fees is a reliable, national benchmark. Citations to a few random plans does not represent a reliable benchmark. Our firm has published the Encore Fiduciary Large-plan recordkeeping survey database that shows what large plans actually play. The 401k Averages Book is a reliable, national benchmark. But it has been used improperly in excess fee cases. The survey continues to show that small plans pay asset-based fees with significant revenue sharing and much higher fees than the average large plan with assets over $500m. The new 2024 survey further reveals that small plans pay substantial fees to advisors. Small plans pay significantly more than what most large plan participants pay for recordkeeping and investment fees. This is the exact opposite of what has been alleged in many lawsuits. Hopefully that is the end of this distorted use of this small-plan benchmark.

Finally, we agree with the premise that large plan fiduciaries should leverage their size to ensure lower fees. But our research has confirmed that the vast majority of large plans have lower fees than smaller plans. The high fees documented in the 401k Averages Book validates our research. In this post-truth society, we need to ensure that any claim of fiduciary imprudence is based on objective and verifiable facts – not distorted claims from a published benchmark.